Akeso (SEHK:9926): Exploring Valuation Perspectives on a Steady Share Price

Reviewed by Kshitija Bhandaru

See our latest analysis for Akeso.

Akeso's share price has hovered near HK$139.8 lately, showing only mild movement in recent weeks. Over the past year, the 1-year total shareholder return stands just under 1%, reflecting modest but steady gains for patient investors. While momentum has not surged, these stable returns hint that the market is cautiously optimistic about the company’s long-term prospects.

If you’re interested in opportunities beyond Akeso, consider broadening your search and discover See the full list for free.

Given Akeso’s steady gains and solid fundamentals, investors may wonder if the current valuation leaves room for upside, or if the market has already priced in future growth opportunities. Could now be the right time to buy?

Most Popular Narrative: 20.3% Undervalued

Akeso's most widely followed narrative places the fair value at HK$175.45 per share, a notable premium over its last close at HK$139.8. This perspective leans on the company’s robust innovation pipeline and successful clinical trial milestones as central contributors to future value.

The collaboration with SUMMIT Therapeutics and the strategic partnership with Pfizer to combine ivonescimab with Pfizer's ADCs suggests expansion into new therapeutic areas and geographic markets, promising to impact earnings positively. The company's strong R&D pipeline, including advanced bispecific antibodies and ADC candidates, provides a foundation for long-term growth and sets the stage for potential increases in net margins as products move from development to commercialization.

What’s the secret sauce behind this ambitious valuation? One key input drives the narrative: bold profit growth targets, fueled by a turnaround in margins and blockbuster revenue expansion. Curious how these factors come together and whether they justify a price target far above today’s share price? Dive into the full narrative to uncover what could power Akeso's next big leap.

Result: Fair Value of $175.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued operating losses and heavy reliance on just a couple of key drugs could quickly challenge even the most optimistic profit forecasts.

Find out about the key risks to this Akeso narrative.

Another View: Expensive by Sales Multiple

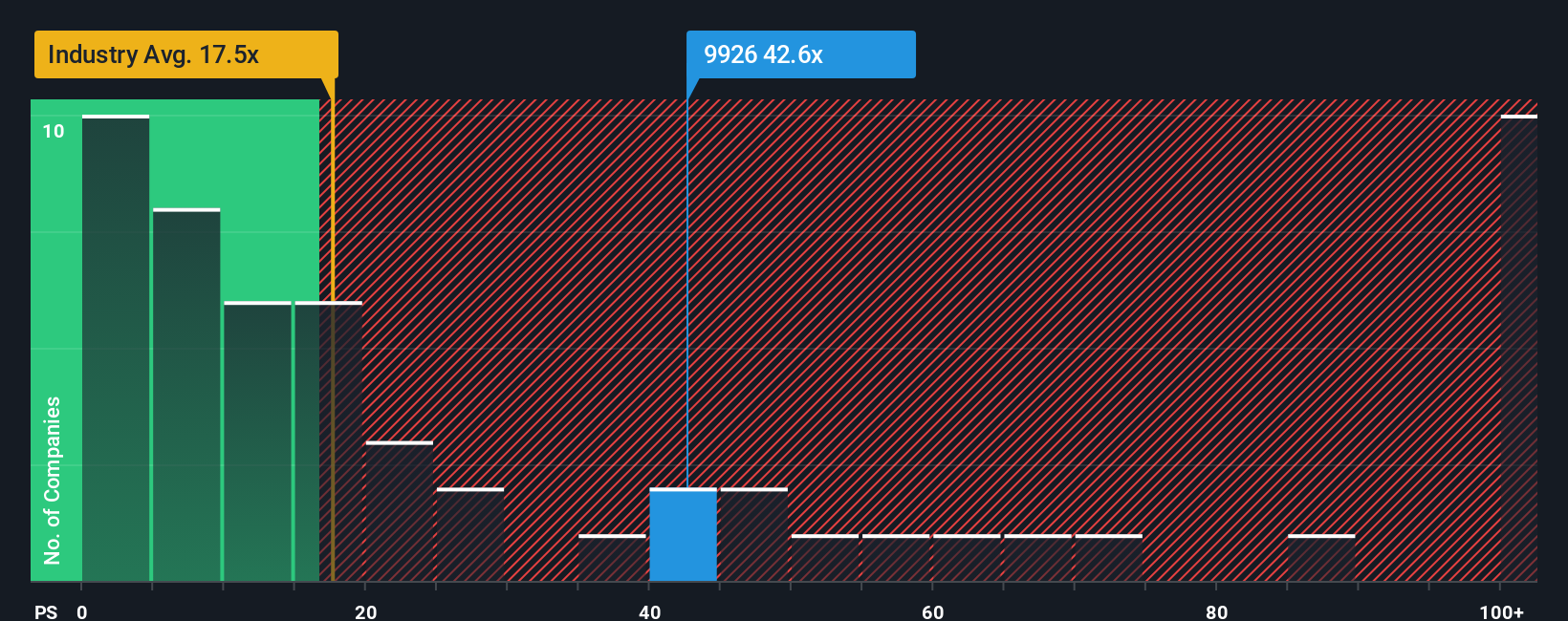

While optimism around Akeso’s pipeline supports a strong price target, a closer look at its valuation based on sales reveals a stark contrast. Akeso trades at a price-to-sales ratio of 46.9x, much higher than both the Hong Kong biotech industry average of 18.2x and its peer group’s 18.6x. Even compared to a fair ratio of 22x, the stock looks expensive and this raises tough questions about whether the market’s high expectations are fully justified.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Akeso Narrative

If you have a different perspective or want to dig into the data on your own, you can craft a personalized narrative for Akeso in just minutes. Do it your way

A great starting point for your Akeso research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Smarter Investment Ideas?

Don’t let the best market opportunities pass you by while you wait. Take action now and unlock unique stock ideas tailored to your goals with Simply Wall Street’s expert screeners.

- Uncover the potential of fast-growing artificial intelligence by starting your search with these 24 AI penny stocks, set to transform entire industries.

- Secure your portfolio’s future income by targeting attractive yields through these 19 dividend stocks with yields > 3%, offering more than 3% returns.

- Ride the wave of next-generation fintech as you tap into exciting prospects among these 78 cryptocurrency and blockchain stocks, at the forefront of blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9926

Akeso

A biopharmaceutical company, engages in the research, development, manufacture, and commercialization of antibody drugs worldwide.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives