Exploring Undervalued Small Caps With Insider Buying In Hong Kong July 2024

Reviewed by Simply Wall St

As of July 2024, the Hang Seng Index has shown modest gains in a holiday-shortened week, reflecting a mixed economic backdrop with ongoing concerns about manufacturing and domestic consumption. This nuanced market environment highlights the potential for identifying undervalued small-cap stocks in Hong Kong, particularly those with recent insider buying which may suggest confidence from those who know these companies best.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| China Overseas Grand Oceans Group | 2.7x | 0.1x | 3.18% | ★★★★★☆ |

| Wasion Holdings | 11.3x | 0.8x | 33.09% | ★★★★☆☆ |

| Xtep International Holdings | 10.5x | 0.8x | 44.94% | ★★★★☆☆ |

| Sany Heavy Equipment International Holdings | 7.7x | 0.7x | -19.18% | ★★★★☆☆ |

| Nissin Foods | 14.7x | 1.3x | 40.15% | ★★★★☆☆ |

| Ever Sunshine Services Group | 5.8x | 0.4x | 16.75% | ★★★★☆☆ |

| China Leon Inspection Holding | 9.4x | 0.7x | 30.55% | ★★★★☆☆ |

| Transport International Holdings | 11.5x | 0.6x | 44.41% | ★★★★☆☆ |

| Giordano International | 8.5x | 0.8x | 37.36% | ★★★☆☆☆ |

| Kinetic Development Group | 4.0x | 1.8x | 18.71% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

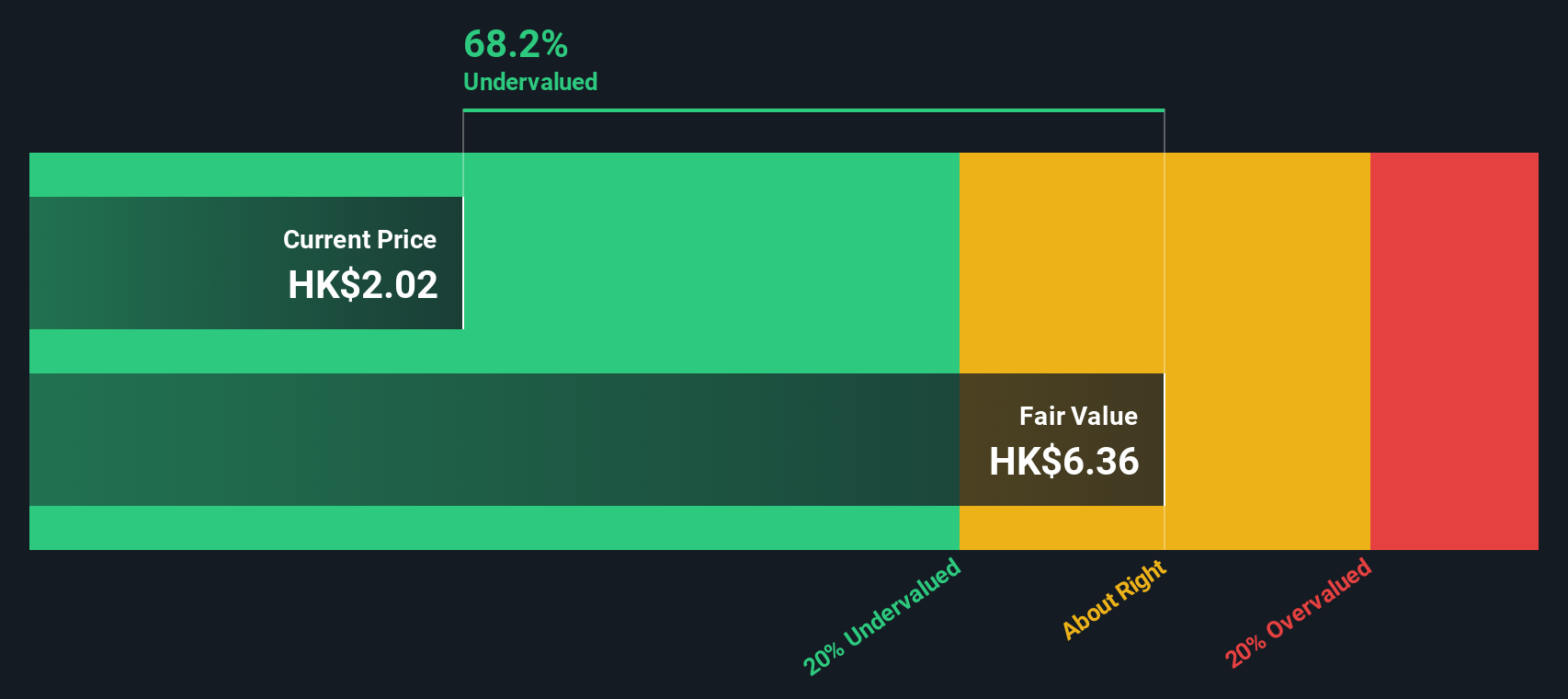

K. Wah International Holdings (SEHK:173)

Simply Wall St Value Rating: ★★★★★☆

Overview: K. Wah International Holdings operates primarily in property development in Hong Kong and Mainland China, with additional interests in property investment, generating a total revenue of HK$6.10 billion.

Operations: The company generates significant revenue from property development, particularly in Mainland China where it earned HK$4.45 billion, followed by Hong Kong with HK$918.77 million, and property investment contributing HK$637.17 million. It achieved a net income margin of 13.14% and a gross profit margin of 33.07% as of the latest reporting period ending December 2023.

PE: 6.7x

K. Wah International Holdings, a lesser-known entity in Hong Kong's bustling market, recently saw significant insider confidence with Mo Chi Cheng purchasing 200,000 shares for HK$361,000. This move in early June underscores a strong belief in the company’s prospects despite its small size and external borrowing as its sole funding source. With earnings expected to grow by about 9% annually, this investment could signal unrecognized potential amidst recent decisions like the reduced dividend payout set for late July. Such strategic financial maneuvers hint at both caution and optimism for future growth.

- Click here and access our complete valuation analysis report to understand the dynamics of K. Wah International Holdings.

Learn about K. Wah International Holdings' historical performance.

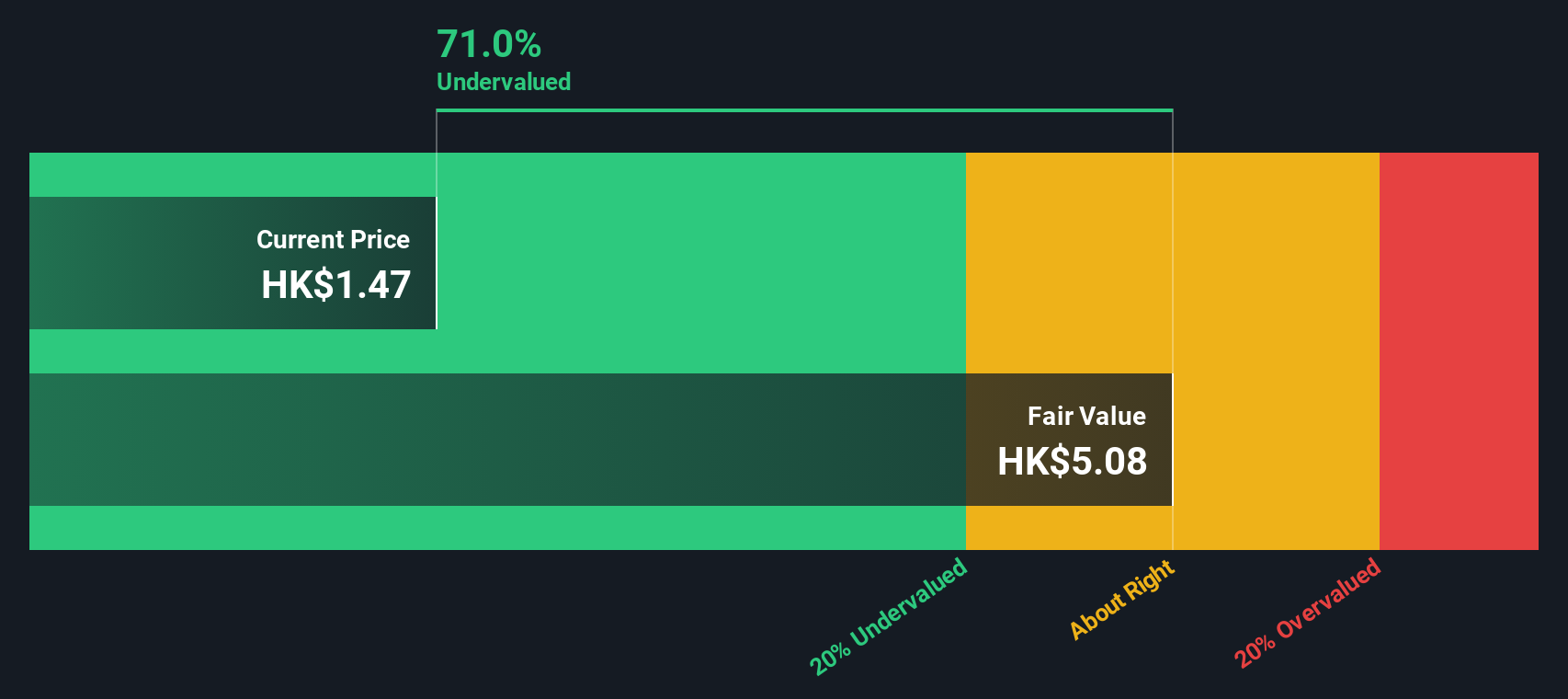

Giordano International (SEHK:709)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Giordano International is a global apparel retailer, operating across various regions including Taiwan, Mainland China, Hong Kong and Macau, the Gulf Cooperation Council, Southeast Asia, Australia, and through overseas franchisees.

Operations: The company generates a gross profit margin of 58.43% as of the latest period, reflecting a slight decline from 58.48% in the previous quarter. The net income for the most recent quarter stands at HK$345 million, with revenue reported at HK$3873 million.

PE: 8.5x

Giordano International, recognized for its strategic management shifts, recently enhanced its board with seasoned experts like Mr. Chau, signaling robust governance. Despite a slight dip in dividends to 13.5 HK cents and mixed first-quarter sales results with revenue slightly down from the previous year, insider confidence is evident as they recently purchased shares, underscoring belief in the company's potential rebound and growth trajectory amidst challenging market conditions. These moves reflect a proactive approach to steering through industry headwinds while capitalizing on emerging opportunities.

- Unlock comprehensive insights into our analysis of Giordano International stock in this valuation report.

Gain insights into Giordano International's past trends and performance with our Past report.

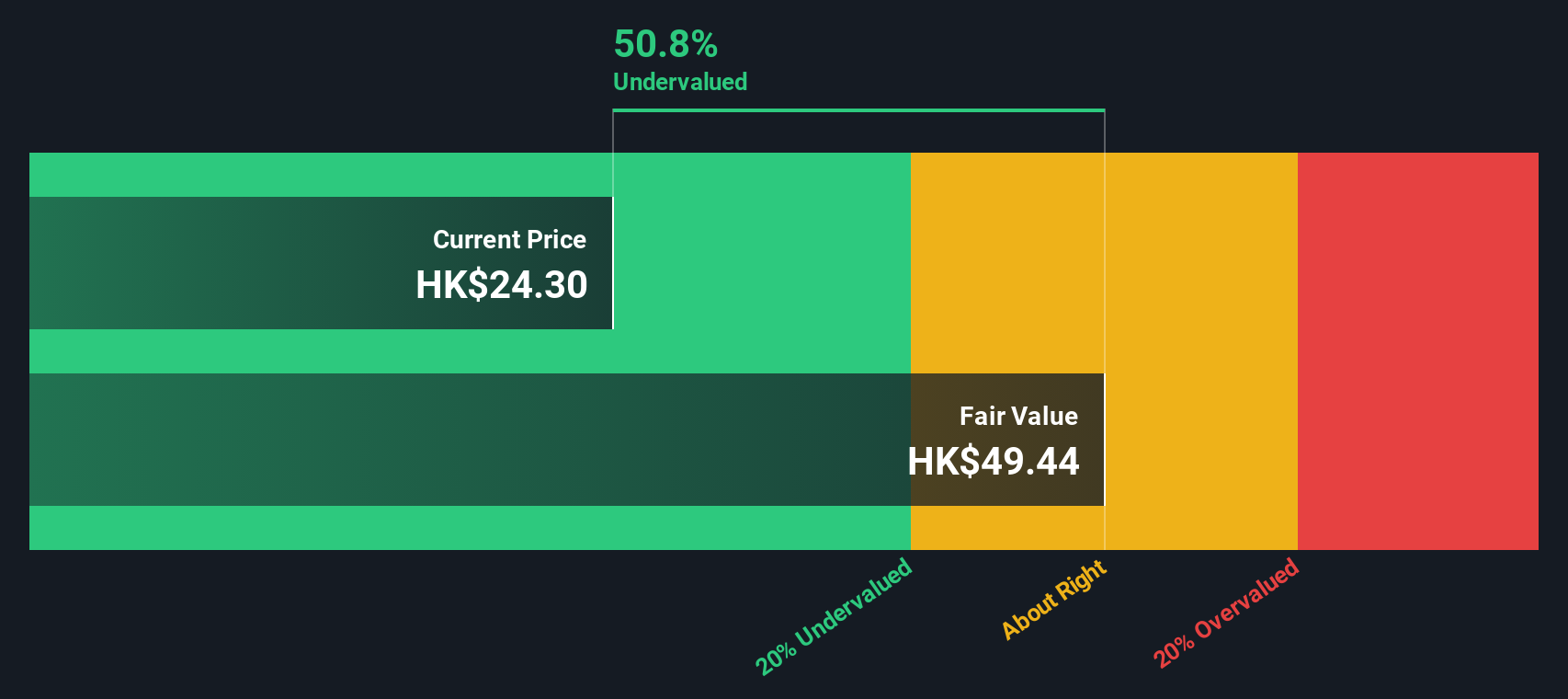

Ferretti (SEHK:9638)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ferretti specializes in the design, construction, and marketing of yachts and recreational boats, with a market capitalization of approximately €1.23 billion.

Operations: The company generates €1.23 billion in revenue primarily through the design, construction, and marketing of yachts and recreational boats. Its gross profit margin has shown an upward trend over recent years, reaching 37.08% as of the latest report, with cost of goods sold amounting to €773.32 million.

PE: 11.5x

Ferretti, a lesser-known entity in Hong Kong's bustling market, recently confirmed its 2024 earnings outlook with anticipated revenues reaching up to €1.24 billion, reflecting a growth of up to 11.6%. This projection aligns with their strategic presentations at the UniCredit Italian Investment Conference, underscoring robust market engagement and forward-looking governance as evidenced by recent bylaw enhancements. Notably, insider confidence is palpable; they've recently purchased shares, signaling strong belief in the company’s trajectory amidst its financial affirmations and operational adjustments.

- Take a closer look at Ferretti's potential here in our valuation report.

Understand Ferretti's track record by examining our Past report.

Where To Now?

- Click here to access our complete index of 20 Undervalued Small Caps With Insider Buying.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9638

Ferretti

Designs, constructs, markets, and sells yachts and vessels under the Riva, Wally, Ferretti Yachts, Pershing, Itama, Easy Boat, CRN, and Custom Line brand names.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives