As the Hong Kong market navigates through a period of economic uncertainty, with the Hang Seng Index recently experiencing a slight decline, investors are increasingly on the lookout for opportunities that may be trading below their intrinsic value. In this context, identifying undervalued stocks becomes crucial as these investments can potentially offer significant long-term returns when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Bosideng International Holdings (SEHK:3998) | HK$3.59 | HK$6.73 | 46.7% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$28.40 | HK$56.14 | 49.4% |

| BYD (SEHK:1211) | HK$242.80 | HK$461.76 | 47.4% |

| Hangzhou SF Intra-city Industrial (SEHK:9699) | HK$11.12 | HK$19.87 | 44% |

| Jiangxi Rimag Group (SEHK:2522) | HK$27.35 | HK$49.19 | 44.4% |

| Digital China Holdings (SEHK:861) | HK$3.23 | HK$6.09 | 47% |

| Akeso (SEHK:9926) | HK$72.20 | HK$132.94 | 45.7% |

| Innovent Biologics (SEHK:1801) | HK$43.80 | HK$80.11 | 45.3% |

| United Company RUSAL International (SEHK:486) | HK$2.33 | HK$4.25 | 45.1% |

| Jinke Smart Services Group (SEHK:9666) | HK$7.01 | HK$13.73 | 48.9% |

Let's explore several standout options from the results in the screener.

BYD (SEHK:1211)

Overview: BYD Company Limited, with a market cap of HK$773 billion, operates in the automobiles and batteries business across the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Operations: The company generates revenue primarily from Automobiles and Related Products and Other Products (CN¥507.52 billion) as well as Mobile Handset Components, Assembly Service, and Other Products (CN¥154.49 billion).

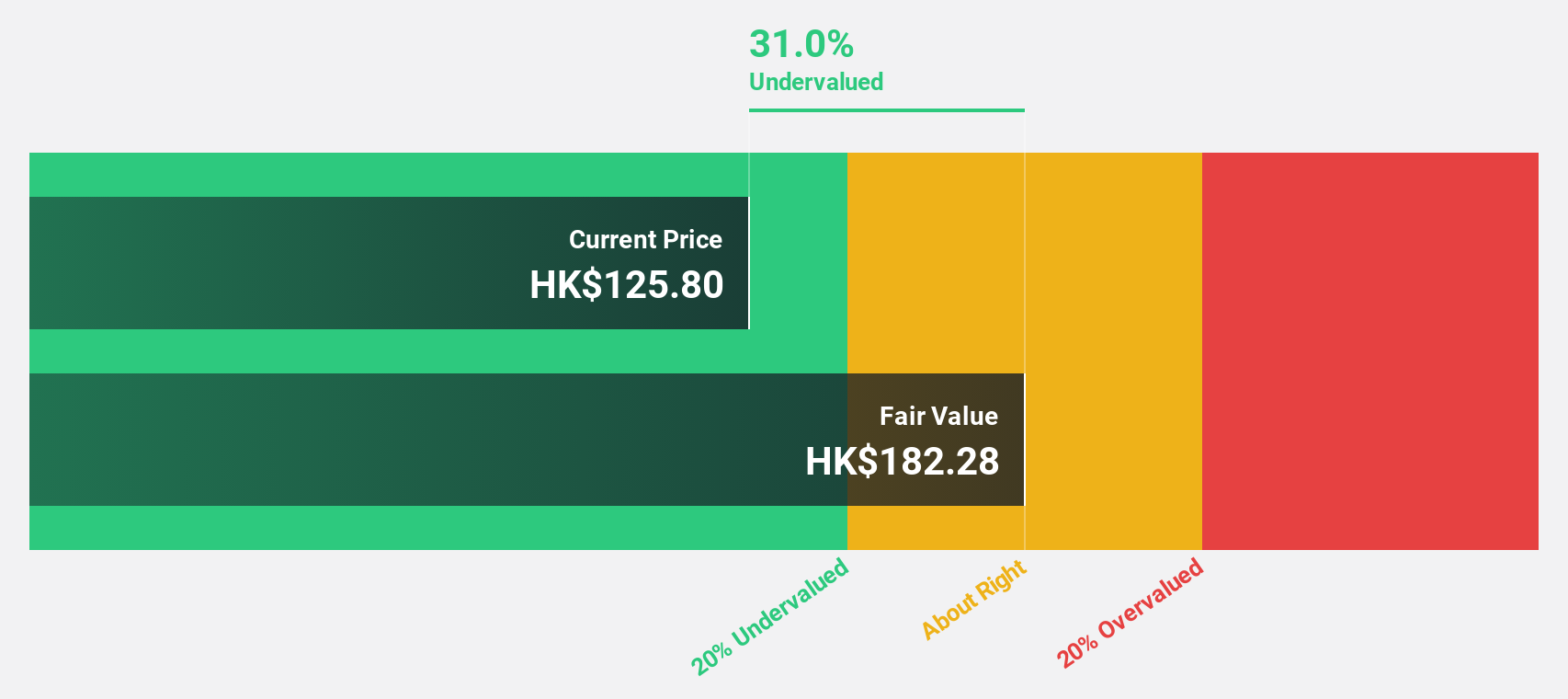

Estimated Discount To Fair Value: 47.4%

BYD appears undervalued based on cash flows, trading at HK$242.8, significantly below its estimated fair value of HK$461.76. Recent production and sales data show robust growth, with year-to-date production and sales volumes reaching 2.32 million units each, up from 1.83 million and 1.55 million respectively last year. The company’s earnings grew to CNY13.63 billion for the half-year ending June 2024 from CNY10.95 billion a year ago, indicating strong financial performance despite market challenges.

- Our comprehensive growth report raises the possibility that BYD is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of BYD stock in this financial health report.

ZJLD Group (SEHK:6979)

Overview: ZJLD Group Inc is involved in the production and sale of baijiu products in China, with a market cap of HK$19.35 billion.

Operations: The company's revenue segments include Li Du (CN¥1.29 billion), Zhen Jiu (CN¥4.98 billion), Xiang Jiao (CN¥844.13 million), and Kai Kou Xiao (CN¥388.16 million).

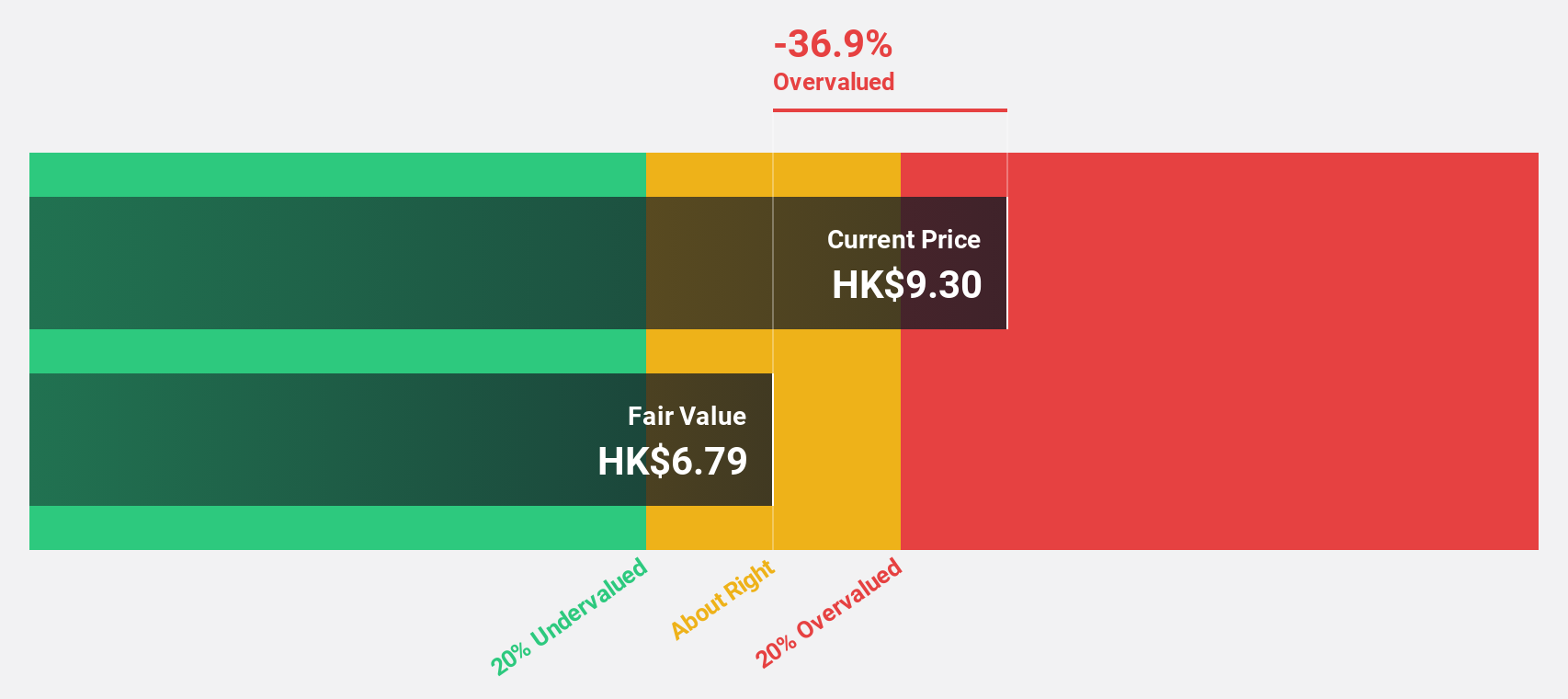

Estimated Discount To Fair Value: 37.2%

ZJLD Group is trading at HK$5.71, well below its estimated fair value of HK$9.1, suggesting it is highly undervalued based on discounted cash flows. The company’s earnings are forecast to grow significantly at 20.72% annually over the next three years, outpacing the Hong Kong market's growth rate of 11.7%. Despite a recent decline in profit margins from 33.1% to 19.5%, ZJLD remains a strong candidate for investors seeking undervalued stocks with robust cash flow potential.

- Insights from our recent growth report point to a promising forecast for ZJLD Group's business outlook.

- Click to explore a detailed breakdown of our findings in ZJLD Group's balance sheet health report.

Akeso (SEHK:9926)

Overview: Akeso, Inc., with a market cap of HK$62.51 billion, is a biopharmaceutical company that researches, develops, manufactures, and commercializes antibody drugs.

Operations: The company's revenue from the research, development, production, and sale of biopharmaceutical products is CN¥1.87 billion.

Estimated Discount To Fair Value: 45.7%

Akeso is trading at HK$72.2, significantly below its estimated fair value of HK$132.94, indicating it is highly undervalued based on discounted cash flows. Despite recent volatility and shareholder dilution, the company's revenue is forecast to grow 33.1% annually, outpacing the Hong Kong market's growth rate of 7.3%. Recent product-related announcements highlight promising clinical trial results for ivonescimab in various cancers, reinforcing Akeso's strong potential for future profitability and robust cash flow generation.

- Upon reviewing our latest growth report, Akeso's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Akeso.

Where To Now?

- Delve into our full catalog of 29 Undervalued SEHK Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BYD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1211

BYD

Engages in automobiles and batteries business in the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Excellent balance sheet with reasonable growth potential.