Exclusive Novartis Ophthalmology Deal Might Change The Case For Investing In China Medical System Holdings (SEHK:867)

Reviewed by Sasha Jovanovic

- On October 27, 2025, China Medical System Holdings announced that its subsidiary CMS Vision International Management Limited had entered into an exclusive five-year distribution agreement with Novartis Pharma Services AG to import, distribute, sell, and promote Lucentis and Beovu injections in mainland China.

- This collaboration expands CMS Vision's ophthalmology portfolio with two key, internationally recognized treatments, strengthening its market presence and offering broader therapeutic options to patients with ocular diseases in China.

- We'll explore how this exclusive partnership for next-generation ophthalmic drugs could reshape CMS's investment narrative and future growth potential.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is China Medical System Holdings' Investment Narrative?

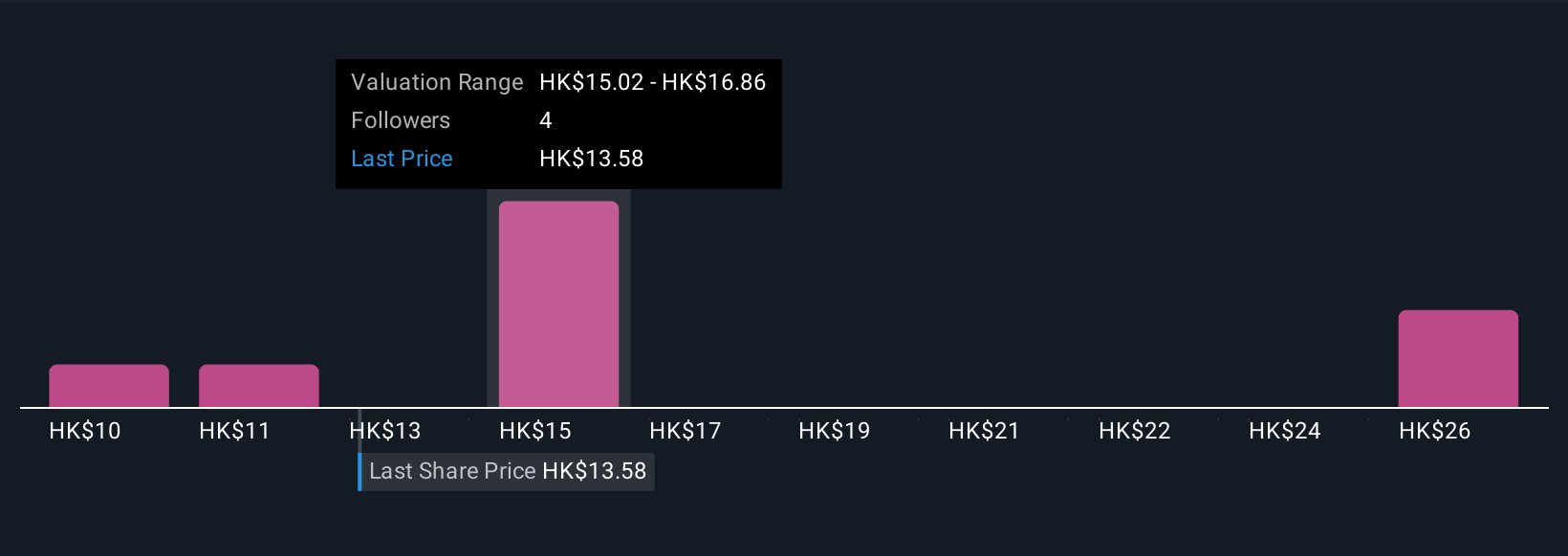

For those considering China Medical System Holdings, the recent exclusive deal with Novartis, bringing Lucentis and Beovu to CMS’s ophthalmology portfolio, could be a powerful short-term catalyst for expanding both revenue streams and market presence. This partnership directly addresses the company’s need for diverse, high-impact products while leveraging CMS’s established network in China, a move that may cushion the current risk of slow profit growth acceleration flagged before the agreement. At the same time, the fair value consensus places CMS shares notably below estimated value, but with recent price gains and profit growth already outpacing peers, the market has shown enthusiasm ahead of this announcement. Still, some risks linger, like board turnover and a management team whose level of experience remains under review, factors that could become more relevant if the new collaboration sparks rapid organizational changes.

However, fresh partnerships don’t eliminate concerns about how efficiently management can scale up new products. China Medical System Holdings' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on China Medical System Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own China Medical System Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Medical System Holdings research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free China Medical System Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Medical System Holdings' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:867

China Medical System Holdings

An investment holding company, manufactures, sells, markets, and promotes pharmaceutical products in the People’s Republic of China.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives