- Hong Kong

- /

- Real Estate

- /

- SEHK:12

Assessing Henderson Land Development (SEHK:12): Does the Current Price Reflect Fair Value?

Reviewed by Simply Wall St

Price-to-Earnings of 21.7x: Is it justified?

Henderson Land Development is currently trading at a price-to-earnings (P/E) ratio of 21.7x, making it appear expensive relative to both industry peers and the wider market. The P/E ratio is a widely used metric that compares a company’s current share price to its per-share earnings. This helps investors assess whether the market is overvaluing or undervaluing future profit potential.

For Henderson Land Development, this multiple stands out because it is higher than the fair price-to-earnings ratio estimated for similar firms (19x), as well as the peer group average (13.1x) and the industry average (13.7x). This suggests that investors may be pricing in strong future growth or other positive catalysts. However, it also raises questions about whether such optimism is warranted given the company’s actual financial performance and sector trends.

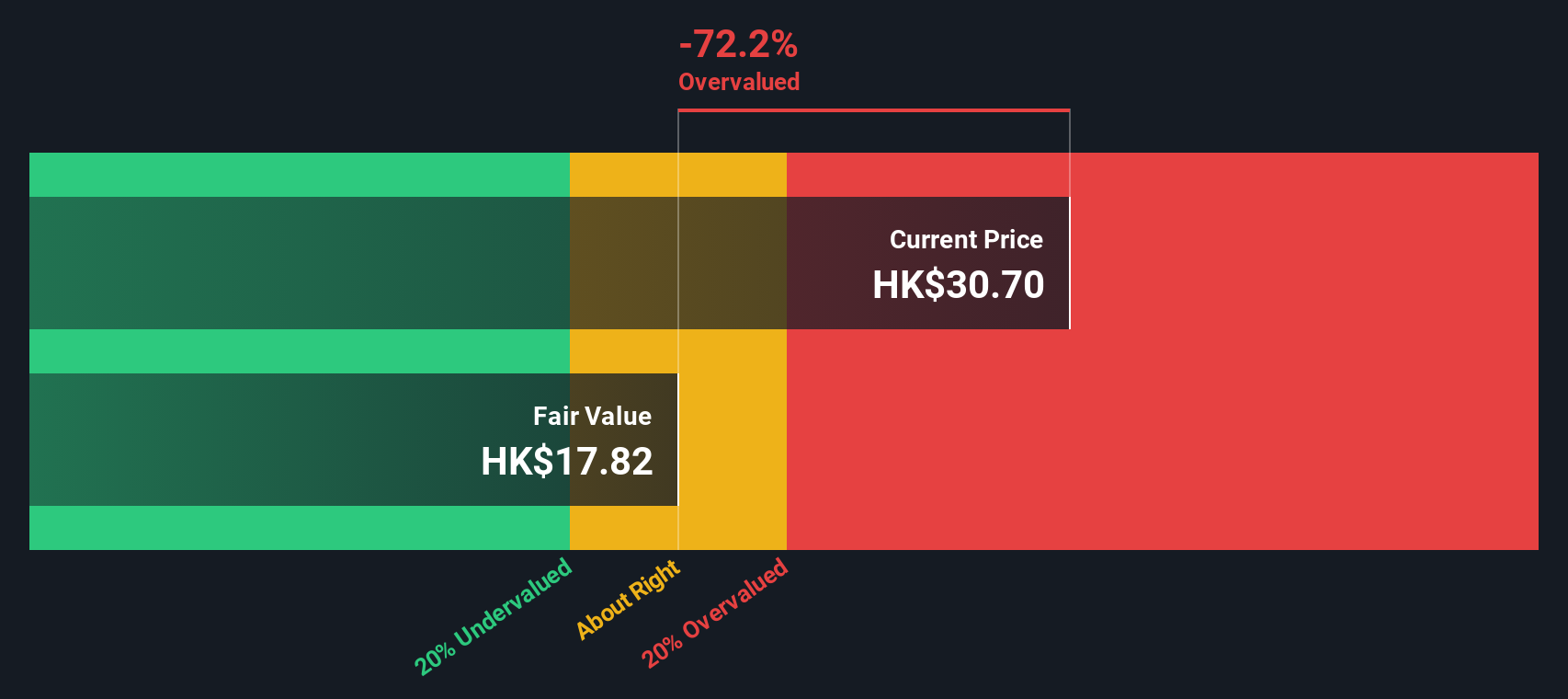

Result: Fair Value of $18.51 (OVERVALUED)

See our latest analysis for Henderson Land Development.However, ongoing revenue and income growth could falter if the broader property market weakens or if regulatory changes impact the sector’s outlook.

Find out about the key risks to this Henderson Land Development narrative.Another View: What Does the SWS DCF Model Say?

Taking a different perspective, our SWS DCF model evaluates Henderson Land Development based on its projected future cash flows rather than current market multiples. This approach sees the company as overvalued as well, although each method brings its own assumptions to the table. Could long-term cash flow forecasts offer deeper insight than simple price-based comparisons?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Henderson Land Development Narrative

Investors who wish to dig deeper can review the figures firsthand and quickly form their own perspective on Henderson Land Development’s outlook. Do it your way

A great starting point for your Henderson Land Development research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize this moment to supercharge your watchlist with stocks packed with potential. Don’t let the next breakout or valuable gem pass you by. Set yourself up to spot tomorrow’s winners now.

- Spot undervalued opportunities that score high on financial strength by using the undervalued stocks based on cash flows to filter stocks that may be trading for less than they're worth.

- Uncover the fastest-growing AI disruptors leading a new wave of innovation, powered by our AI penny stocks. This tool highlights the companies shaping tomorrow’s technology landscape.

- Grow your portfolio’s passive income by pinpointing companies with reliable, high-yield payouts. The dividend stocks with yields > 3% helps you find strong dividend payers above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Henderson Land Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SEHK:12

Henderson Land Development

An investment holding company, engages in the property development and investment activities in Hong Kong and Mainland China.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives