- Hong Kong

- /

- Real Estate

- /

- SEHK:194

Liu Chong Hing Investment (HKG:194) Will Pay A Smaller Dividend Than Last Year

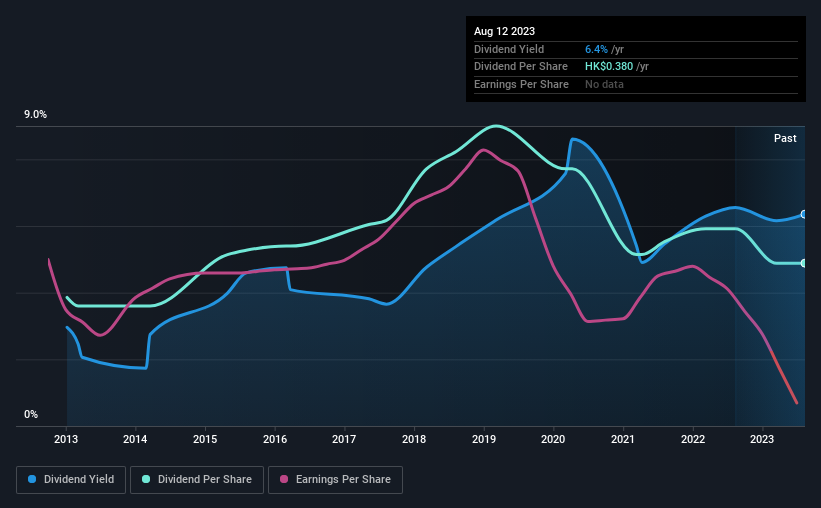

Liu Chong Hing Investment Limited (HKG:194) is reducing its dividend to HK$0.11 on the 15th of Septemberwhich is 39% less than last year's comparable payment of HK$0.18. The dividend yield of 6.4% is still a nice boost to shareholder returns, despite the cut.

View our latest analysis for Liu Chong Hing Investment

Liu Chong Hing Investment's Distributions May Be Difficult To Sustain

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Even in the absence of profits, Liu Chong Hing Investment is paying a dividend. Along with this, it is also not generating free cash flows, which raises concerns about the sustainability of the dividend.

Looking forward, earnings per share could 43.3% over the next year if the trend of the last few years can't be broken. This means the company will be unprofitable and managers could face the tough choice between continuing to pay the dividend or taking pressure off the balance sheet.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The dividend has gone from an annual total of HK$0.30 in 2013 to the most recent total annual payment of HK$0.38. This implies that the company grew its distributions at a yearly rate of about 2.4% over that duration. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

Dividend Growth Potential Is Shaky

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Earnings per share has been sinking by 43% over the last five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future.

We're Not Big Fans Of Liu Chong Hing Investment's Dividend

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The company seems to be stretching itself a bit to make such big payments, but it doesn't appear they can be consistent over time. Considering all of these factors, we wouldn't rely on this dividend if we wanted to live on the income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Taking the debate a bit further, we've identified 2 warning signs for Liu Chong Hing Investment that investors need to be conscious of moving forward. Is Liu Chong Hing Investment not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:194

Liu Chong Hing Investment

An investment holding company, engages in the investment, development, sale, management, and letting of properties in Hong Kong, the People’s Republic of China, the United Kingdom, and Thailand.

Fair value with mediocre balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026