- Hong Kong

- /

- Real Estate

- /

- SEHK:1329

Market Might Still Lack Some Conviction On Beijing Capital Grand Limited (HKG:1329) Even After 30% Share Price Boost

Despite an already strong run, Beijing Capital Grand Limited (HKG:1329) shares have been powering on, with a gain of 30% in the last thirty days. Notwithstanding the latest gain, the annual share price return of 5.7% isn't as impressive.

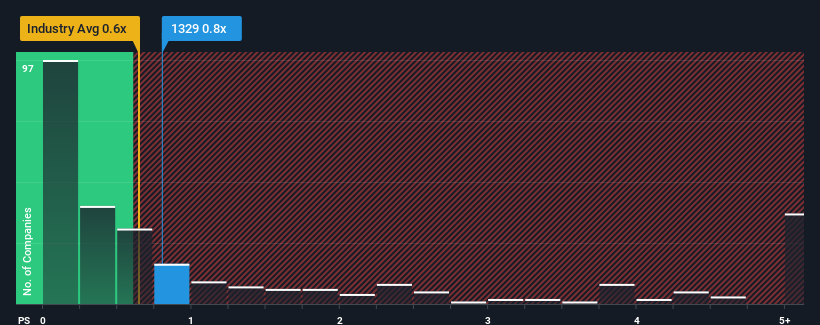

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Beijing Capital Grand's P/S ratio of 0.8x, since the median price-to-sales (or "P/S") ratio for the Real Estate industry in Hong Kong is also close to 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Beijing Capital Grand

What Does Beijing Capital Grand's Recent Performance Look Like?

Beijing Capital Grand certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Beijing Capital Grand will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Beijing Capital Grand, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

Beijing Capital Grand's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 104% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 71% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 5.1%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's curious that Beijing Capital Grand's P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Beijing Capital Grand's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To our surprise, Beijing Capital Grand revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

You should always think about risks. Case in point, we've spotted 2 warning signs for Beijing Capital Grand you should be aware of, and 1 of them is potentially serious.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Capital Grand might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1329

Beijing Capital Grand

Engages in the development of commercial properties in the People's Republic of China.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives