- Hong Kong

- /

- Real Estate

- /

- SEHK:123

Yuexiu Property (SEHK:123) Earnings Show Increased Sales But Decreased Net Income

Reviewed by Simply Wall St

Following its earnings announcement and news of a dividend decrease, Yuexiu Property (SEHK:123) experienced a price move of 16% over the last quarter. The company's interim dividend reduction for 2025 and its earnings showing increased sales but decreased net income and earnings per share could have added countervailing weight to the broader market trend. During the same period, major U.S. indices reached record highs, driven by expectations of interest rate cuts influenced by inflation data. Despite these mixed signals, Yuexiu Property's stock move aligns broadly with the market's upward trajectory of 1% over the last week.

Over the past year, Yuexiu Property's total shareholder return, which includes both share price appreciation and dividends, was 28.98%. This performance, while positive, fell short of the Hong Kong Real Estate industry's return of 39% and the broader Hong Kong Market's return of 54.4% over the same period. Such comparative underperformance suggests challenges in capturing market or industry-wide growth trends.

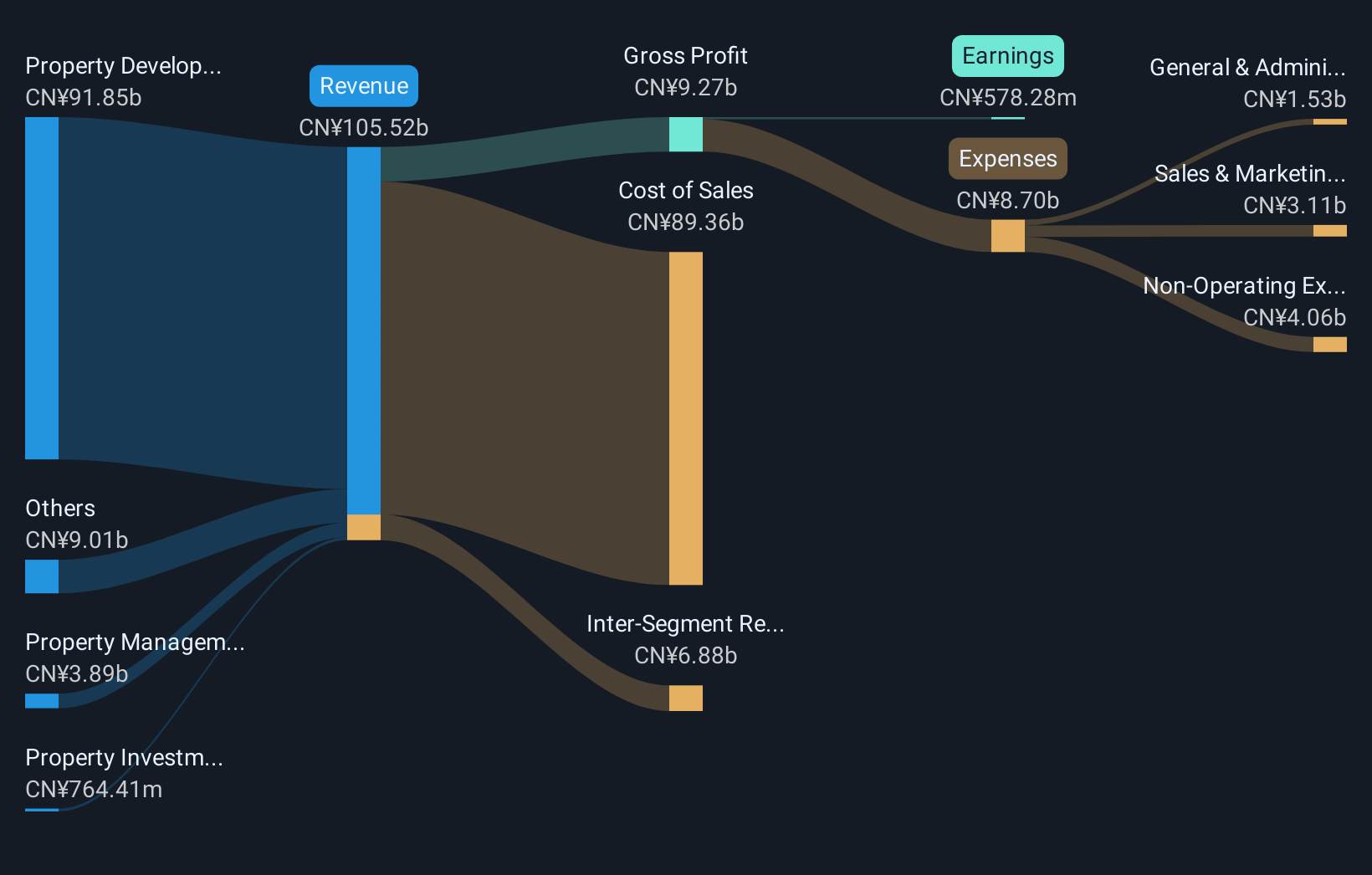

The company's revenue increase, reported at CNY 98.63 billion, contrasts with a significant decline in earnings, which stood at CNY 578.28 million. This divergence between revenue and earnings might relate to factors such as reduced profit margins and impaired asset valuations, impacting earnings forecasts negatively. Consequently, these elements could contribute to less optimistic investor sentiment and potential downward pressure on future valuations.

Currently trading at HK$5.18, Yuexiu Property is perceived to have a significant discount relative to the consensus analyst price target of HK$6.41, indicating potential upside. However, investor sentiment may remain cautious due to mixed signals from recent earnings and corporate actions, coupled with the analyst consensus showing variance, limiting forecast confidence. These factors may influence future share performance and anticipated market alignment.

Gain insights into Yuexiu Property's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:123

Yuexiu Property

Develops, sells, invests, and manages properties primarily in Mainland China and Hong Kong.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives