- Hong Kong

- /

- Real Estate

- /

- SEHK:101

Hang Lung Properties (SEHK:101): Exploring Valuation Following Recent Share Price Momentum

Reviewed by Simply Wall St

Hang Lung Properties (SEHK:101) has been on the radar lately, and it is no wonder investors are taking a closer look. There has not been a major corporate event or headline this week. However, the stock’s recent upward trajectory could have some shareholders wondering if there is more happening beneath the surface. Sometimes moves like these are a signal, prompting those on the sidelines to reassess what is driving momentum and whether new opportunities are emerging.

Over the past year, Hang Lung Properties has steadily climbed, posting a strong 72% total return, despite previous years showing declines. Relatively recent gains are especially apparent, with the stock up over 40% year to date and nearly 31% in the past 3 months. With revenue and net income also showing solid growth on an annual basis, the storyline for Hang Lung Properties has shifted from caution to renewed interest.

The key question now, given this rapid comeback, is whether Hang Lung Properties is still trading at an attractive valuation or if the recent rally has already factored in all the future upside.

Most Popular Narrative: 5.3% Undervalued

The most widely followed narrative suggests that Hang Lung Properties is currently trading below its estimated fair value, hinting at upside potential for investors if assumptions hold true.

Large-scale mixed-use developments and expansions (for example, Westlake 66, Pavilion, Center 66 Phase 2) in high-growth, well-connected locations are coming online. These projects are leveraging urban vibrancy and long-term secular demand for integrated spaces, which is likely to support step-up gains in recurring income and future earnings as pre-leasing shows solid momentum.

Want a glimpse at the math behind this valuation? It hinges on ambitious forecasts for future earnings, margin improvement, and strategic developments that could vault the company into a new league. Curious what kinds of growth and profitability assumptions power this 5.3% discount? Keep reading to uncover the surprising calculations at the core of this bullish story.

Result: Fair Value of $9.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in tenant sales or a prolonged downturn in the highly competitive office market could quickly challenge this positive outlook.

Find out about the key risks to this Hang Lung Properties narrative.Another View: The Market’s Multiple Tells a Different Story

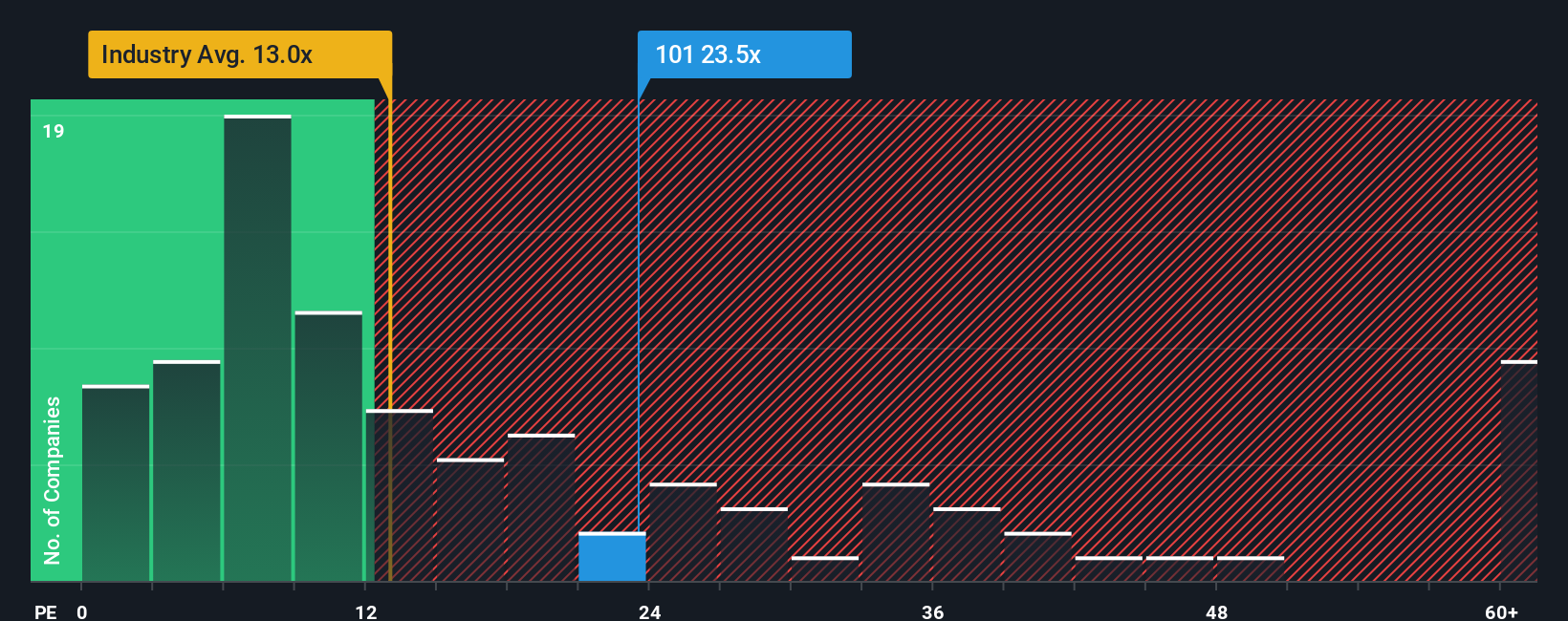

While the first approach points to opportunity, the market’s favored yardstick suggests Hang Lung Properties is trading above what is typical for the industry. Do the market’s current expectations hint at overheating, or is optimism justified?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Hang Lung Properties to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Hang Lung Properties Narrative

If you are interested in viewing the numbers through your own lens, you can assemble a personalized narrative in just a few minutes. Do it your way.

A great starting point for your Hang Lung Properties research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye on new opportunities. Don’t miss your chance to access stocks forging ahead in powerful growth sectors and unique niches.

- Unlock financial stability by targeting companies known for reliable income streams and high yields, found through our dividend stocks with yields > 3%.

- Ride the momentum of groundbreaking technology by seizing opportunities among businesses leading breakthroughs in artificial intelligence with our AI penny stocks.

- Stay ahead of the curve by pinpointing hidden gems trading below fair value using our proven method for finding undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hang Lung Properties might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SEHK:101

Hang Lung Properties

An investment holding company, engages in the property investment, development, and management activities in Hong Kong and Mainland China.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives