- Hong Kong

- /

- Real Estate

- /

- SEHK:1972

Investors Still Waiting For A Pull Back In Swire Properties Limited (HKG:1972)

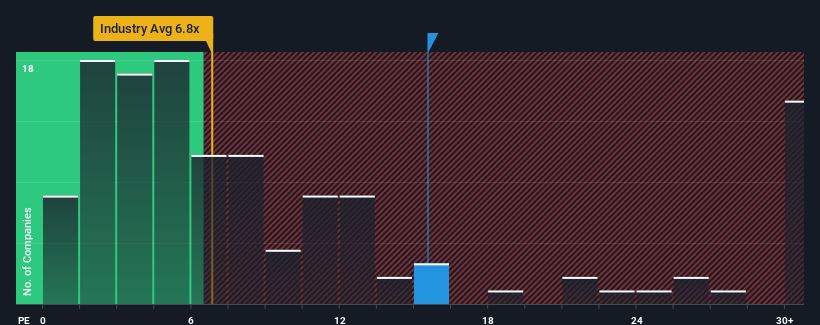

When close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 9x, you may consider Swire Properties Limited (HKG:1972) as a stock to avoid entirely with its 15.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings that are retreating more than the market's of late, Swire Properties has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Swire Properties

Is There Enough Growth For Swire Properties?

Swire Properties' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 38%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 6.9% overall rise in EPS. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 21% each year during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 16% per annum, which is noticeably less attractive.

With this information, we can see why Swire Properties is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Swire Properties' P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Swire Properties maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Swire Properties (1 shouldn't be ignored!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1972

Swire Properties

Develops, owns, and operates mixed-use, primarily commercial properties in Hong Kong, Mainland China, the United States, and internationally.

Reasonable growth potential second-rate dividend payer.