- Hong Kong

- /

- Real Estate

- /

- SEHK:1918

There's Reason For Concern Over Sunac China Holdings Limited's (HKG:1918) Price

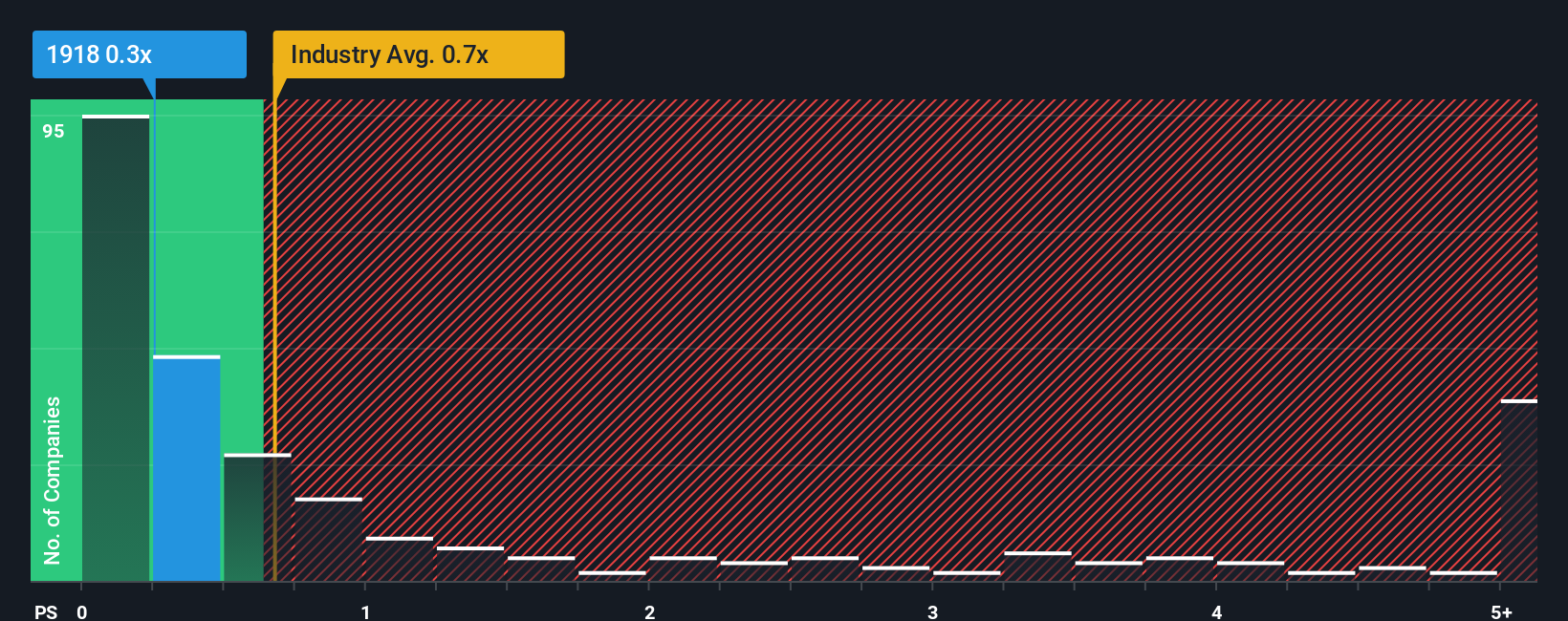

There wouldn't be many who think Sunac China Holdings Limited's (HKG:1918) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Real Estate industry in Hong Kong is similar at about 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Sunac China Holdings

How Has Sunac China Holdings Performed Recently?

With revenue that's retreating more than the industry's average of late, Sunac China Holdings has been very sluggish. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think Sunac China Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is Sunac China Holdings' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Sunac China Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 52% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 63% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to slump, contracting by 9.9% per year during the coming three years according to the two analysts following the company. With the industry predicted to deliver 3.6% growth each year, that's a disappointing outcome.

With this information, we find it concerning that Sunac China Holdings is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

While Sunac China Holdings' P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

You should always think about risks. Case in point, we've spotted 2 warning signs for Sunac China Holdings you should be aware of.

If you're unsure about the strength of Sunac China Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1918

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.