- Hong Kong

- /

- Healthcare Services

- /

- SEHK:874

With Guangzhou Baiyunshan Pharmaceutical Holdings Company Limited (HKG:874) It Looks Like You'll Get What You Pay For

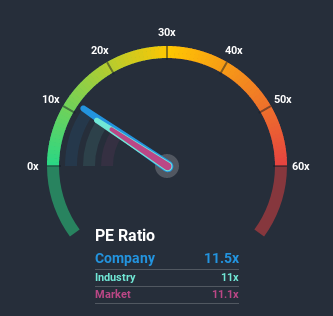

It's not a stretch to say that Guangzhou Baiyunshan Pharmaceutical Holdings Company Limited's (HKG:874) price-to-earnings (or "P/E") ratio of 11.5x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 11x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

With earnings that are retreating more than the market's of late, Guangzhou Baiyunshan Pharmaceutical Holdings has been very sluggish. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Guangzhou Baiyunshan Pharmaceutical Holdings

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Guangzhou Baiyunshan Pharmaceutical Holdings would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 29%. Regardless, EPS has managed to lift by a handy 27% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 17% per annum as estimated by the five analysts watching the company. That's shaping up to be similar to the 19% per year growth forecast for the broader market.

In light of this, it's understandable that Guangzhou Baiyunshan Pharmaceutical Holdings' P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Guangzhou Baiyunshan Pharmaceutical Holdings' analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Guangzhou Baiyunshan Pharmaceutical Holdings you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

If you decide to trade Guangzhou Baiyunshan Pharmaceutical Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:874

Guangzhou Baiyunshan Pharmaceutical Holdings

Researches, develops, manufactures, and sells Chinese patent and Western medicines, chemical raw materials, natural and biological medicines, and intermediates of chemical raw materials in the People’s Republic of China and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives