- Hong Kong

- /

- Real Estate

- /

- SEHK:1995

Increases to CEO Compensation Might Be Put On Hold For Now at Ever Sunshine Services Group Limited (HKG:1995)

Key Insights

- Ever Sunshine Services Group's Annual General Meeting to take place on 6th of June

- Total pay for CEO Hongbin Zhou includes CN¥4.41m salary

- The total compensation is 51% higher than the average for the industry

- Over the past three years, Ever Sunshine Services Group's EPS grew by 1.1% and over the past three years, the total loss to shareholders 90%

The underwhelming share price performance of Ever Sunshine Services Group Limited (HKG:1995) in the past three years would have disappointed many shareholders. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 6th of June. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

Check out our latest analysis for Ever Sunshine Services Group

How Does Total Compensation For Hongbin Zhou Compare With Other Companies In The Industry?

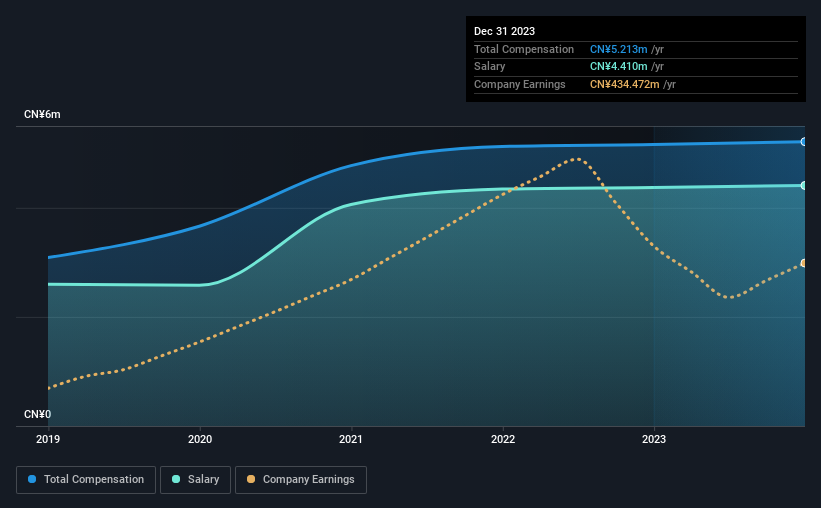

According to our data, Ever Sunshine Services Group Limited has a market capitalization of HK$3.1b, and paid its CEO total annual compensation worth CN¥5.2m over the year to December 2023. This means that the compensation hasn't changed much from last year. In particular, the salary of CN¥4.41m, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar companies from the Hong Kong Real Estate industry with market caps ranging from HK$1.6b to HK$6.3b, we found that the median CEO total compensation was CN¥3.5m. Accordingly, our analysis reveals that Ever Sunshine Services Group Limited pays Hongbin Zhou north of the industry median. Moreover, Hongbin Zhou also holds HK$105m worth of Ever Sunshine Services Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥4.4m | CN¥4.4m | 85% |

| Other | CN¥803k | CN¥787k | 15% |

| Total Compensation | CN¥5.2m | CN¥5.2m | 100% |

Talking in terms of the industry, salary represented approximately 77% of total compensation out of all the companies we analyzed, while other remuneration made up 23% of the pie. Our data reveals that Ever Sunshine Services Group allocates salary more or less in line with the wider market. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Ever Sunshine Services Group Limited's Growth

Ever Sunshine Services Group Limited's earnings per share (EPS) grew 1.1% per year over the last three years. Its revenue is up 4.2% over the last year.

We would argue that the improvement in revenue is good, but isn't particularly impressive, but the modest improvement in EPS is good. So there are some positives here, but not enough to earn high praise. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Ever Sunshine Services Group Limited Been A Good Investment?

The return of -90% over three years would not have pleased Ever Sunshine Services Group Limited shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. Shareholders would be keen to know what's holding the stock back when earnings have grown. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for Ever Sunshine Services Group that you should be aware of before investing.

Switching gears from Ever Sunshine Services Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if Ever Sunshine Services Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1995

Ever Sunshine Services Group

An investment holding company, provides property management services in the People's Republic of China.

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026