- Hong Kong

- /

- Real Estate

- /

- SEHK:1209

Mixc Lifestyle (SEHK:1209) Earnings Growth Slows Below Five-Year Pace, Challenging Market Premium

Reviewed by Simply Wall St

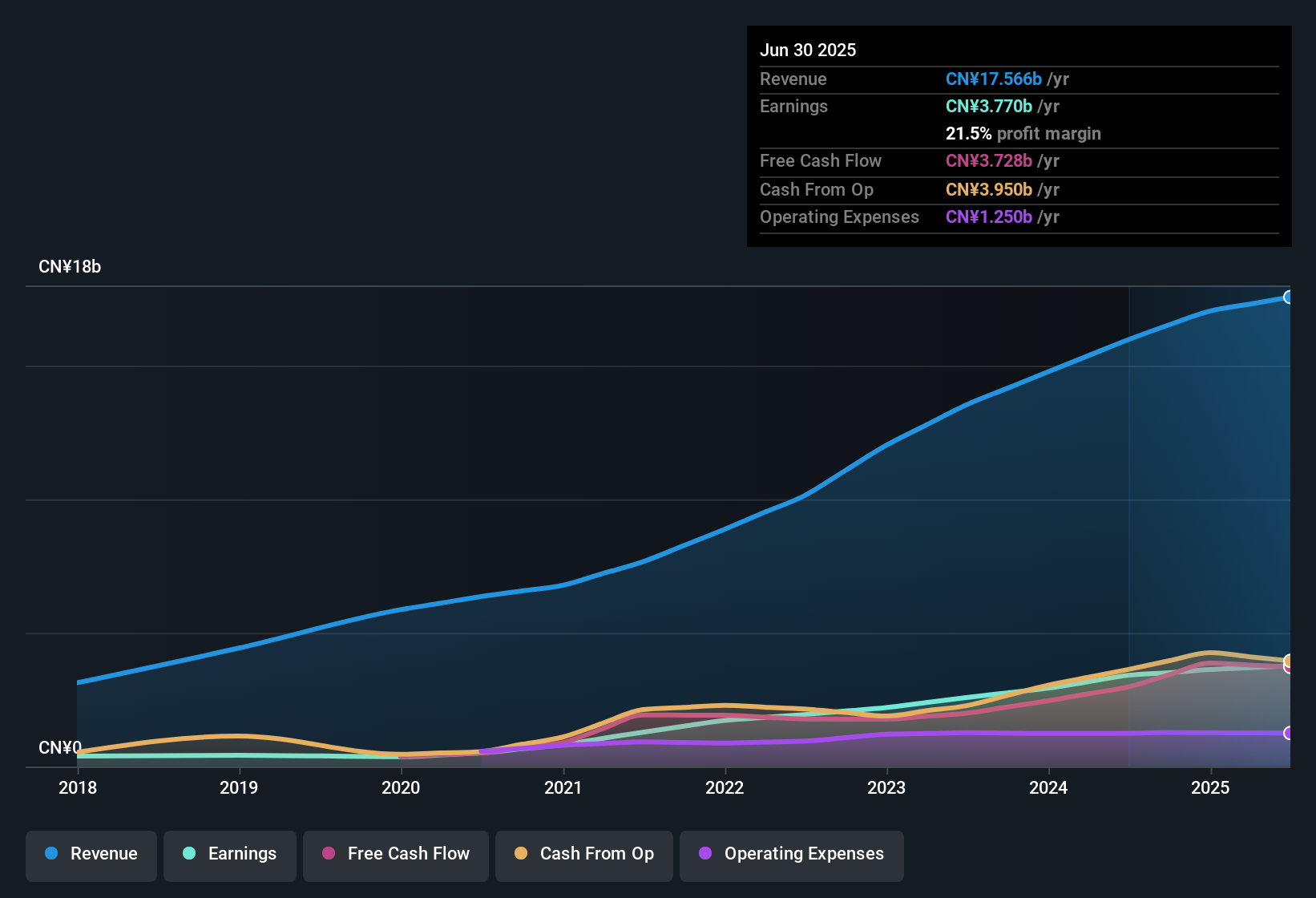

China Resources Mixc Lifestyle Services (SEHK:1209) reported revenue growth of 10.1% per year and expects earnings to climb 12.66% per year, both outpacing the Hong Kong market averages. However, recent earnings growth slowed to 10.4% this year, down from the company’s five-year average of 29.8% per year. Investors are watching closely as the company’s forecasts remain strong, but recent deceleration may prompt questions about the sustainability of its momentum.

See our full analysis for China Resources Mixc Lifestyle Services.Next, we will put these results in context by weighing them against the prevailing narratives to see which views are supported and which might be up for debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

P/E Ratio Commands Industry Premium

- China Resources Mixc Lifestyle Services trades at a Price-To-Earnings ratio of 22.5x, meaning investors are paying a much higher multiple than the Hong Kong Real Estate industry average of 13.7x or the peer average of 17.1x.

- The prevailing market view suggests this premium is justified by the company’s expectation to grow earnings faster than most. With a 12.66% per year earnings forecast outpacing the 8.6% market average,

- Supporters argue the high P/E reflects confidence in Mixc’s stability and profit visibility, given its state-backed parent and track record of high-quality earnings.

- However, such a significant valuation gap leaves little room for disappointment if momentum slips below projected double-digit growth.

DCF Fair Value Leaves Upside Gap

- At a current share price of HK$40.54, Mixc is trading below its DCF fair value estimate of HK$47.10, presenting a potential discount despite rich earnings multiples.

- While bulls highlight strong cash flow and long-term growth trends underpinning this fair value,

- This gap between current price and DCF value supports bullish confidence around the company’s ability to outperform,

- but the market’s past willingness to "pay up" for quality could face a test if sector volatility persists or growth rates moderate.

Growth Outpaces Market, but Momentum Shows Deceleration

- Mixc’s 10.4% earnings growth in the latest year fell short of its own five-year average of 29.8% per year, signaling the first meaningful slowdown even as outstanding growth remains ahead of the market’s 8.6% norm.

- The company’s projected revenue and earnings growth continues to outstrip industry peers, which drives the premium valuation,

- yet the recent deceleration challenges expectations for uninterrupted rapid expansion, calling attention to how sustainable the current momentum will be if growth cools further.

- This tension is central to ongoing market debate, fueling both optimism and caution within the investor base.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on China Resources Mixc Lifestyle Services's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.See What Else Is Out There

Mixc’s premium valuation relies on rapid growth continuing; however, the recent slowdown in earnings momentum raises questions about the consistency of its future performance.

If you want to avoid unexpected slowdowns and seek companies with a record of consistent results, check out stable growth stocks screener so you can focus on businesses delivering steady growth across changing conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1209

China Resources Mixc Lifestyle Services

An investment holding company, engages in the provision of property management and commercial operational services in the People’s Republic of China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives