- Hong Kong

- /

- Real Estate

- /

- SEHK:147

International Business Settlement Holdings Limited's (HKG:147) 42% Cheaper Price Remains In Tune With Revenues

The International Business Settlement Holdings Limited (HKG:147) share price has softened a substantial 42% over the previous 30 days, handing back much of the gains the stock has made lately. Looking at the bigger picture, even after this poor month the stock is up 32% in the last year.

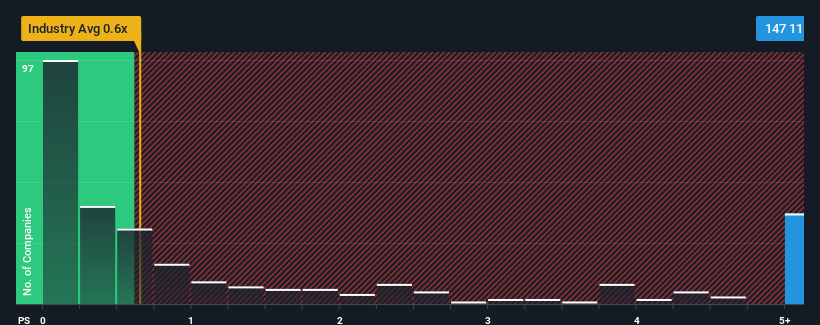

In spite of the heavy fall in price, you could still be forgiven for thinking International Business Settlement Holdings is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 11.9x, considering almost half the companies in Hong Kong's Real Estate industry have P/S ratios below 0.6x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for International Business Settlement Holdings

What Does International Business Settlement Holdings' P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at International Business Settlement Holdings over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for International Business Settlement Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, International Business Settlement Holdings would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 79%. Still, the latest three year period has seen an excellent 103% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 5.1% shows it's noticeably more attractive.

With this information, we can see why International Business Settlement Holdings is trading at such a high P/S compared to the industry. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

International Business Settlement Holdings' shares may have suffered, but its P/S remains high. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that International Business Settlement Holdings maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

We don't want to rain on the parade too much, but we did also find 1 warning sign for International Business Settlement Holdings that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:147

International Business Settlement Holdings

An investment holding company, engages in the property development business in Mainland China and Hong Kong.

Mediocre balance sheet minimal.

Market Insights

Community Narratives