Amidst a backdrop of global economic uncertainty, Asian markets have been navigating challenges such as trade policy shifts and fluctuating currency values. Despite these hurdles, opportunities still exist for investors willing to look beyond the major indices. Penny stocks, although an older term, remain relevant as they can offer potential growth and value when backed by strong financials. This article will focus on several promising Asian penny stocks that exhibit financial strength and could present long-term investment opportunities.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB4.14 | THB4.09B | ✅ 4 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.47 | HK$927.5M | ✅ 4 ⚠️ 1 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$2.09 | HK$3.61B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.38 | HK$1.98B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.535 | SGD216.83M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.57 | SGD10.11B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.98 | THB1.44B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.70 | THB9.5B | ✅ 3 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.57 | SGD979.43M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 979 stocks from our Asian Penny Stocks screener.

Let's explore several standout options from the results in the screener.

China Shengmu Organic Milk (SEHK:1432)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Shengmu Organic Milk Limited is an investment holding company involved in the production and distribution of raw milk and dairy products in the People’s Republic of China, with a market cap of HK$2.97 billion.

Operations: The company generates revenue from its Dairy Farming Business, amounting to CN¥3.13 billion.

Market Cap: HK$2.97B

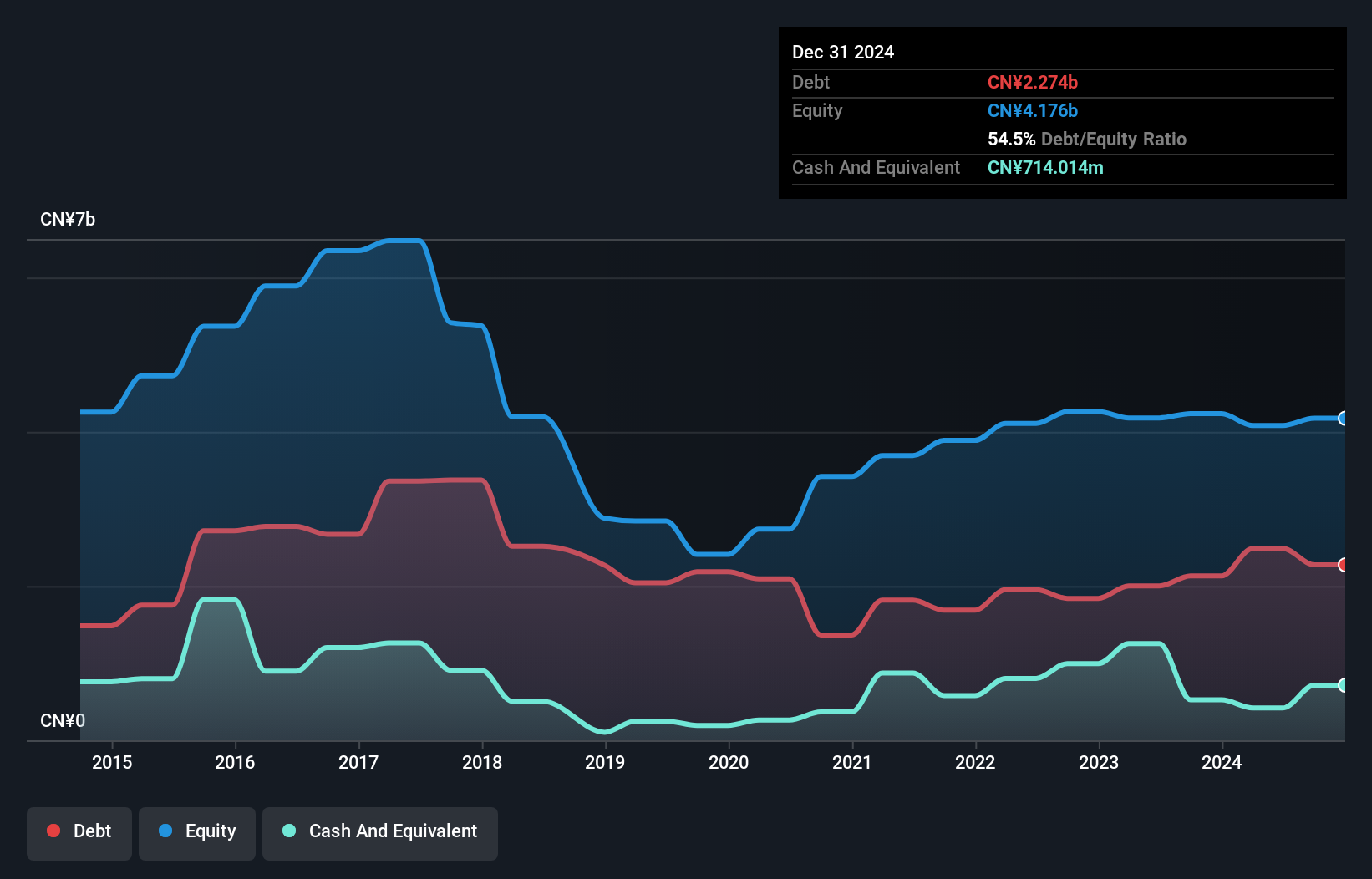

China Shengmu Organic Milk, with a market cap of HK$2.97 billion, is currently unprofitable and has seen its losses increase by 25.7% annually over the past five years. Despite this, the company benefits from a seasoned management team and board, each with an average tenure of over five years. The company's net debt to equity ratio is satisfactory at 37.4%, and its interest payments are well covered by EBIT at 47 times coverage. However, short-term liabilities exceed short-term assets by CN¥0.5 billion, indicating potential liquidity challenges amid high share price volatility.

- Dive into the specifics of China Shengmu Organic Milk here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into China Shengmu Organic Milk's track record.

EverChina Int'l Holdings (SEHK:202)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: EverChina Int'l Holdings Company Limited is an investment holding company focused on property investment and hotel operations in China and Bolivia, with a market cap of HK$568.96 million.

Operations: The company generates revenue from its agricultural operation, contributing HK$78.43 million, and its property investment operation, which brings in HK$29.75 million.

Market Cap: HK$568.96M

EverChina Int'l Holdings, with a market cap of HK$568.96 million, remains unprofitable but has significantly reduced its net loss from HK$319.85 million to HK$40.21 million over the past year. The company generates substantial revenue from agricultural operations (HK$78.43 million) and property investments (HK$29.75 million). Despite high share price volatility and short-term liabilities exceeding short-term assets by HK$54 million, it maintains a satisfactory net debt to equity ratio of 9.2%. While management is relatively inexperienced with an average tenure of 1.3 years, the board's experience averages 8.6 years, offering some stability in governance.

- Get an in-depth perspective on EverChina Int'l Holdings' performance by reading our balance sheet health report here.

- Gain insights into EverChina Int'l Holdings' past trends and performance with our report on the company's historical track record.

Spindex Industries (SGX:564)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Spindex Industries Limited, with a market cap of SGD151.13 million, operates in the manufacture, import, export, and trade of mechanical, electrical, electronic, and precision machine parts through its subsidiaries.

Operations: The company's revenue is divided into three segments: Imaging and Printing (IP) generating SGD29.91 million, Consumer Product and Others contributing SGD75.71 million, and Machinery and Automotive Systems accounting for SGD116.15 million.

Market Cap: SGD151.13M

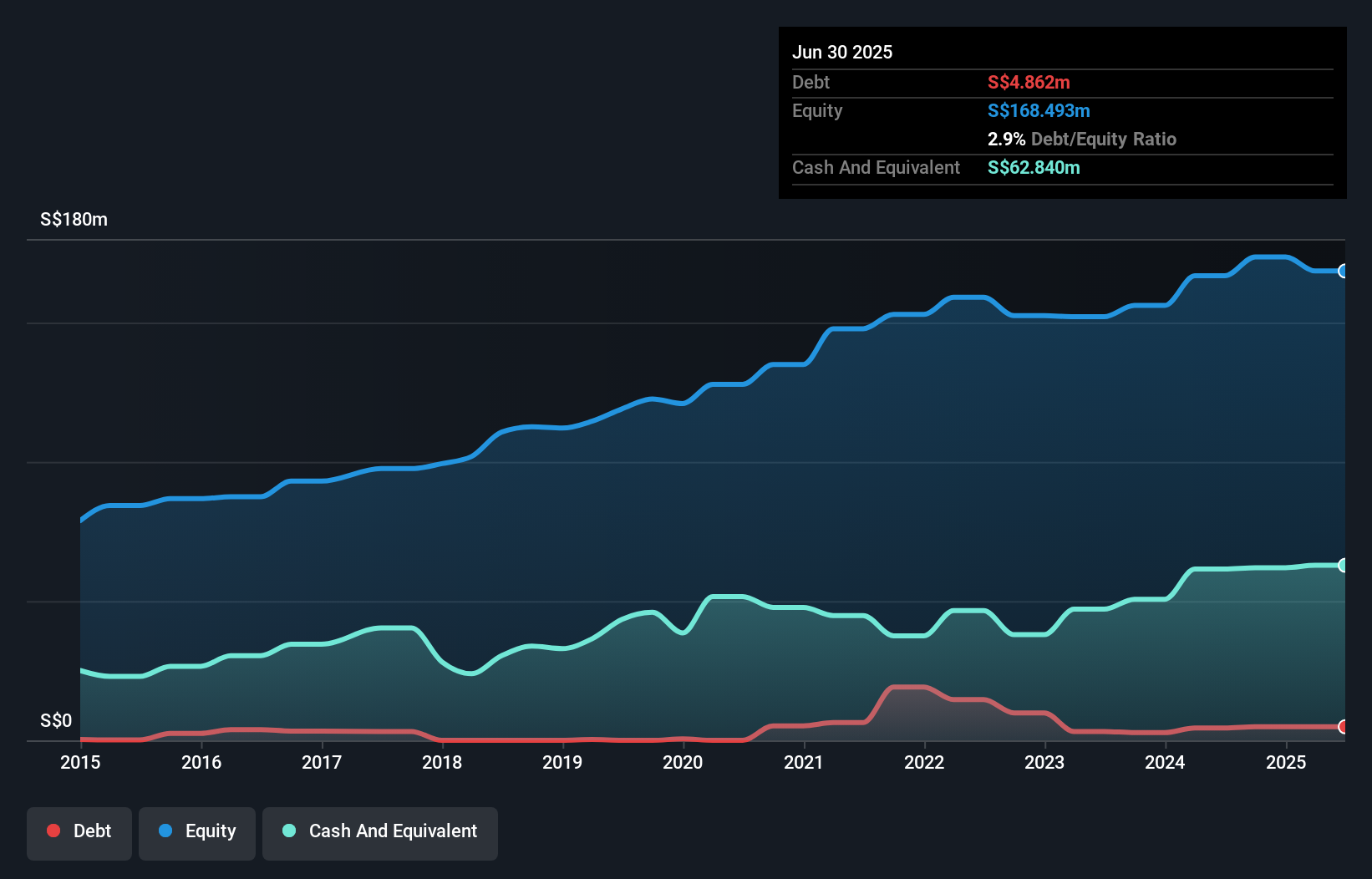

Spindex Industries, with a market cap of SGD151.13 million, shows strong financial health with short-term assets of SGD144.0 million exceeding both short-term and long-term liabilities. Its earnings grew by 43.8% over the past year, surpassing industry averages, though they have declined by 3.4% annually over five years. The management team is seasoned with an average tenure of 14.2 years, and the company has not diluted shareholders recently. Despite having more cash than debt and stable weekly volatility at 6%, its Return on Equity remains low at 9.2%. Spindex trades below estimated fair value by a significant margin.

- Take a closer look at Spindex Industries' potential here in our financial health report.

- Examine Spindex Industries' past performance report to understand how it has performed in prior years.

Seize The Opportunity

- Click this link to deep-dive into the 979 companies within our Asian Penny Stocks screener.

- Curious About Other Options? Uncover 19 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:564

Spindex Industries

Engages in the manufacture, import, export, and trade of mechanical, electrical, electronic, and precision machine parts.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives