- Japan

- /

- Professional Services

- /

- TSE:2181

Asian Growth Stocks Insiders Own With Up To 32% Return On Equity

Reviewed by Simply Wall St

Amidst escalating geopolitical tensions and trade uncertainties, the Asian markets have shown a mixed performance, with some indices experiencing declines while others remain buoyant. In this environment, growth companies with high insider ownership can offer unique insights into potential resilience and long-term value creation, as insiders often have a vested interest in the company's success.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 59.9% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 23.5% |

| Schooinc (TSE:264A) | 30.6% | 68.9% |

| Samyang Foods (KOSE:A003230) | 11.7% | 24.3% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 94.4% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11% | 63.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 40.3% |

| Fulin Precision (SZSE:300432) | 13.6% | 43% |

Let's review some notable picks from our screened stocks.

Newborn Town (SEHK:9911)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Newborn Town Inc., with a market cap of HK$14.49 billion, operates as an investment holding company engaged in the global social networking business.

Operations: The company's revenue is primarily derived from its Social Networking Business, which generated CN¥4.63 billion, and its Innovative Business, contributing CN¥459.64 million.

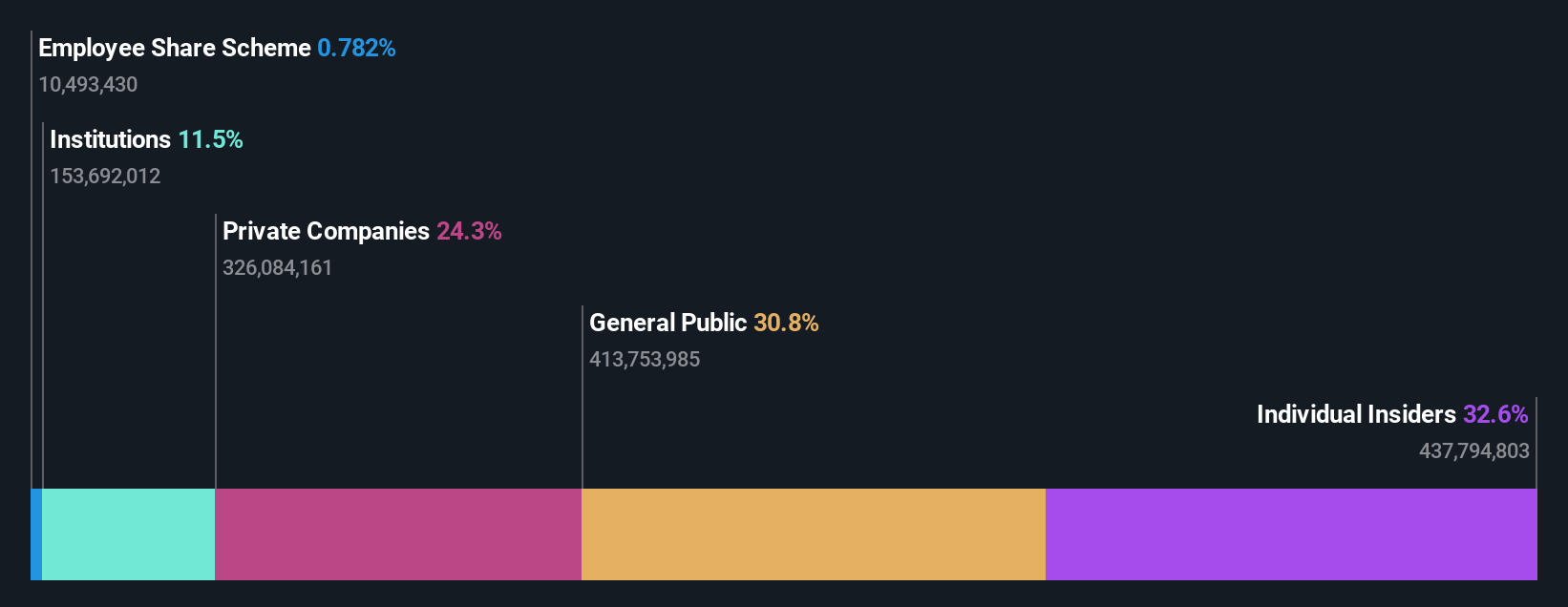

Insider Ownership: 32.6%

Return On Equity Forecast: 32% (2027 estimate)

Newborn Town is experiencing significant growth, with earnings forecasted to increase by over 30% annually, surpassing the Hong Kong market's growth rate. Despite recent volatility in its share price and a decline in profit margins from last year, the company trades at a substantial discount to estimated fair value. The establishment of its global headquarters in Hong Kong signals strategic expansion efforts and capitalizes on the region's business environment, potentially enhancing long-term growth prospects.

- Dive into the specifics of Newborn Town here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Newborn Town is priced higher than what may be justified by its financials.

RemeGen (SEHK:9995)

Simply Wall St Growth Rating: ★★★★★★

Overview: RemeGen Co., Ltd. is a biopharmaceutical company focused on discovering, developing, and commercializing biologics for autoimmune, oncology, and ophthalmic diseases in Mainland China and the United States, with a market cap of approximately HK$35.93 billion.

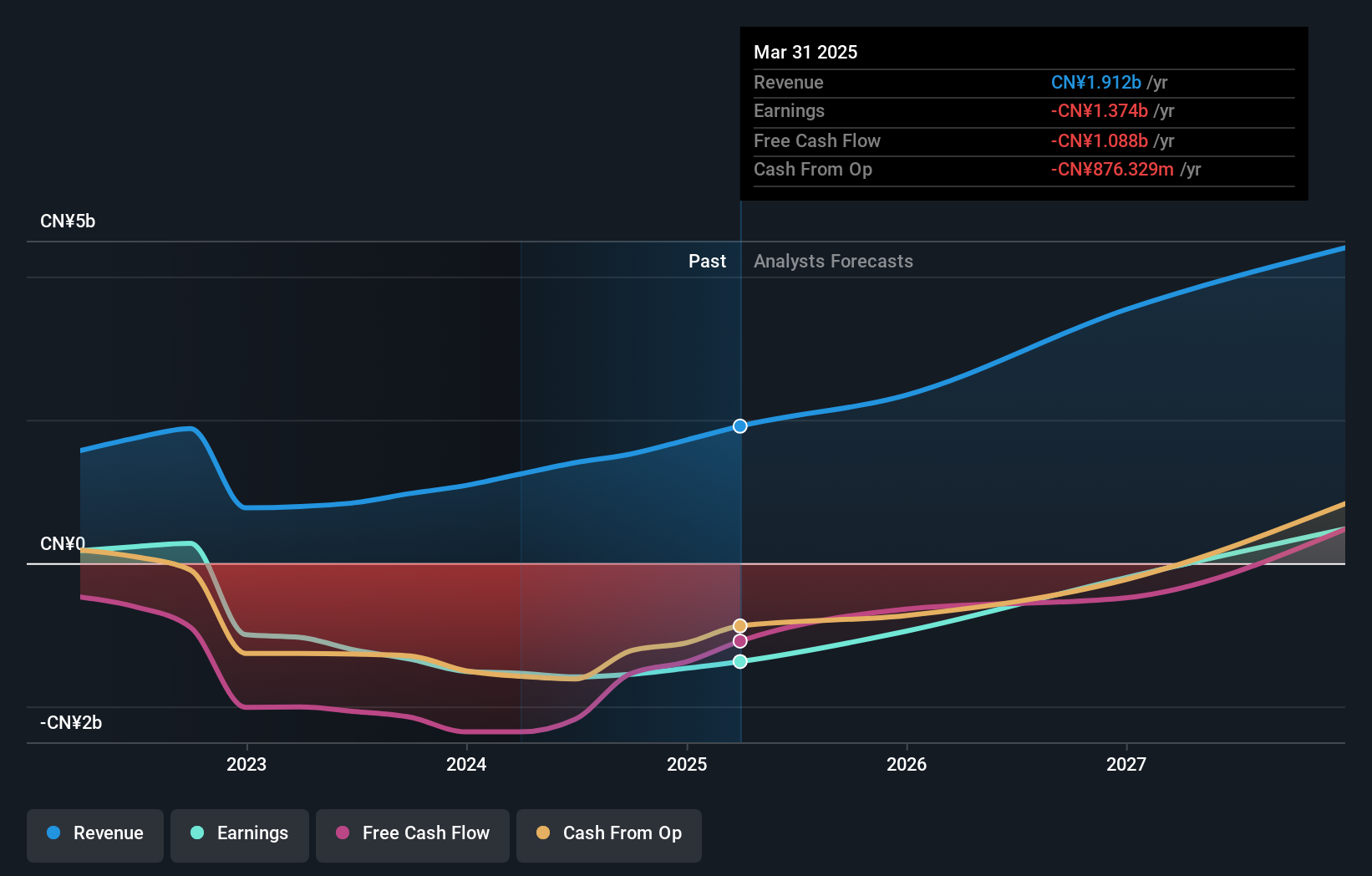

Operations: RemeGen Co., Ltd. generates revenue from its biopharmaceutical research, service, production, and sales segment amounting to CN¥1.91 billion.

Insider Ownership: 11.2%

Return On Equity Forecast: 30% (2028 estimate)

RemeGen is poised for growth, with revenue expected to grow over 23% annually, outpacing the Hong Kong market. The company trades at a significant discount to its estimated fair value and is forecasted to achieve profitability within three years. Recent clinical trial successes, including disitamab vedotin for gastric cancer and Telitacicept for myasthenia gravis, highlight its innovative pipeline. A recent HK$806.36 million equity offering supports further development and expansion efforts in Asia's competitive biotech sector.

- Take a closer look at RemeGen's potential here in our earnings growth report.

- Our expertly prepared valuation report RemeGen implies its share price may be too high.

Persol HoldingsLtd (TSE:2181)

Simply Wall St Growth Rating: ★★★★☆☆

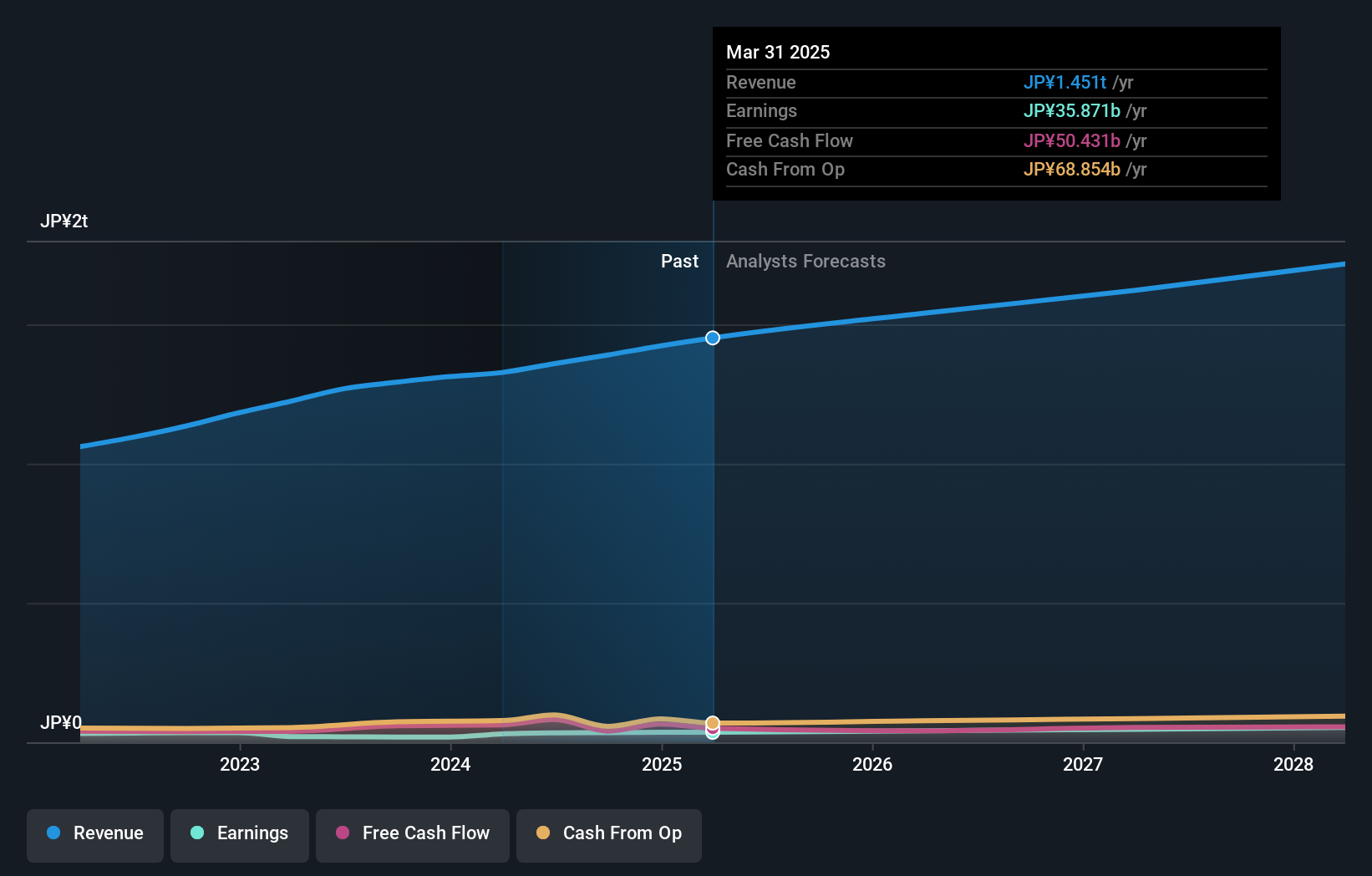

Overview: Persol Holdings Co., Ltd. is a global provider of human resource services under the PERSOL brand, with a market capitalization of ¥614.98 billion.

Operations: The company's revenue is primarily derived from its Staffing segment at ¥602.44 billion, followed by the Asia Pacific segment at ¥476.10 billion, Career services at ¥144.65 billion, Technology services at ¥114.71 billion, and BPO services contributing ¥117.23 billion.

Insider Ownership: 12.1%

Return On Equity Forecast: 22% (2028 estimate)

Persol Holdings is positioned for growth with earnings projected to increase by 12.26% annually, surpassing the Japanese market's average. Despite trading at a substantial discount to estimated fair value, revenue growth is moderate at 5.2% per year but still above the market average. The company recently announced plans to dispose of treasury shares as restricted stock compensation and provided guidance for increased dividends, reflecting confidence in its financial outlook despite an unstable dividend history.

- Navigate through the intricacies of Persol HoldingsLtd with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Persol HoldingsLtd's shares may be trading at a discount.

Seize The Opportunity

- Reveal the 611 hidden gems among our Fast Growing Asian Companies With High Insider Ownership screener with a single click here.

- Seeking Other Investments? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2181

Persol HoldingsLtd

Provides human resource services under the PERSOL brand worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives