- Hong Kong

- /

- Real Estate

- /

- SEHK:17

New World Development (SEHK:17): Assessing Valuation Following Latest Earnings Decline and New Loan Facility

Reviewed by Kshitija Bhandaru

New World Development (SEHK:17) just reported its full-year 2025 earnings, showing a sharp drop in sales and a reduced net loss compared to last year. In addition, the company secured a new loan facility backed by prime assets to bolster its financing flexibility.

See our latest analysis for New World Development.

Following these earnings and the fresh loan facility news, New World Development’s share price has shown only subtle short-term movement. Its 1-year total shareholder return remains slightly negative. Momentum has yet to meaningfully build, which reflects ongoing cautious sentiment around the business.

If you’re looking for other compelling investment opportunities beyond the property sector, now is an ideal moment to broaden your horizons and discover fast growing stocks with high insider ownership

Given the drop in revenue, a narrower but still sizeable net loss, and a share price below analyst targets, investors now face a familiar dilemma: does New World Development present deep value, or is the market already pricing in a potential turnaround?

Most Popular Narrative: 53% Overvalued

Analysts now estimate New World Development’s fair value at HK$5.36 per share, while the stock last closed at HK$8.21. This sharp gap reflects ongoing skepticism about the company’s recovery, despite upbeat signals on future performance.

The company’s high leverage remains a critical risk, and management continues to prioritize debt reduction through asset sales, cost-cutting, and suspending dividends. However, persistently high interest rates mean debt servicing costs will remain elevated, potentially compressing net margins and weighing on future earnings.

Want to see what bold projections fuel this narrative? There is a major twist: analysts anticipate a dramatic swing from deep losses to profits in just a few years. What assumptions are making that possible? Find out what could change the game.

Result: Fair Value of $5.36 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, signs of stabilization in China's property market and stronger recurring income from flagship assets could quickly change the outlook for New World Development.

Find out about the key risks to this New World Development narrative.

Another View: What Does the Market Multiple Say?

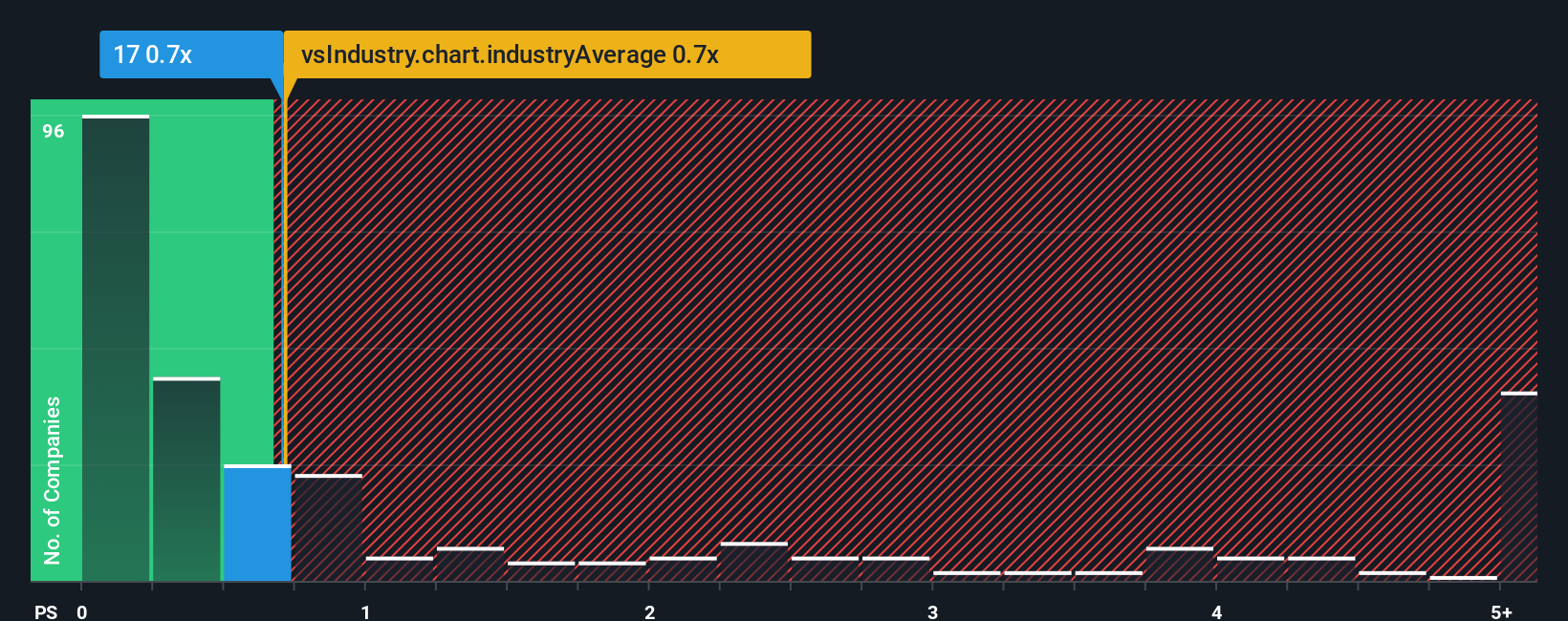

Instead of using analyst price targets to judge value, some investors look to the price-to-sales ratio as a guide. New World Development trades at just 0.7x sales, matching the industry average. However, this figure also lines up with its fair ratio of 1x, which suggests the shares are not notably cheap or expensive compared to peers. With market expectations already priced in, could a shift in sector fortunes tip the scales?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own New World Development Narrative

If you want to dig deeper, challenge the consensus, or craft your own view from the numbers, it only takes a few minutes to build your own perspective. Do it your way

A great starting point for your New World Development research is our analysis highlighting 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Smart investors always keep an eye out for new opportunities that could outperform the crowd. Don’t just watch from the sidelines—seize the chance to build a stronger portfolio with these standout themes:

- Power up your returns by tracking market leaders with solid yield potential by reviewing these 19 dividend stocks with yields > 3%, offering steady income above 3%.

- Stay ahead of the curve and unlock fresh prospects in technology by checking out these 24 AI penny stocks, tapping into the artificial intelligence wave.

- Benefit from tomorrow’s breakthroughs by seeing which companies are at the forefront of next-generation computing within these 26 quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New World Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:17

New World Development

An investment holding company, operates in the property development and investment business in Hong Kong and Mainland China.

Slightly overvalued with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives