- Hong Kong

- /

- Real Estate

- /

- SEHK:1209

It May Be Possible That China Resources Mixc Lifestyle Services Limited's (HKG:1209) CEO Compensation Could Get Bumped Up

Key Insights

- China Resources Mixc Lifestyle Services' Annual General Meeting to take place on 5th of June

- Total pay for CEO Linkang Yu includes CN¥1.60m salary

- The overall pay is 77% below the industry average

- Over the past three years, China Resources Mixc Lifestyle Services' EPS grew by 28% and over the past three years, the total shareholder return was 8.1%

Shareholders will probably not be disappointed by the robust results at China Resources Mixc Lifestyle Services Limited (HKG:1209) recently and they will be keeping this in mind as they go into the AGM on 5th of June. They will probably be more interested in hearing the board discuss future initiatives to further improve the business as they vote on resolutions such as executive remuneration. Here is our take on why we think CEO compensation is fair and may even warrant a raise.

See our latest analysis for China Resources Mixc Lifestyle Services

Comparing China Resources Mixc Lifestyle Services Limited's CEO Compensation With The Industry

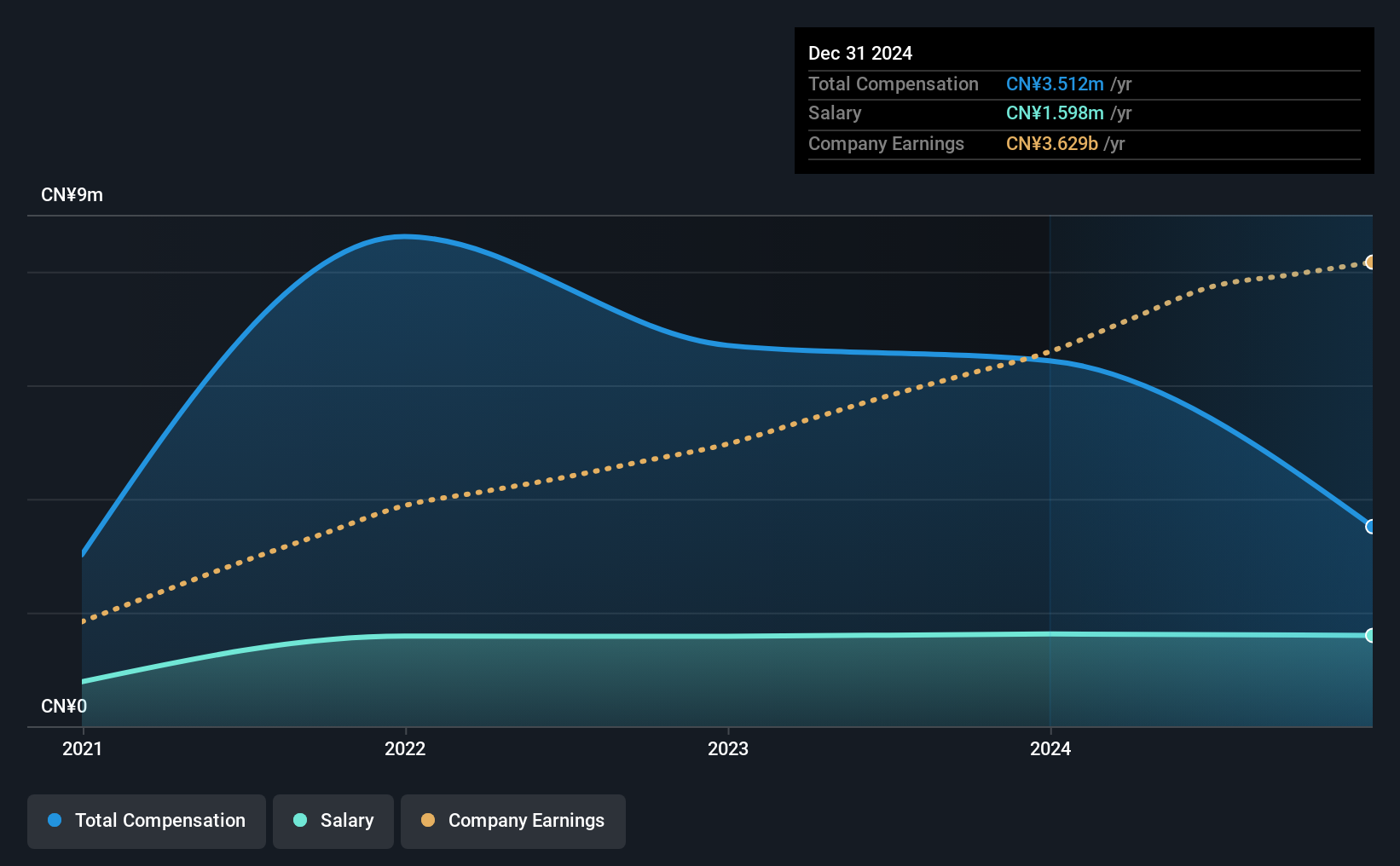

At the time of writing, our data shows that China Resources Mixc Lifestyle Services Limited has a market capitalization of HK$86b, and reported total annual CEO compensation of CN¥3.5m for the year to December 2024. That's a notable decrease of 45% on last year. While we always look at total compensation first, our analysis shows that the salary component is less, at CN¥1.6m.

For comparison, other companies in the Hong Kong Real Estate industry with market capitalizations above HK$63b, reported a median total CEO compensation of CN¥16m. In other words, China Resources Mixc Lifestyle Services pays its CEO lower than the industry median. What's more, Linkang Yu holds HK$14m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CN¥1.6m | CN¥1.6m | 46% |

| Other | CN¥1.9m | CN¥4.8m | 54% |

| Total Compensation | CN¥3.5m | CN¥6.4m | 100% |

Talking in terms of the industry, salary represented approximately 82% of total compensation out of all the companies we analyzed, while other remuneration made up 18% of the pie. It's interesting to note that China Resources Mixc Lifestyle Services allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at China Resources Mixc Lifestyle Services Limited's Growth Numbers

Over the past three years, China Resources Mixc Lifestyle Services Limited has seen its earnings per share (EPS) grow by 28% per year. It achieved revenue growth of 15% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has China Resources Mixc Lifestyle Services Limited Been A Good Investment?

China Resources Mixc Lifestyle Services Limited has not done too badly by shareholders, with a total return of 8.1%, over three years. It would be nice to see that metric improve in the future. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

In Summary...

The company's overall performance, while not bad, could be better. If it continues on the same road, shareholders might feel even more confident about their investment, and have little to no objections concerning CEO pay. Rather, investors would more likely want to engage on discussions related to key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at China Resources Mixc Lifestyle Services.

Important note: China Resources Mixc Lifestyle Services is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1209

China Resources Mixc Lifestyle Services

An investment holding company, engages in the provision of property management and commercial operational services in the People’s Republic of China.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion