- Taiwan

- /

- Electrical

- /

- TWSE:1514

Undiscovered Gems In Asia And 2 Other Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by easing trade tensions and mixed economic indicators, small-cap stocks in Asia present intriguing opportunities for investors seeking growth beyond the well-trodden paths. In this environment, identifying promising small-cap stocks involves looking for companies with strong fundamentals and the ability to adapt to shifting market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AIC | NA | 25.92% | 57.48% | ★★★★★★ |

| Jiangyin Haida Rubber And Plastic | 16.31% | 7.95% | -9.56% | ★★★★★★ |

| Shenyang Yuanda Intellectual Industry GroupLtd | NA | 10.83% | 32.79% | ★★★★★★ |

| Tai Sin Electric | 28.69% | 9.56% | 4.66% | ★★★★★☆ |

| Firich Enterprises | 36.97% | -1.55% | 33.31% | ★★★★★☆ |

| Poly Plastic Masterbatch (SuZhou)Ltd | 3.67% | 24.06% | 0.13% | ★★★★★☆ |

| Suzhou Chunqiu Electronic Technology | 46.46% | 3.33% | -19.72% | ★★★★★☆ |

| Ningbo Henghe Precision IndustryLtd | 66.02% | 5.50% | 23.91% | ★★★★☆☆ |

| Qingdao Daneng Environmental Protection Equipment | 61.56% | 31.58% | 23.66% | ★★★★☆☆ |

| Guangdong Sanhe Pile | 76.56% | -2.58% | -32.76% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Alphamab Oncology (SEHK:9966)

Simply Wall St Value Rating: ★★★★★☆

Overview: Alphamab Oncology is a clinical-stage biopharmaceutical company focused on the research, development, manufacture, and commercialization of oncology biologics with a market cap of HK$7.55 billion.

Operations: The company focuses on the development and commercialization of oncology biologics. Financial details are limited, with no specific revenue segments provided in the available data.

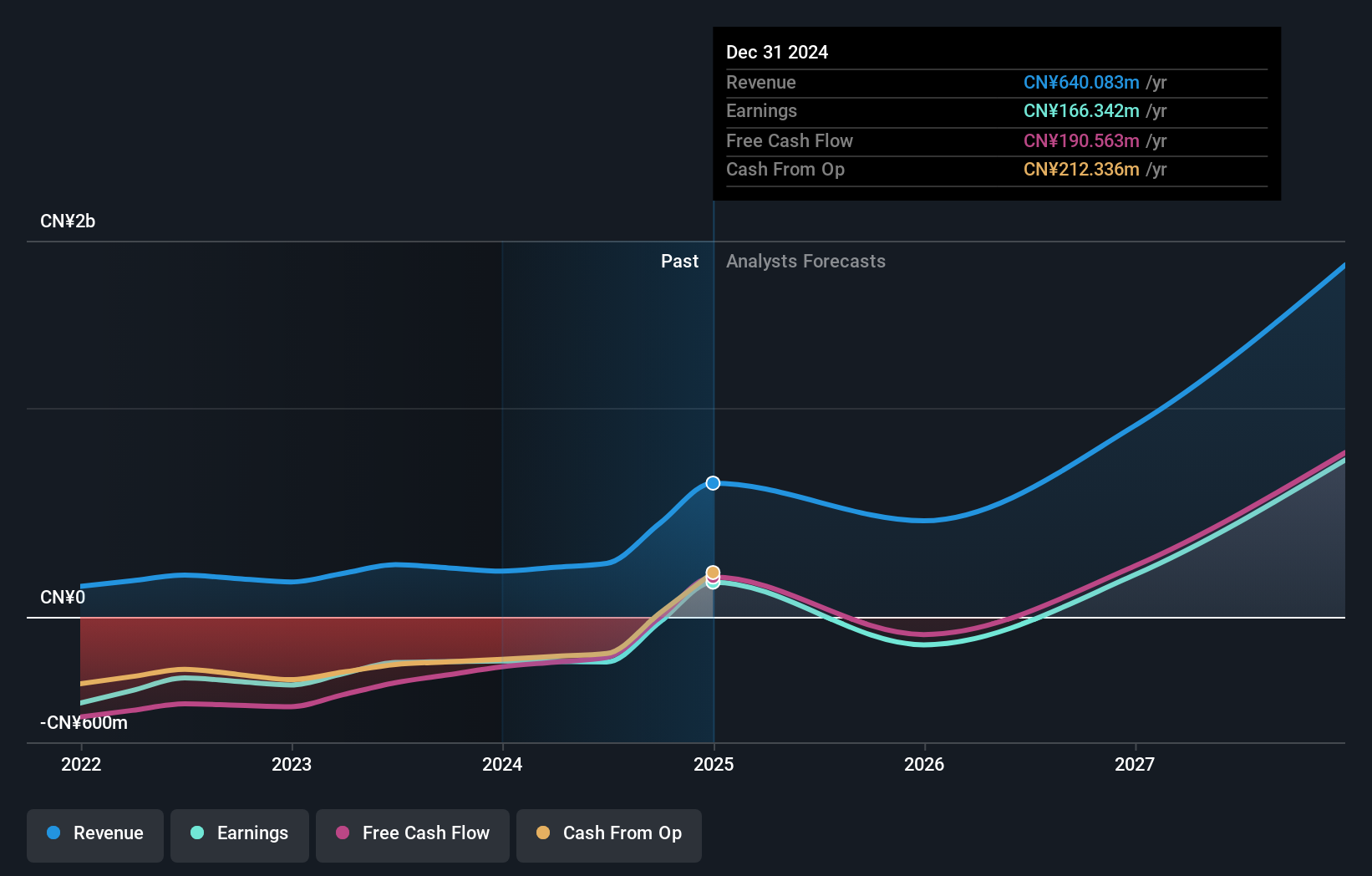

Alphamab Oncology, a nimble player in the biotech space, has shown impressive progress with its innovative pipeline. Recently turning profitable with net income of CNY 166 million for 2024, up from a loss of CNY 211 million the previous year, it highlights robust growth. The recent breakthrough therapy designation for JSKN003 by China's National Medical Products Administration underscores its potential impact on ovarian cancer treatment. Trading at a significant discount to its estimated fair value and boasting high-quality earnings, Alphamab's strategic collaborations and clinical advancements position it well within the competitive ADC landscape.

Telink Semiconductor(Shanghai)Co.Ltd (SHSE:688591)

Simply Wall St Value Rating: ★★★★★☆

Overview: Telink Semiconductor(Shanghai)Co.,Ltd. focuses on the research, development, design, and sales of low-power wireless IoT chips with a market capitalization of CN¥9.56 billion.

Operations: Telink Semiconductor generates revenue primarily from the sales of low-power wireless IoT chips. The company's gross profit margin is a key financial metric, reflecting its ability to manage production costs relative to sales.

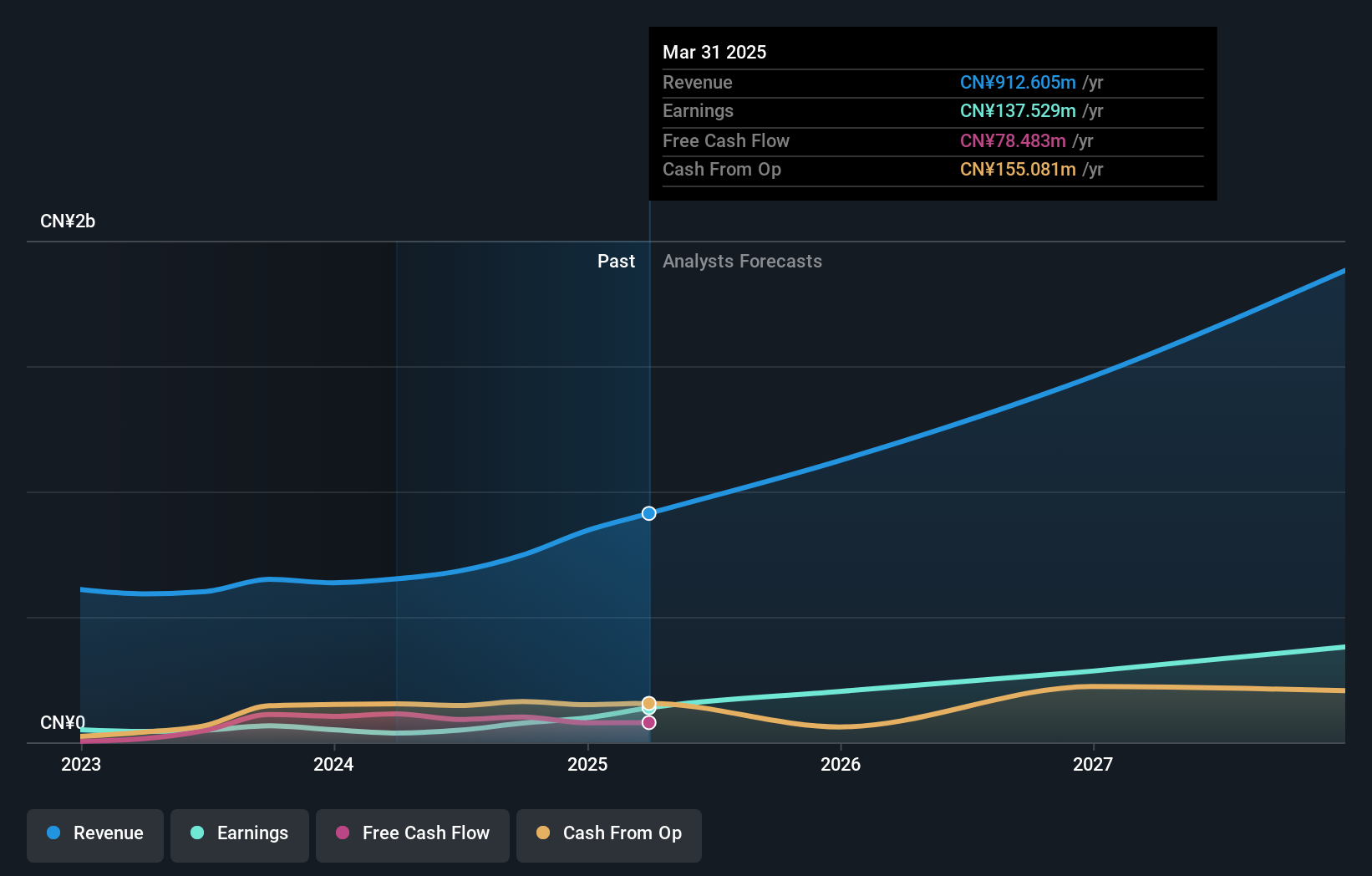

Telink Semiconductor, a nimble player in the semiconductor sector, has shown impressive momentum with earnings growth of 95.7% in the past year, outpacing the industry average of 10.1%. The company enjoys high-quality earnings and maintains a favorable debt position with more cash than total debt. Recent financials reveal that for Q1 2025, Telink reported sales of CNY 230 million and net income of CNY 35.71 million, a turnaround from last year's net loss. Despite share price volatility over three months, projected annual earnings growth at 48.18% suggests potential for continued expansion in its niche market space.

Allis ElectricLtd (TWSE:1514)

Simply Wall St Value Rating: ★★★★★☆

Overview: Allis Electric Co., Ltd. develops, produces, and sells transformers, switching devices, and electronic products worldwide with a market capitalization of NT$26.81 billion.

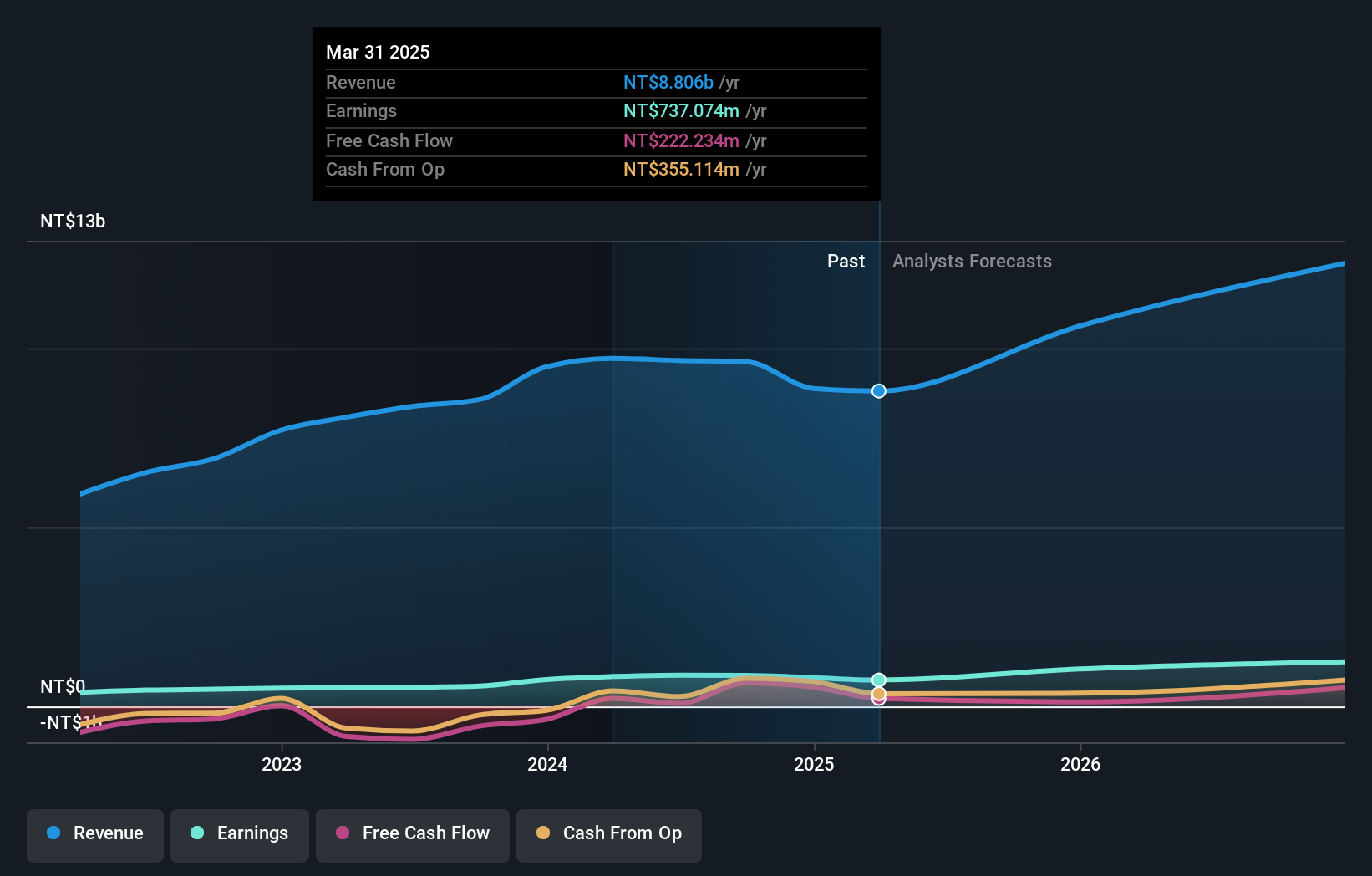

Operations: Allis Electric generates revenue primarily from its Electronics Sector and Switchboard Department, contributing NT$2.43 billion and NT$2.38 billion respectively. The Construction Division also plays a significant role with NT$1.72 billion in revenue, while the Motor Devices Division and Transformer Department contribute NT$1 billion and NT$1.07 billion respectively.

Allis Electric, a nimble player in the electrical sector, has shown robust earnings growth of 24% annually over the past five years. Despite a dip in sales to TWD 8.88 billion from TWD 9.48 billion last year, net income climbed to TWD 801 million. The company's interest payments are well covered with EBIT at a solid 28.9x coverage, and its net debt to equity ratio stands at a satisfactory 17.6%. Although earnings growth of 6.6% lagged behind the industry average of 21%, Allis Electric's high-quality past earnings and positive free cash flow signal resilience amidst market fluctuations.

Make It Happen

- Dive into all 2705 of the Asian Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1514

Allis ElectricLtd

Develops, produces, and sells transformers, switching devices, and electronic products worldwide.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives