RemeGen’s Reduced Losses and Telitacicept Results Could Be a Game Changer for RemeGen (SEHK:9995)

Reviewed by Sasha Jovanovic

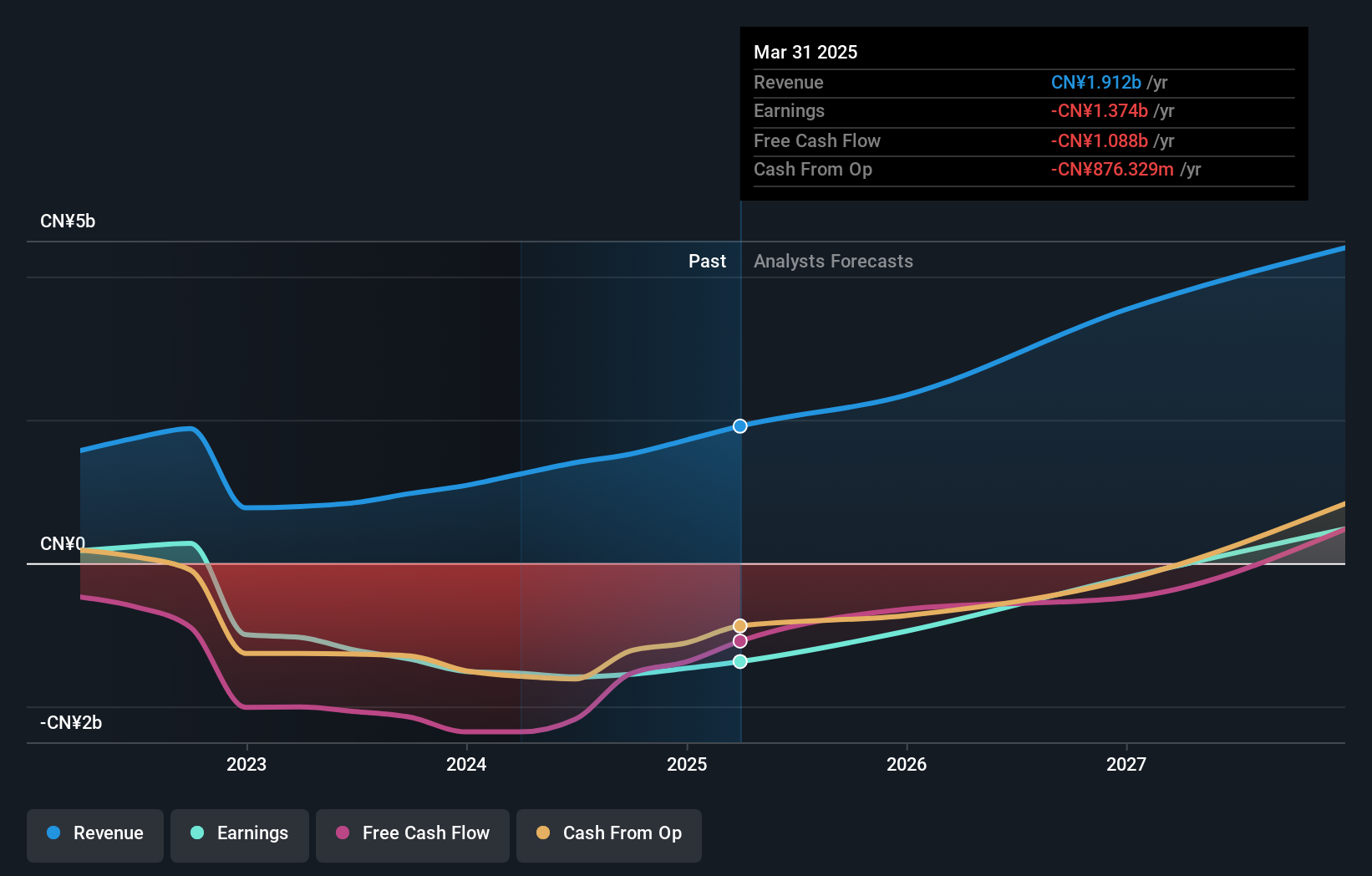

- RemeGen reported its earnings for the nine months ended September 30, 2025, posting sales of CNY 1,719.83 million and reducing its net loss to CNY 550.7 million compared to the same period last year.

- Additionally, Vor Bio announced new 48-week data from a Phase 3 study in China showing telitacicept, developed with RemeGen, delivered high rates of clinically meaningful improvement in generalized myasthenia gravis patients.

- We'll explore how these financial gains and promising clinical results for telitacicept shape RemeGen's broader investment outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is RemeGen's Investment Narrative?

The big picture for RemeGen right now hinges on the investor’s confidence in both the company’s continued top-line growth and its ability to convert promising clinical data into approved treatments with commercial success. The recent 48-week telitacicept data in generalized myasthenia gravis is a substantial short-term catalyst: it strengthens RemeGen's late-stage pipeline and could help accelerate approvals and partnerships globally. Paired with a sharp reduction in net losses for the nine months to September, these results point to operational improvement and solid momentum. However, risks still remain centered around high operating losses, expensive share valuations relative to peers, and recent share price volatility. With the new data and financial performance, optimism on pipeline execution seems better supported than before, but uncertainty around timelines to profitability and heavy reliance on clinical outcomes continue to be important considerations.

Yet, uncertainty about the path to consistent profitability is a key detail investors should keep in mind.

Exploring Other Perspectives

Explore another fair value estimate on RemeGen - why the stock might be worth just HK$104.04!

Build Your Own RemeGen Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RemeGen research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free RemeGen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RemeGen's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9995

RemeGen

A biopharmaceutical company, discovers, develops, produces, and commercializes biological drugs for the treatment of autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States.

Exceptional growth potential with imperfect balance sheet.

Market Insights

Community Narratives