3 Prominent Stocks Estimated To Be Undervalued In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape of rising inflation and cautious monetary policies, U.S. stock indexes are climbing toward record highs, buoyed by optimism surrounding trade negotiations and robust earnings reports. In this environment, identifying undervalued stocks can be crucial for investors seeking opportunities that may offer potential growth despite broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhejiang Meorient Commerce Exhibition (SZSE:300795) | CN¥23.89 | CN¥47.35 | 49.5% |

| Provident Financial Services (NYSE:PFS) | US$18.66 | US$36.99 | 49.6% |

| Samwha ElectricLtd (KOSE:A009470) | ₩43300.00 | ₩86056.86 | 49.7% |

| Power Wind Health Industry (TWSE:8462) | NT$111.00 | NT$221.07 | 49.8% |

| Smurfit Westrock (NYSE:SW) | US$55.30 | US$109.74 | 49.6% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.07 | CN¥30.01 | 49.8% |

| Com2uS (KOSDAQ:A078340) | ₩48300.00 | ₩96048.27 | 49.7% |

| BIKE O (TSE:3377) | ¥410.00 | ¥812.21 | 49.5% |

| Saipem (BIT:SPM) | €2.341 | €4.67 | 49.8% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.8% |

Here's a peek at a few of the choices from the screener.

ASMPT (SEHK:522)

Overview: ASMPT Limited is an investment holding company involved in designing, manufacturing, and marketing machines, tools, and materials for the semiconductor and electronics assembly industries globally, with a market cap of HK$29.07 billion.

Operations: The company's revenue is primarily derived from Semiconductor Solutions, contributing HK$6.42 billion, and Surface Mount Technology (SMT) Solutions, which accounts for HK$6.81 billion.

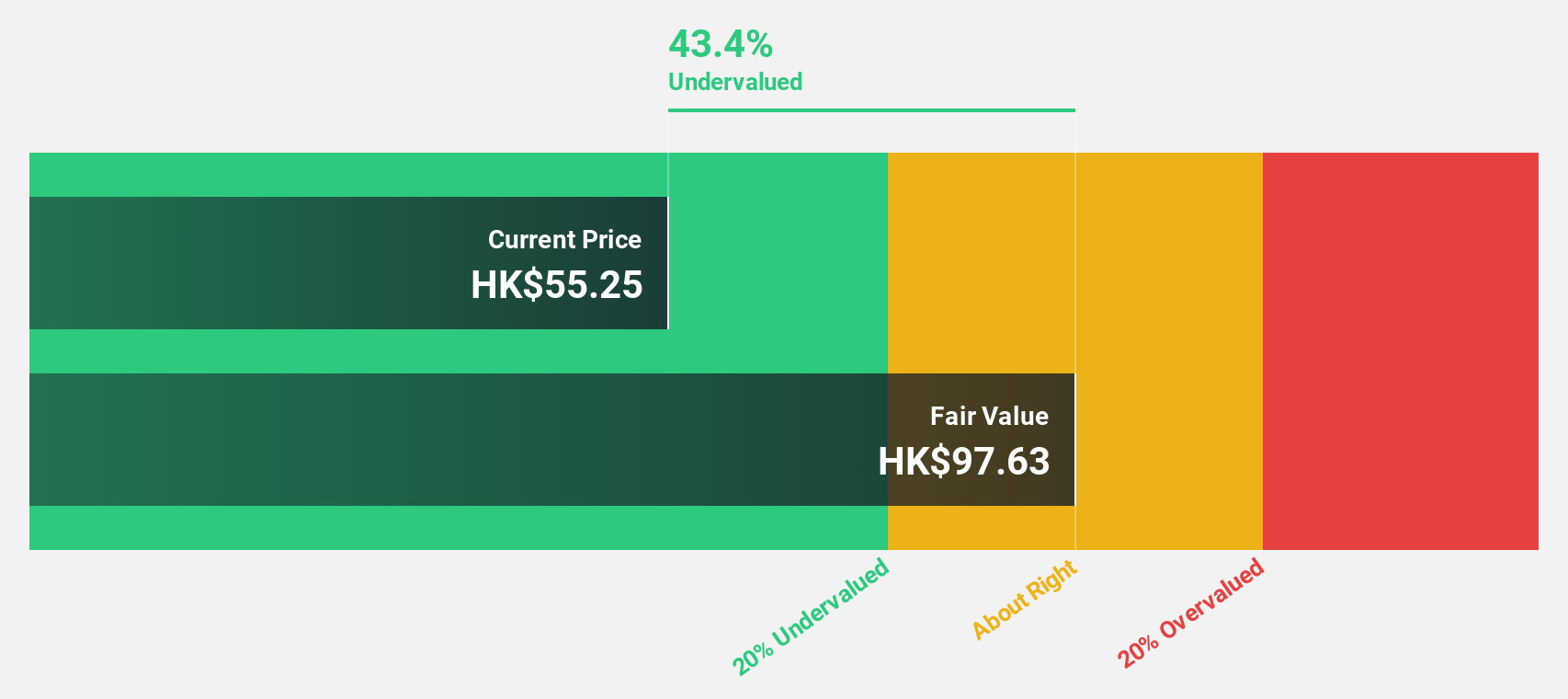

Estimated Discount To Fair Value: 49.5%

ASMPT is trading at HK$71.6, significantly below its estimated fair value of HK$141.78, suggesting it may be undervalued based on cash flows. While the company's profit margins have decreased to 3.1% from 5.8% last year, earnings are expected to grow substantially at 46.1% annually, outpacing the Hong Kong market's growth rate of 11.7%. However, its forecasted Return on Equity remains modest at 13.4%.

- In light of our recent growth report, it seems possible that ASMPT's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in ASMPT's balance sheet health report.

Akeso (SEHK:9926)

Overview: Akeso, Inc. is a biopharmaceutical company that focuses on the research, development, manufacturing, and commercialization of antibody drugs, with a market cap of HK$53.72 billion.

Operations: The company's revenue is primarily derived from the research, development, production, and sale of biopharmaceutical products, amounting to CN¥1.87 billion.

Estimated Discount To Fair Value: 47.9%

Akeso's stock, trading at HK$62.65, is considered undervalued based on cash flows with a fair value estimate of HK$120.25. The company is expected to achieve profitability within three years and has a strong revenue growth forecast of 30.1% annually, outpacing the Hong Kong market average. Recent developments include the acceptance of its IND application for AK139 and ongoing clinical trials for innovative bispecific antibodies, enhancing its potential in both oncology and non-oncology segments.

- According our earnings growth report, there's an indication that Akeso might be ready to expand.

- Take a closer look at Akeso's balance sheet health here in our report.

Zhejiang Meorient Commerce Exhibition (SZSE:300795)

Overview: Zhejiang Meorient Commerce Exhibition Inc. operates in the exhibition and trade show industry with a market cap of CN¥5.12 billion.

Operations: Zhejiang Meorient Commerce Exhibition Inc. generates revenue from its operations in the exhibition and trade show industry.

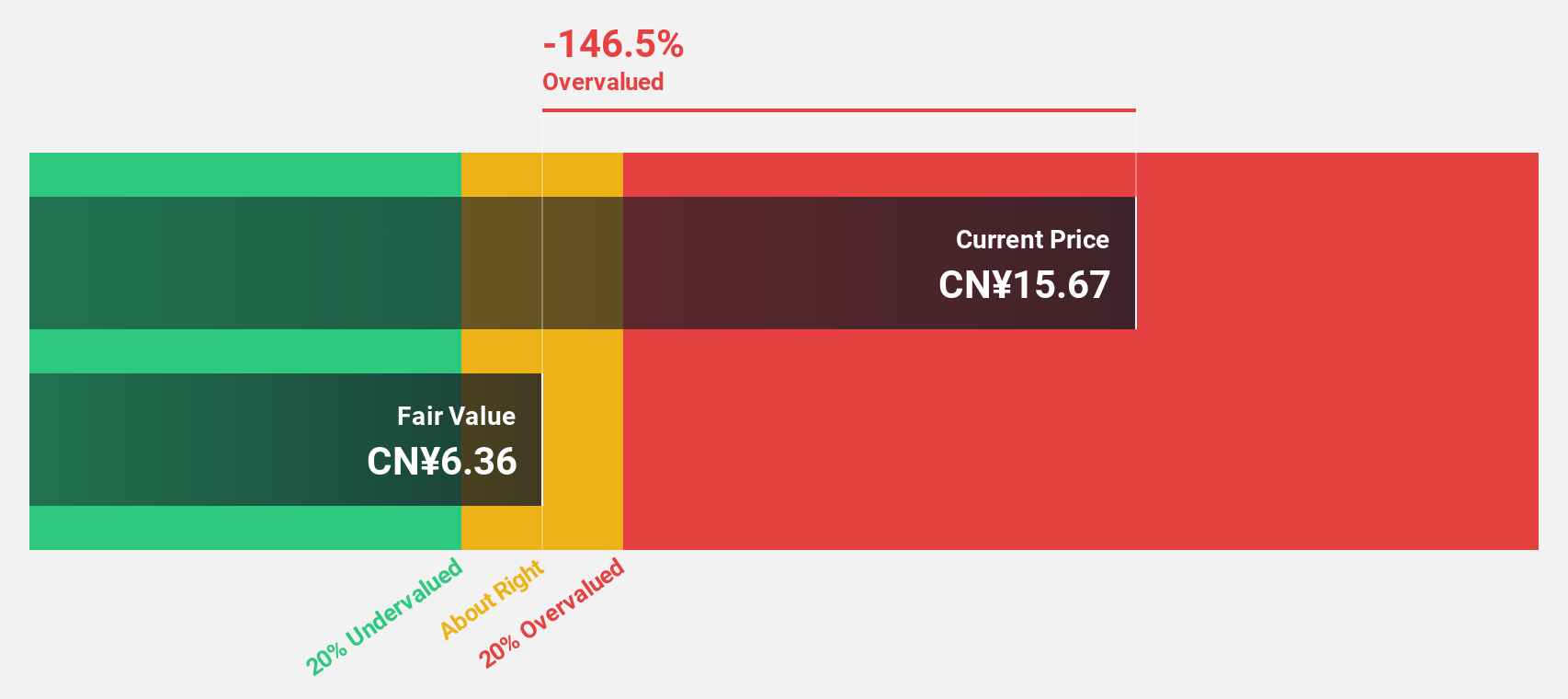

Estimated Discount To Fair Value: 49.5%

Zhejiang Meorient Commerce Exhibition is trading at CN¥23.89, significantly below its estimated fair value of CN¥47.35, indicating it may be undervalued based on cash flows. Despite recent volatility and being dropped from the S&P Global BMI Index, the company forecasts robust revenue growth of 26.9% annually and earnings growth of 31.8%, surpassing market averages in China. However, its dividend yield of 2.51% is not well covered by free cash flows.

- Upon reviewing our latest growth report, Zhejiang Meorient Commerce Exhibition's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Zhejiang Meorient Commerce Exhibition.

Seize The Opportunity

- Embark on your investment journey to our 925 Undervalued Stocks Based On Cash Flows selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Meorient Commerce Exhibition might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300795

Zhejiang Meorient Commerce Exhibition

Zhejiang Meorient Commerce Exhibition Inc.

Exceptional growth potential with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives