Optimistic Investors Push Alphamab Oncology (HKG:9966) Shares Up 27% But Growth Is Lacking

Alphamab Oncology (HKG:9966) shareholders are no doubt pleased to see that the share price has bounced 27% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 64% share price drop in the last twelve months.

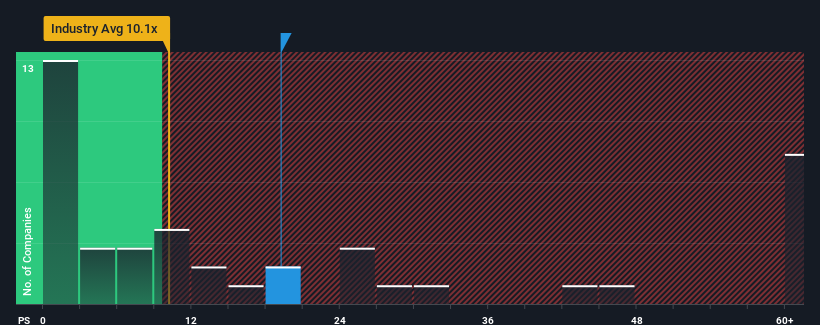

After such a large jump in price, Alphamab Oncology may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 19.2x, since almost half of all companies in the Biotechs industry in Hong Kong have P/S ratios under 10.1x and even P/S lower than 2x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Alphamab Oncology

What Does Alphamab Oncology's P/S Mean For Shareholders?

Alphamab Oncology could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Alphamab Oncology's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Alphamab Oncology's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 16% during the coming year according to the three analysts following the company. With the industry predicted to deliver 86% growth, the company is positioned for a weaker revenue result.

With this in consideration, we believe it doesn't make sense that Alphamab Oncology's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Alphamab Oncology's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It comes as a surprise to see Alphamab Oncology trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

You should always think about risks. Case in point, we've spotted 2 warning signs for Alphamab Oncology you should be aware of, and 1 of them makes us a bit uncomfortable.

If these risks are making you reconsider your opinion on Alphamab Oncology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9966

Alphamab Oncology

A biopharmaceutical company, engages in the research, development, manufacture, and commercialization of biotherapeutics for cancer treatment in the People’s Republic of China.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives