- Hong Kong

- /

- Real Estate

- /

- SEHK:1209

China Resources Mixc Lifestyle (SEHK:1209): Evaluating Valuation Following Key Partnership and Service Agreement Renewals

Reviewed by Simply Wall St

China Resources Mixc Lifestyle Services (SEHK:1209) recently renewed several framework agreements with affiliated entities, covering procurement, value-added services, property management, and membership operations. These moves highlight the company's ongoing efforts to secure stable and recurring revenue streams while fostering reliable business relationships.

See our latest analysis for China Resources Mixc Lifestyle Services.

Momentum is clearly building for China Resources Mixc Lifestyle Services, with a 49.7% year-to-date share price return and a 32.6% total shareholder return over the past year. The latest 5.0% single-day jump hints that investors are recognizing the growth potential behind its recent contract renewals and expanding service agreements, reinforcing a positive outlook for both short-term and long-term performance.

If a strong run like this has you wondering where else opportunity might be lurking, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

Yet with the stock up nearly 50% this year and trading just below its analyst price target, the key question is whether the market has already priced in all this momentum or if a genuine buying opportunity remains.

Price-to-Earnings of 23.1x: Is it justified?

China Resources Mixc Lifestyle Services is currently trading at a price-to-earnings (P/E) ratio of 23.1x, which is significantly higher than its peers. With the most recent close at HK$41.76, this valuation suggests that investors are pricing in premium expectations for future earnings growth compared to industry averages.

The price-to-earnings ratio is a key metric showing how much investors are willing to pay for each dollar of the company’s earnings. In real estate management and development, a higher P/E may reflect confidence in the company’s growth prospects, business model resilience, or quality of earnings.

Looking deeper, this 23.1x P/E is notably above both the peer average (17.2x) and the broader Hong Kong Real Estate industry average (13.2x). Even relative to the estimated fair price-to-earnings ratio of 15.3x, the market appears to be pricing the shares at a notable premium. This could adjust if profit momentum slows or investor sentiment shifts.

Explore the SWS fair ratio for China Resources Mixc Lifestyle Services

Result: Price-to-Earnings of 23.1x (OVERVALUED)

However, slower-than-expected earnings growth or any negative shifts in investor sentiment could quickly change the outlook and impact the stock's premium valuation.

Find out about the key risks to this China Resources Mixc Lifestyle Services narrative.

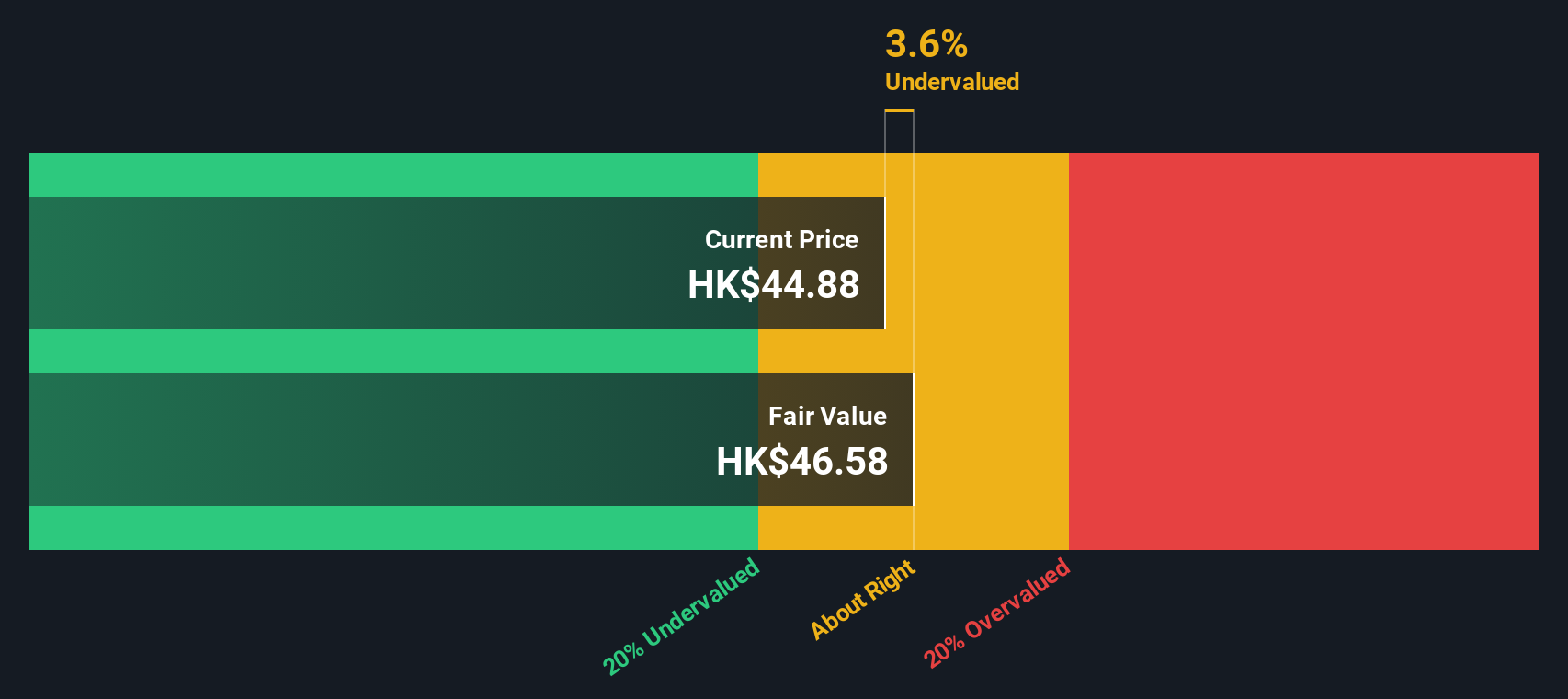

Another View: Discounted Cash Flow Tells a Different Story

While the market’s current valuation leans expensive, our DCF model estimates China Resources Mixc Lifestyle Services shares are actually trading at about 10.6% below their fair value. This perspective points to an undervalued opportunity and challenges the risk implied by high earnings multiples. The question is, which signal should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Resources Mixc Lifestyle Services for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Resources Mixc Lifestyle Services Narrative

Keep in mind that you can always form your own perspective using the same data, and craft a personal investment story in just a few minutes. Do it your way

A great starting point for your China Resources Mixc Lifestyle Services research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you're ready to uncover fresh opportunities and stay ahead of the crowd, don't settle for just one stock story. Let the Simply Wall Street Screener guide you to even more promising investments tailored to your interests.

- Spot undervalued gems primed for potential upside by using these 882 undervalued stocks based on cash flows. Steer your money toward stocks trading below real worth.

- Capture a slice of emerging tech by tapping into these 25 AI penny stocks that are powering the AI revolution and setting tomorrow's pace.

- Boost your income with steady payouts by checking out these 16 dividend stocks with yields > 3%, which feature attractive yields and time-tested cashflows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1209

China Resources Mixc Lifestyle Services

An investment holding company, engages in the provision of property management and commercial operational services in the People’s Republic of China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives