Exploring Three High Growth Tech Stocks With Promising Potential

Reviewed by Simply Wall St

As global markets show resilience with major indexes approaching record highs and smaller-cap indexes outperforming large-caps, investors are increasingly focused on sectors with robust growth potential, such as technology. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation capabilities and adaptability to evolving market demands.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Seojin SystemLtd | 32.56% | 43.21% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.16% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| JNTC | 20.52% | 57.26% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1295 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

AAC Technologies Holdings (SEHK:2018)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AAC Technologies Holdings Inc. is an investment holding company that offers solutions for smart devices across various regions including Mainland China, Hong Kong SAR, Taiwan, other Asian countries, the United States, and Europe, with a market capitalization of HK$43.87 billion.

Operations: AAC Technologies Holdings generates revenue primarily from its Acoustics Products and Electromagnetic Drives and Precision Mechanics segments, contributing CN¥7.64 billion and CN¥8.28 billion respectively. The company also engages in Optics Products, Sensor and Semiconductor Products, with these segments adding to its diverse portfolio in the smart device solutions market across multiple regions.

AAC Technologies Holdings has demonstrated robust growth, with earnings surging by 81.3% over the past year, significantly outpacing the electronic industry's average of 11.7%. This surge is underpinned by a strategic focus on R&D, which not only enhances its product offerings but also solidifies its competitive edge in the tech sector. The company's revenue is projected to grow at an annual rate of 12.5%, surpassing Hong Kong's market average of 7.8%. Moreover, AAC's commitment to innovation is evident from its forecasted earnings growth of 21.7% annually, well above the market norm of 11.6%. These figures highlight AAC’s potential in maintaining a strong trajectory amidst dynamic market conditions and evolving technological demands.

- Navigate through the intricacies of AAC Technologies Holdings with our comprehensive health report here.

Gain insights into AAC Technologies Holdings' past trends and performance with our Past report.

Akeso (SEHK:9926)

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company that focuses on the research, development, manufacturing, and commercialization of antibody drugs with a market capitalization of approximately HK$68.93 billion.

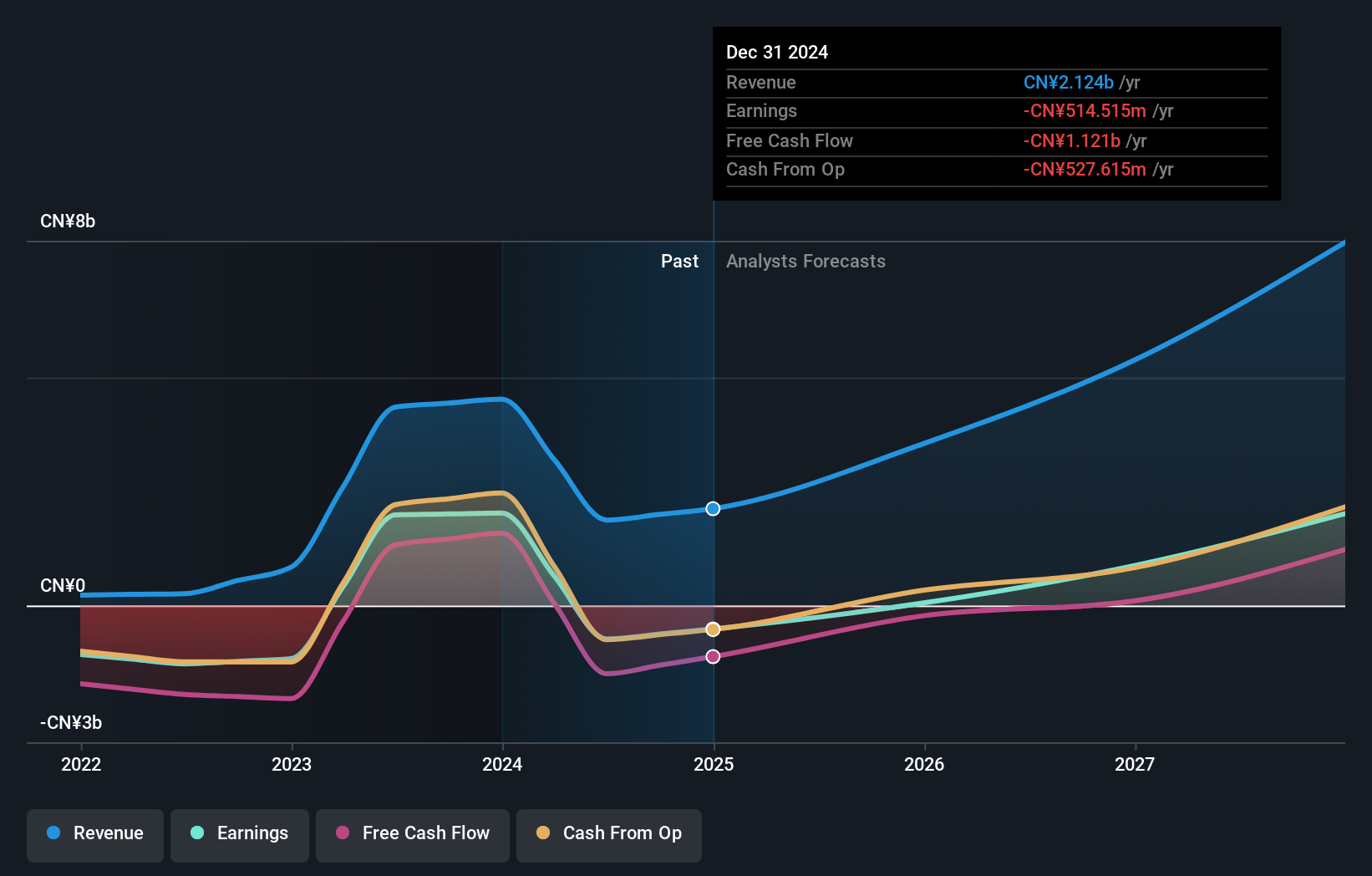

Operations: The company generates revenue primarily through the research, development, production, and sale of biopharmaceutical products, amounting to CN¥1.87 billion.

Akeso stands out in the biotech landscape, not just for its robust pipeline but also for its strategic R&D investments, which are evident from its recent acceptance of a supplemental new drug application by China's NMPA. This move underscores Akeso's commitment to expanding its therapeutic horizons, particularly in oncology with penpulimab showing a promising 33.5% annual revenue growth. Moreover, the company’s focus on innovative cancer treatments is further highlighted by a significant 53.5% projected annual earnings growth. These figures not only reflect Akeso's aggressive growth strategy but also its potential to lead in high-stakes markets through continuous innovation and targeted research endeavors.

SAP (XTRA:SAP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SAP SE, along with its subsidiaries, delivers a range of applications, technology solutions, and services on a global scale and has a market capitalization of approximately €260.01 billion.

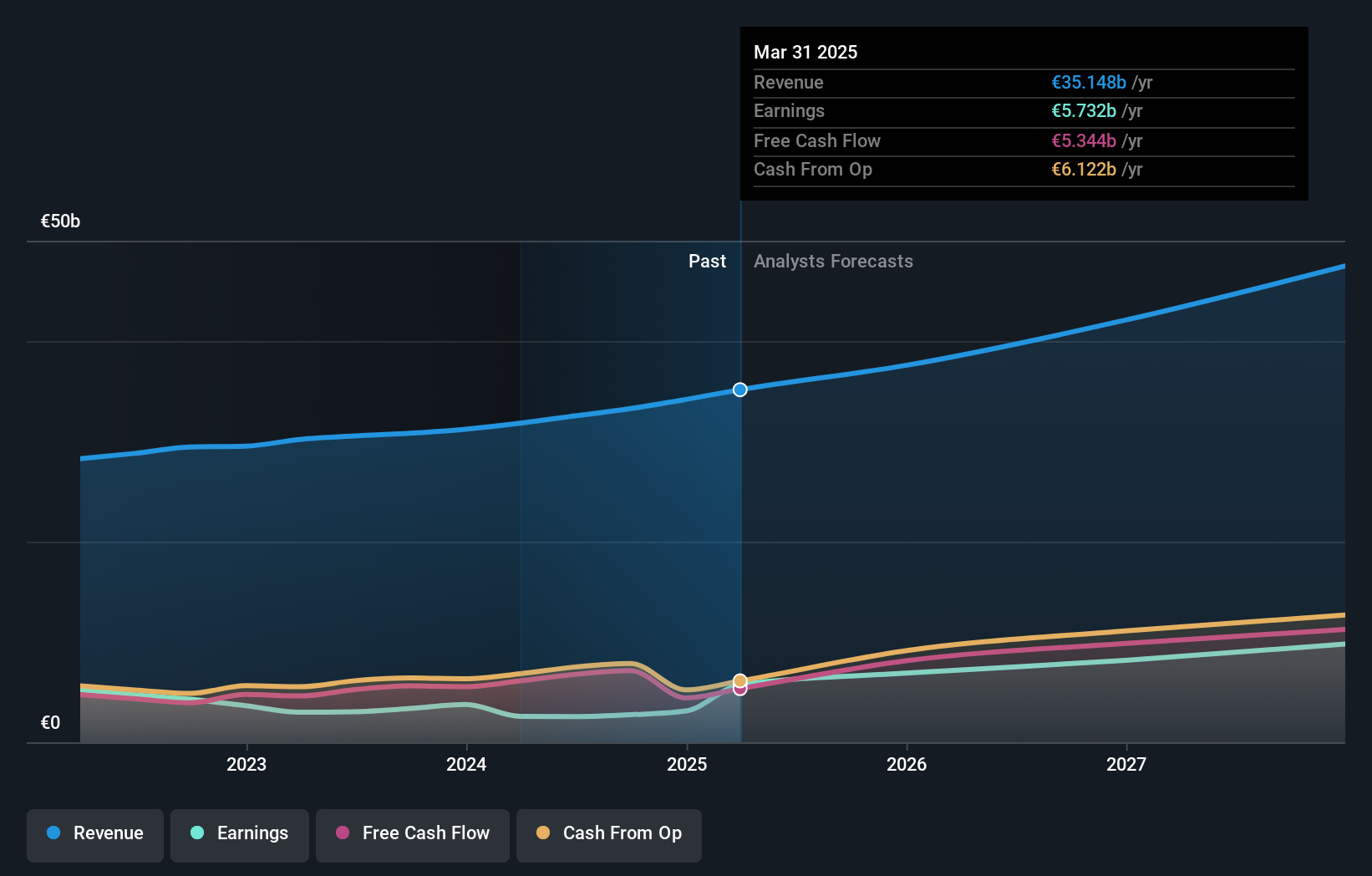

Operations: The company generates revenue primarily through its Applications, Technology & Services segment, which accounted for €33.27 billion. The business focuses on providing a comprehensive suite of software solutions and services to enterprises worldwide.

SAP has demonstrated a robust commitment to innovation, particularly in its R&D efforts which are crucial for maintaining competitiveness in the fast-evolving tech landscape. The company invested €4.5 billion in R&D last year alone, representing a significant 14% of its total revenue, underscoring a strategic focus on developing cutting-edge solutions that meet dynamic market demands. This investment is part of SAP's broader strategy to enhance its software offerings, particularly through initiatives like SAP S/4HANA and various cloud-based solutions which have seen an adoption increase reflected in a 10.3% revenue growth rate this year. Furthermore, with earnings projected to surge by 40.7% annually, SAP is not just growing but doing so at an accelerated pace compared to the broader German market’s growth figures. These financial commitments and outcomes highlight SAP's proactive approach in both sustaining and catalyzing its market position through continuous technological advancements and customer-centric innovations.

- Take a closer look at SAP's potential here in our health report.

Review our historical performance report to gain insights into SAP's's past performance.

Seize The Opportunity

- Explore the 1295 names from our High Growth Tech and AI Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SAP

Flawless balance sheet with reasonable growth potential.