Increases to Wai Yuen Tong Medicine Holdings Limited's (HKG:897) CEO Compensation Might Cool off for now

CEO Ching Ho Tang has done a decent job of delivering relatively good performance at Wai Yuen Tong Medicine Holdings Limited (HKG:897) recently. As shareholders go into the upcoming AGM on 25 August 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders may still want to keep CEO compensation within reason.

See our latest analysis for Wai Yuen Tong Medicine Holdings

Comparing Wai Yuen Tong Medicine Holdings Limited's CEO Compensation With the industry

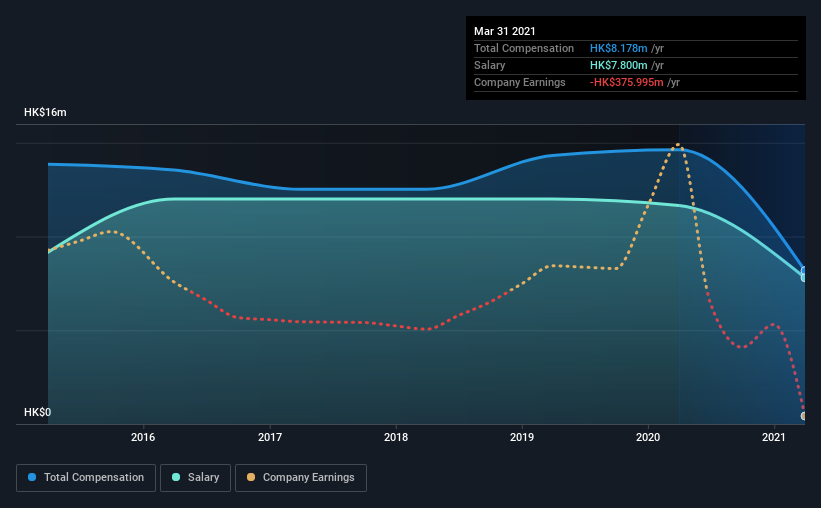

Our data indicates that Wai Yuen Tong Medicine Holdings Limited has a market capitalization of HK$376m, and total annual CEO compensation was reported as HK$8.2m for the year to March 2021. We note that's a decrease of 44% compared to last year. In particular, the salary of HK$7.80m, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$4.1m. This suggests that Ching Ho Tang is paid more than the median for the industry.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | HK$7.8m | HK$12m | 95% |

| Other | HK$378k | HK$3.0m | 5% |

| Total Compensation | HK$8.2m | HK$15m | 100% |

On an industry level, around 71% of total compensation represents salary and 29% is other remuneration. Wai Yuen Tong Medicine Holdings is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Wai Yuen Tong Medicine Holdings Limited's Growth Numbers

Over the last three years, Wai Yuen Tong Medicine Holdings Limited has shrunk its earnings per share by 24% per year. It achieved revenue growth of 79% over the last year.

Investors would be a bit wary of companies that have lower EPS But on the other hand, revenue growth is strong, suggesting a brighter future. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Wai Yuen Tong Medicine Holdings Limited Been A Good Investment?

Wai Yuen Tong Medicine Holdings Limited has served shareholders reasonably well, with a total return of 20% over three years. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

Ching Ho receives almost all of their compensation through a salary. Although the company has performed relatively well, we still think there are some areas that could be improved. We still think that some shareholders will be hesitant of increasing CEO pay until EPS growth improves, since they are already paid higher than the industry.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 2 warning signs for Wai Yuen Tong Medicine Holdings you should be aware of, and 1 of them doesn't sit too well with us.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Wai Yuen Tong Medicine Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:897

Wai Yuen Tong Medicine Holdings

An investment holding company, engages in production and sale of Chinese and western pharmaceuticals and health food products in Mainland China and Hong Kong.

Flawless balance sheet and good value.

Market Insights

Community Narratives