InnoCare Pharma (SEHK:9969) Valuation in Focus After Revenue Growth and Narrowed Losses

Reviewed by Simply Wall St

InnoCare Pharma (SEHK:9969) just released its latest earnings, reporting both higher revenue and a significantly smaller net loss for the nine months through September. These results are giving investors plenty to analyze right now.

See our latest analysis for InnoCare Pharma.

Fresh from reporting sharply reduced net losses and steadily rising revenue, InnoCare Pharma has enjoyed some serious momentum. Its share price has soared 160.98% year-to-date, and over the past year, investors have seen a total shareholder return of 121.31%. Short-term price moves reflect renewed optimism, especially as recent board changes and upcoming investor conferences put the spotlight on future growth potential for the company.

If big moves like these have you thinking about what other opportunities are out there, take a moment to discover See the full list for free.

With such a sharp rally and significant improvements in the business, the crucial question for investors is whether there is still value to be found in InnoCare Pharma, or if markets have already accounted for the company’s future growth.

Most Popular Narrative: 19% Undervalued

Compared to its last close at HK$14.85, the most widely followed narrative estimates InnoCare Pharma’s fair value at HK$18.33. This notable gap puts the stock’s recent momentum and outlook under scrutiny and provides a provocative backdrop for the direct insights below.

The company has a strong pipeline with numerous drugs in late-stage development, including tafasitamab, zurletrectinib, and others. These are expecting approvals and launches in the next few years, which could significantly bolster future revenues. The introduction of InnoCare's ADC platform aims to tap into new therapeutic areas with highly differentiated products, potentially opening new revenue streams and improving net margins through innovative therapies with a better safety profile.

What is fueling this bold valuation? It centers on a revenue and margin acceleration powered by fresh product launches, breakthrough therapies, and a global expansion push. The story is driven by blockbuster financial forecasts that differ from the industry’s usual pace. Curious which assumptions set the stage for a higher fair value? Find out what makes the market’s consensus so bullish.

Result: Fair Value of $18.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are risks to consider, including heavy reliance on a few key drugs and the uncertainty of converting significant R&D spending into successful launches.

Find out about the key risks to this InnoCare Pharma narrative.

Another View: Market Multiples Show a Higher Price Tag

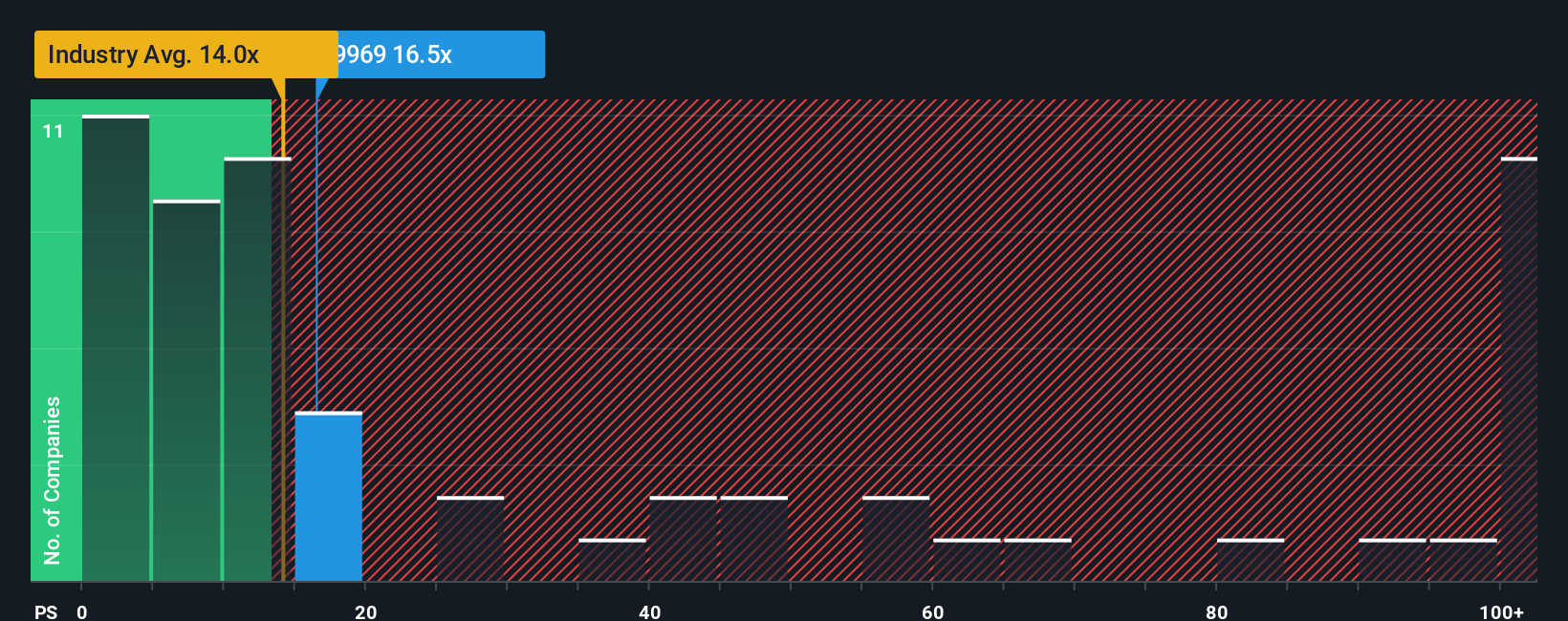

Looking at valuation through the lens of price-to-sales, InnoCare Pharma trades at 16.1x, which is well above the Hong Kong biotech industry’s 13.3x average but below the peer group’s 22.3x. Compared to its fair ratio of 11.5x, the stock looks expensive using this approach. Does this premium signal real future growth, or are investors paying up too soon?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own InnoCare Pharma Narrative

If you have a different take or want to dig into the figures on your own, it's easy to build your own perspective with just a few clicks. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding InnoCare Pharma.

Looking for More Smart Investment Opportunities?

There’s no need to stop here. Gain an edge by tapping into fresh angles and under-the-radar stocks using the hand-picked screeners below. Don’t let the next great idea pass you by.

- Capture the strongest yields by checking out these 15 dividend stocks with yields > 3% with payouts surpassing 3% for income-focused portfolios.

- Spot tomorrow’s leaders by jumping into these 25 AI penny stocks where AI-driven innovation shapes high-potential opportunities.

- Accelerate your hunt for value by considering these 926 undervalued stocks based on cash flows that show real upside based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9969

InnoCare Pharma

A biopharmaceutical company, engages in discovering, developing, and commercializing drugs for the treatment of cancer and autoimmune diseases in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success