- Hong Kong

- /

- Real Estate

- /

- SEHK:1168

Shareholders in Sinolink Worldwide Holdings (HKG:1168) have lost 68%, as stock drops 18% this past week

Sinolink Worldwide Holdings Limited (HKG:1168) shareholders should be happy to see the share price up 30% in the last quarter. But don't envy holders -- looking back over 5 years the returns have been really bad. In fact, the share price has declined rather badly, down some 74% in that time. So is the recent increase sufficient to restore confidence in the stock? Not yet. But it could be that the fall was overdone.

Since Sinolink Worldwide Holdings has shed HK$178m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Sinolink Worldwide Holdings

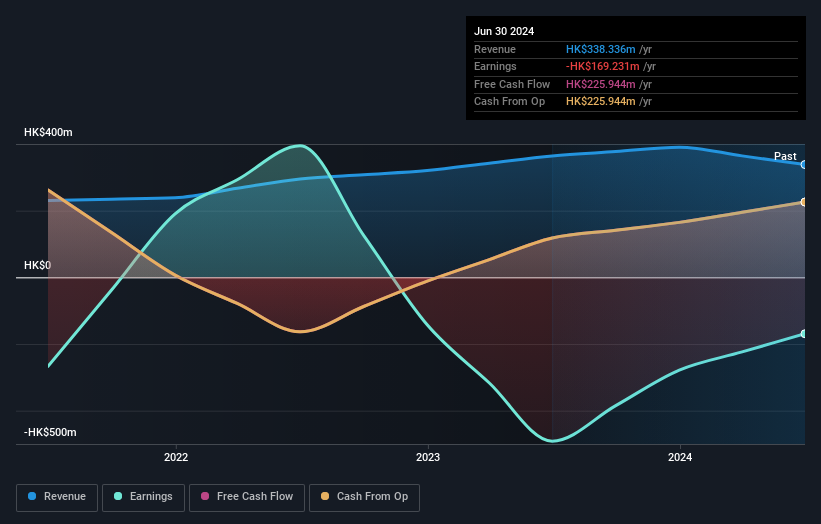

Given that Sinolink Worldwide Holdings didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last half decade, Sinolink Worldwide Holdings saw its revenue increase by 28% per year. That's well above most other pre-profit companies. So on the face of it we're really surprised to see the share price has averaged a fall of 12% each year, in the same time period. You'd have to assume the market is worried that profits won't come soon enough. While there might be an opportunity here, you'd want to take a close look at the balance sheet strength.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Sinolink Worldwide Holdings' total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. We note that Sinolink Worldwide Holdings' TSR, at -68% is higher than its share price return of -74%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Sinolink Worldwide Holdings shareholders are up 6.6% for the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 11% endured over half a decade. It could well be that the business is stabilizing. You could get a better understanding of Sinolink Worldwide Holdings' growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course Sinolink Worldwide Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1168

Sinolink Worldwide Holdings

An investment holding company, primarily engages in financial technology investment and management in the People’s Republic of China.

Excellent balance sheet and slightly overvalued.