- Hong Kong

- /

- Real Estate

- /

- SEHK:169

Take Care Before Diving Into The Deep End On Wanda Hotel Development Company Limited (HKG:169)

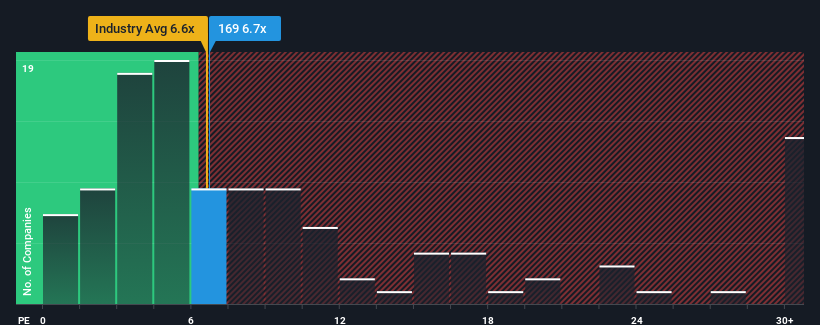

When close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 9x, you may consider Wanda Hotel Development Company Limited (HKG:169) as an attractive investment with its 6.7x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For example, consider that Wanda Hotel Development's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Wanda Hotel Development

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Wanda Hotel Development's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 15%. Even so, admirably EPS has lifted 432% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 18% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that Wanda Hotel Development is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Wanda Hotel Development currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Before you settle on your opinion, we've discovered 1 warning sign for Wanda Hotel Development that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Wanda Hotel Development, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wanda Hotel Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:169

Wanda Hotel Development

An investment holding company, engages in property development, investment, leasing, and management activities in the People's Republic of China and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives