InnoCare Pharma (SEHK:9969): Evaluating Valuation After Sales Growth and Pipeline Advances Spark Market Interest

Reviewed by Simply Wall St

InnoCare Pharma (SEHK:9969) just reported higher sales and a smaller net loss for the first nine months of 2025, while also advancing key drug candidates in its clinical pipeline. This combination is catching investor attention.

See our latest analysis for InnoCare Pharma.

Momentum has returned in a big way for InnoCare Pharma, with its share price rallying 5.08% over the past week and boasting a striking year-to-date gain of 165.38%. Even after a pullback in the last quarter, the total shareholder return stands at 119.16% over the last year. This points to strong market confidence as progress in the clinic and improved sales drive the growth narrative.

If these recent milestones have you looking for other healthcare standouts, now’s a great time to explore the broader sector through our curated list in See the full list for free.

With shares surging alongside clinical and financial milestones, the key question is whether InnoCare Pharma’s rally still leaves room for upside, or if the market has already factored in future growth potential and innovation.

Most Popular Narrative: 17.9% Undervalued

With InnoCare Pharma closing at HK$15.10 while the most widely followed narrative sets fair value at HK$18.38, the gap suggests there is notable optimism in the company’s future. Behind this optimism are assumptions tied to innovation, expansion, and financial transformation. Here is what drives the buzz.

The company has a strong pipeline with numerous drugs in late-stage development, including tafasitamab, zurletrectinib, and others, expecting approvals and launches in the next few years, which could significantly bolster future revenues. The introduction of InnoCare's ADC platform aims to tap into new therapeutic areas with highly differentiated products, potentially opening new revenue streams and improving net margins through innovative therapies with a better safety profile.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is record-breaking earnings and a future profit multiple usually associated with tech leaders. Interested in which bold financial projections support that price target? Dive deeper to see the surprising numbers that drive this fair value calculation.

Result: Fair Value of $18.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, higher R&D costs or increased competition could limit the company’s earnings growth and challenge some of the more optimistic forecasts regarding its future.

Find out about the key risks to this InnoCare Pharma narrative.

Another View: What Do Market Ratios Reveal?

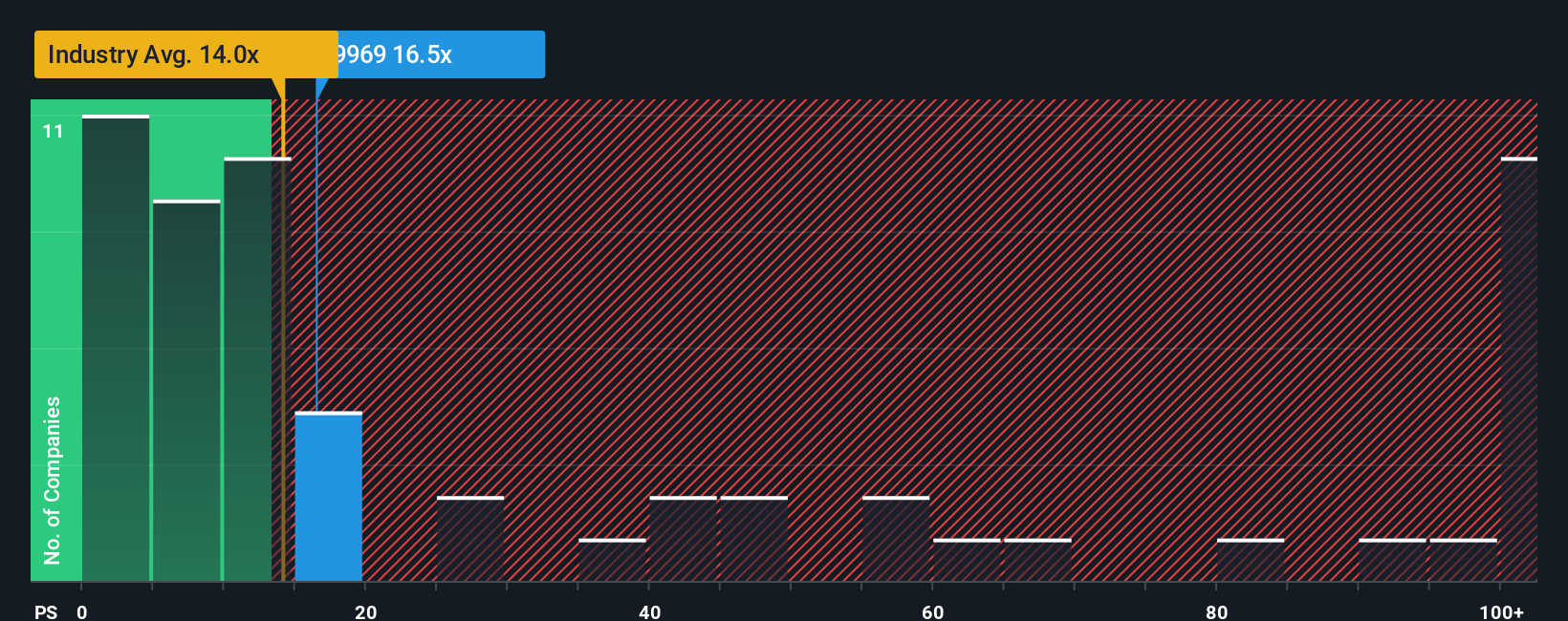

While the current narrative paints InnoCare Pharma as attractively undervalued, the company’s price-to-sales ratio of 17.7x tells a more expensive story. This is notably above the Hong Kong Biotechs industry average of 13.6x, the peer average of 11.8x, and even the fair ratio of 11.9x. That gap points to valuation risk if the growth story does not meet expectations. Could the market be pricing in too much optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own InnoCare Pharma Narrative

If you see things differently or prefer digging into the numbers yourself, you can shape your own perspective in just a few minutes, so Do it your way

A great starting point for your InnoCare Pharma research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

If you want to stay ahead of the market, don’t stop at just one opportunity. Boost your portfolio with more smart, high-conviction ideas through these unique lists:

- Tap into potential early-stage gains by checking out these 3585 penny stocks with strong financials with strong financials and promising growth stories.

- Unlock passive income and steady returns with these 14 dividend stocks with yields > 3% featuring yields above 3% and solid fundamentals.

- Ride the tech wave and power up your watchlist with these 27 AI penny stocks that are pushing the boundaries of artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9969

InnoCare Pharma

A biopharmaceutical company, engages in discovering, developing, and commercializing drugs for the treatment of cancer and autoimmune diseases in China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives