Alphamab Oncology (SEHK:9966) Reports Revenues Of CNY 319 Million For Half Year Ending June 2025

Reviewed by Simply Wall St

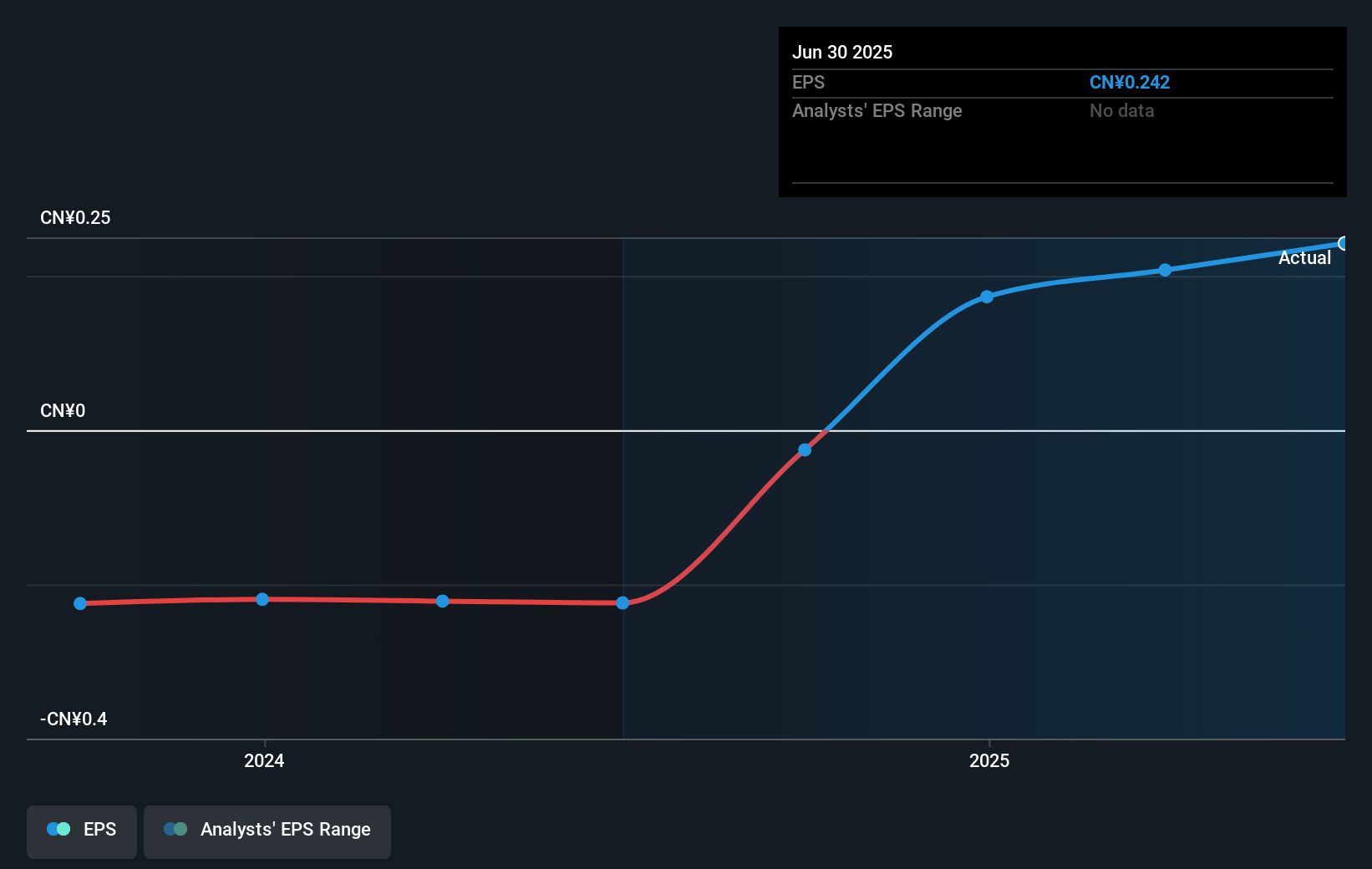

Alphamab Oncology (SEHK:9966) recently reported favorable earnings for the half year ended June 2025, showcasing a revenue increase to CNY 319 million and a net income turnaround to CNY 21 million from a prior loss. This aligns well with their earlier guidance that anticipated a profit shift, bolstered by milestones from licensed collaborations. Amid these events, the company's stock rose 31% in the last quarter. The positive trajectory might have been bolstered by the overall robust market environment, where indices like the S&P 500 and Nasdaq reached new highs, aiding equities across various sectors.

Over the last year, Alphamab Oncology's shares produced a total return of 370.13%, reflecting significant appreciation. This remarkable performance surpasses the broader Hong Kong market's return of 50.8% and even the impressive 188.3% return of the Hong Kong Biotechs industry. This strong return could be influenced by its recent transition to profitability, highlighted by the half-year revenue of CNY 319.44 million and a net income of CNY 21.58 million. The positive earnings announcement, alongside other strategic advancements such as product approvals and collaborations, likely contributed to this substantial increase in shareholder value.

These favorable financial results and operational milestones might encourage analysts to adjust their revenue and earnings forecasts upwards, though explicit forecasts remain unclear. Furthermore, Alphamab Oncology's share price, currently at HK$10.86, shows it is trading above the estimated fair value of HK$5.26, suggesting potential overvaluation according to this estimate. The pricing dynamics, alongside a lack of a clear price target consensus, underscores the complexities in assessing the company's valuation amidst its rapid recent growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9966

Alphamab Oncology

A biopharmaceutical company, engages in the research, development, manufacture, and commercialization of biotherapeutics for cancer treatment in the People’s Republic of China.

Excellent balance sheet and good value.

Market Insights

Community Narratives