As global markets navigate a complex landscape marked by geopolitical tensions and fluctuating economic indicators, investors are increasingly turning their attention to smaller-cap stocks. Penny stocks, often associated with smaller or newer companies, continue to attract interest due to their potential for growth at lower price points. Despite being an outdated term, penny stocks can offer significant opportunities when backed by strong financials and solid fundamentals. In this article, we explore several Asian penny stocks that stand out as hidden gems in the current market environment.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.102 | SGD43.35M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.28 | HK$807.62M | ✅ 4 ⚠️ 1 View Analysis > |

| KPa-BM Holdings (SEHK:2663) | HK$0.335 | HK$186.57M | ✅ 2 ⚠️ 4 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.42 | SGD170.22M | ✅ 4 ⚠️ 3 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.14 | HK$1.9B | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.22 | SGD8.74B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.173 | SGD34.46M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.10 | SGD850.49M | ✅ 4 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.76 | HK$54.53B | ✅ 3 ⚠️ 1 View Analysis > |

| United Energy Group (SEHK:467) | HK$0.52 | HK$13.44B | ✅ 4 ⚠️ 4 View Analysis > |

Click here to see the full list of 1,016 stocks from our Asian Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Jacobio Pharmaceuticals Group (SEHK:1167)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jacobio Pharmaceuticals Group Co., Ltd. is an investment holding company focused on the in-house discovery and development of oncology therapies, with a market cap of HK$3.86 billion.

Operations: The company's revenue is primarily derived from the research and development of new drugs, amounting to CN¥155.71 million.

Market Cap: HK$3.86B

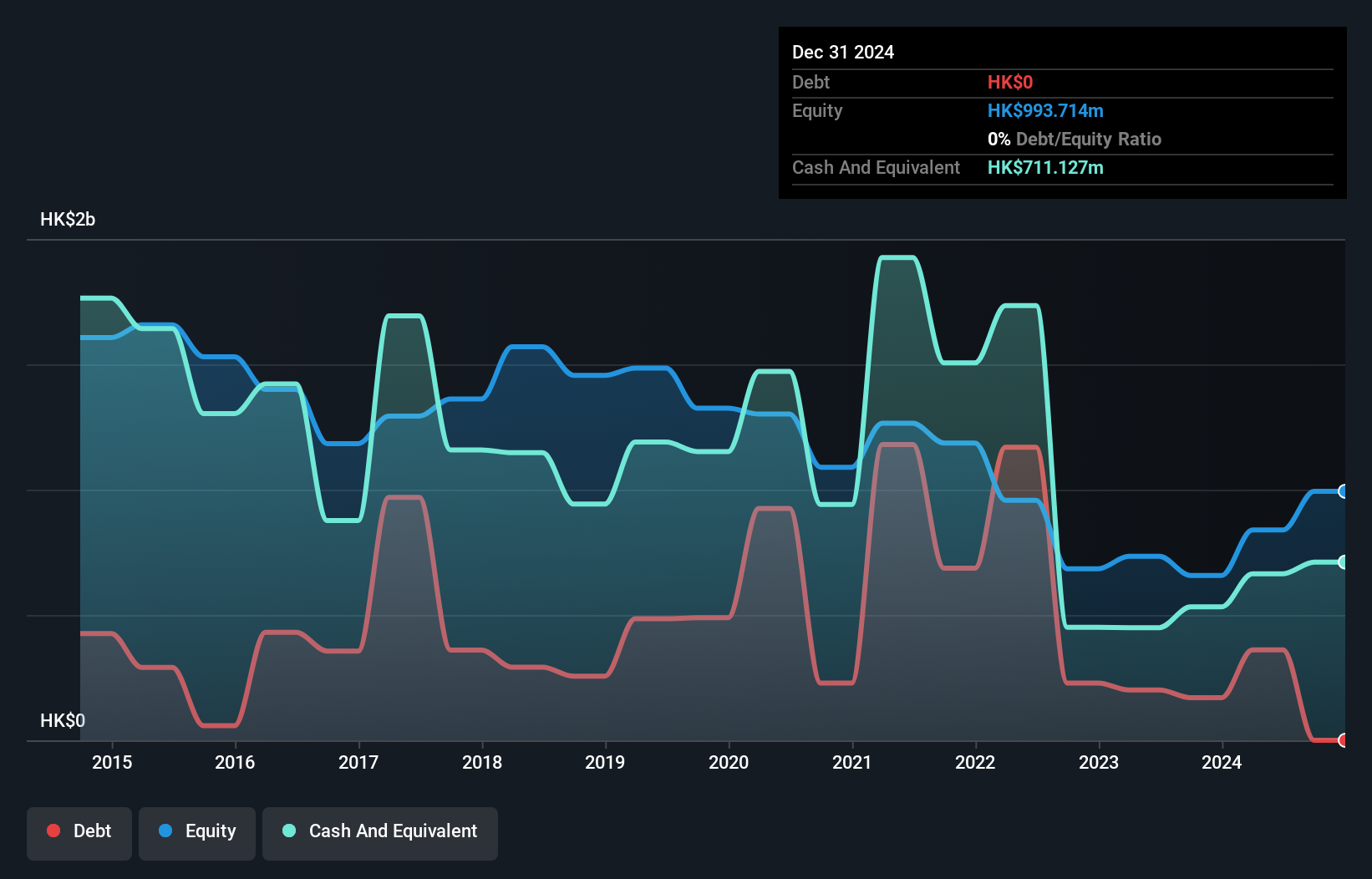

Jacobio Pharmaceuticals Group, with a market cap of HK$3.86 billion, remains pre-revenue and unprofitable but shows promise through its oncology-focused pipeline. The recent approval of its KRAS G12C inhibitor, glecirasib, for non-small cell lung cancer marks a significant milestone, triggering a RMB 50 million payment from partner Allist Pharmaceuticals. Despite high share price volatility and negative return on equity (-16.87%), Jacobio's strong cash position exceeds total debt and covers liabilities comfortably. Ongoing clinical trials in multiple regions highlight potential growth avenues as the company advances innovative cancer therapies across various signaling pathways.

- Click here and access our complete financial health analysis report to understand the dynamics of Jacobio Pharmaceuticals Group.

- Evaluate Jacobio Pharmaceuticals Group's prospects by accessing our earnings growth report.

Midland Holdings (SEHK:1200)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Midland Holdings Limited is an investment holding company offering property agency services in Hong Kong, Macau, and Mainland China with a market cap of HK$1.05 billion.

Operations: The company generates revenue primarily from its property agency services, with HK$6.02 billion coming from residential properties and HK$46.57 million from commercial, industrial properties, and shops.

Market Cap: HK$1.05B

Midland Holdings, with a market cap of HK$1.05 billion, has shown strong financial performance recently by reporting HK$6.08 billion in sales for 2024, marking significant growth from the previous year. The company's profitability is underscored by a net income of HK$320.32 million and high-quality earnings, supported by robust short-term assets exceeding liabilities. Despite no debt concerns and stable volatility, insider selling has been notable over the past quarter. The recent termination and renewal of its Cross Referral Services Framework Agreement indicate strategic adjustments to capitalize on stronger-than-expected estate agency performance while maintaining compliance with listing rules.

- Dive into the specifics of Midland Holdings here with our thorough balance sheet health report.

- Assess Midland Holdings' future earnings estimates with our detailed growth reports.

Q & M Dental Group (Singapore) (SGX:QC7)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Q & M Dental Group (Singapore) (SGX:QC7) is an investment holding company that offers private dental healthcare services in the People's Republic of China, with a market capitalization of S$387.91 million.

Operations: The company's revenue is derived from its Core Dental Business, which generated S$173.79 million, and Other Businesses, contributing S$6.89 million.

Market Cap: SGD387.91M

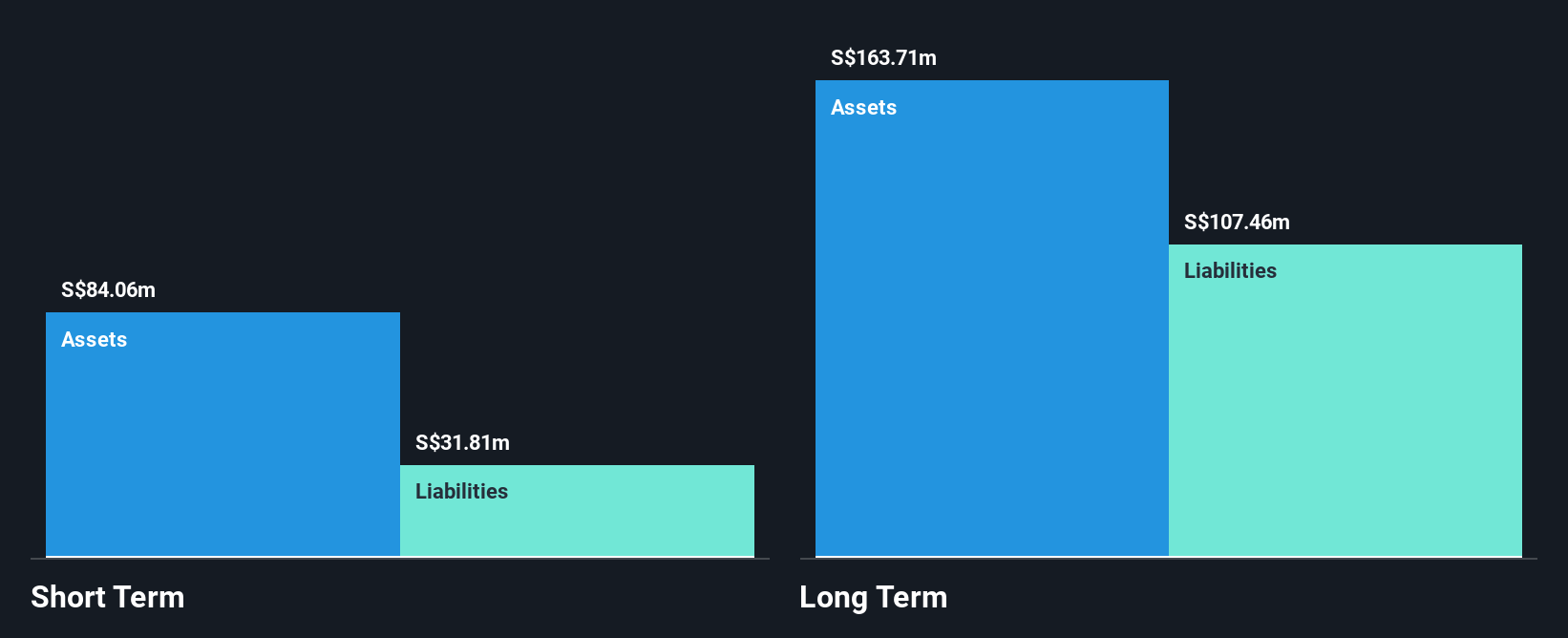

Q & M Dental Group (Singapore), with a market capitalization of S$387.91 million, has experienced earnings growth of 27.1% over the past year, surpassing its five-year average decline. The company's net profit margin improved to 8.1%, and it trades at a significant discount to estimated fair value. Although short-term assets cover liabilities, long-term liabilities remain uncovered by these assets. Recent share buyback initiatives indicate strategic capital allocation, while changes in the board suggest evolving governance dynamics. Despite stable weekly volatility and satisfactory debt levels, high-quality earnings are impacted by a large one-off loss of S$5.2 million last year.

- Click to explore a detailed breakdown of our findings in Q & M Dental Group (Singapore)'s financial health report.

- Learn about Q & M Dental Group (Singapore)'s future growth trajectory here.

Make It Happen

- Click through to start exploring the rest of the 1,013 Asian Penny Stocks now.

- Searching for a Fresh Perspective? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1167

Jacobio Pharmaceuticals Group

An investment holding company, engages in the in-house discovery and development of oncology therapies.

Flawless balance sheet minimal.

Market Insights

Community Narratives