- Hong Kong

- /

- Metals and Mining

- /

- SEHK:3833

Frontage Holdings And 2 Other Promising Asian Penny Stocks

Reviewed by Simply Wall St

As Asian markets continue to navigate a complex economic landscape, characterized by fluctuating demand and policy shifts, investors remain vigilant for opportunities that align with current trends. Penny stocks, though often associated with higher risk due to their smaller size and market presence, can still present compelling value when backed by strong financials. This article explores three such penny stocks in Asia that demonstrate potential through their financial strength and growth prospects.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.97 | HK$2.42B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.52 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.88 | THB1.21B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.60 | HK$2.16B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.08 | SGD437.71M | ✅ 4 ⚠️ 2 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.098 | SGD51.3M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.52 | SGD13.85B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.05 | HK$2.82B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.07 | NZ$152.31M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.38 | THB8.85B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 959 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Frontage Holdings (SEHK:1521)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Frontage Holdings Corporation is a contract research organization offering laboratory and related services to pharmaceutical, biotechnology, and agrochemical companies, with a market cap of HK$2.53 billion.

Operations: The company generates revenue from its operations in North America and Europe, contributing $197.38 million, and the People's Republic of China, adding $55.63 million.

Market Cap: HK$2.53B

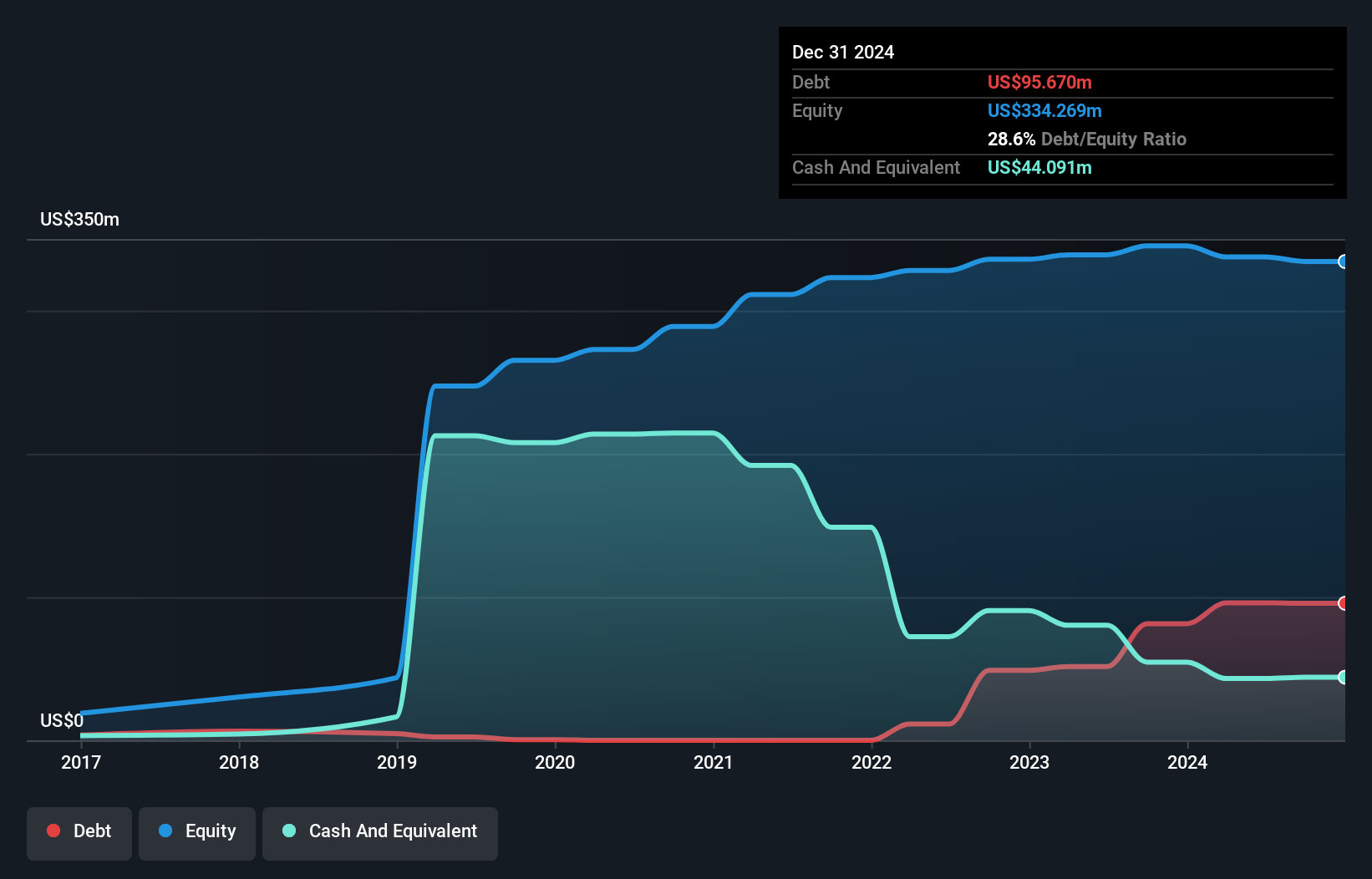

Frontage Holdings, a contract research organization, reported half-year sales of US$126.58 million, slightly down from the previous year. Despite this dip in sales, the company turned a net income of US$2.93 million compared to a net loss previously. The management and board are experienced with average tenures of 2.8 and 4 years respectively, which may provide stability amid challenges like low return on equity (1.1%) and declining profit margins (1.5%). The debt level is satisfactory with net debt to equity at 13.4%, but interest coverage remains weak at 1.4 times EBIT.

- Click here and access our complete financial health analysis report to understand the dynamics of Frontage Holdings.

- Gain insights into Frontage Holdings' future direction by reviewing our growth report.

Xinjiang Xinxin Mining Industry (SEHK:3833)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Xinjiang Xinxin Mining Industry Co., Ltd. operates in the mining, ore processing, smelting, refining, and sale of nickel, copper, and other nonferrous metals with a market capitalization of HK$5.92 billion.

Operations: No revenue segments are reported for Xinjiang Xinxin Mining Industry Co., Ltd.

Market Cap: HK$5.92B

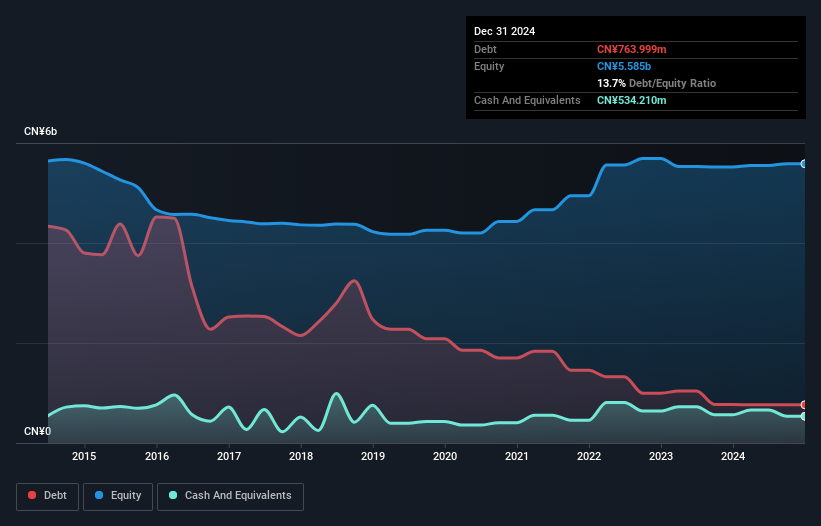

Xinjiang Xinxin Mining Industry faces challenges with declining earnings, dropping by 10.5% annually over five years, and a volatile share price. Recent half-year results show increased revenue of CN¥1.12 billion but a significant net income drop to CN¥71.65 million due to lower nickel prices and rising production costs. The company has reduced its debt-to-equity ratio from 44.2% to 26.1%, indicating improved financial leverage, yet operating cash flow covers only 14.4% of debt, suggesting liquidity concerns remain. Leadership changes may impact strategic direction as the management team averages just 1.9 years in tenure, pointing to potential instability.

- Click to explore a detailed breakdown of our findings in Xinjiang Xinxin Mining Industry's financial health report.

- Review our historical performance report to gain insights into Xinjiang Xinxin Mining Industry's track record.

Antengene (SEHK:6996)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Antengene Corporation Limited is a clinical-stage APAC biopharmaceutical company focused on developing novel oncology therapies in Greater China and internationally, with a market cap of HK$3.35 billion.

Operations: Antengene's revenue is derived from the research, development, and commercialization of pharmaceutical products, amounting to CN¥84.35 million.

Market Cap: HK$3.35B

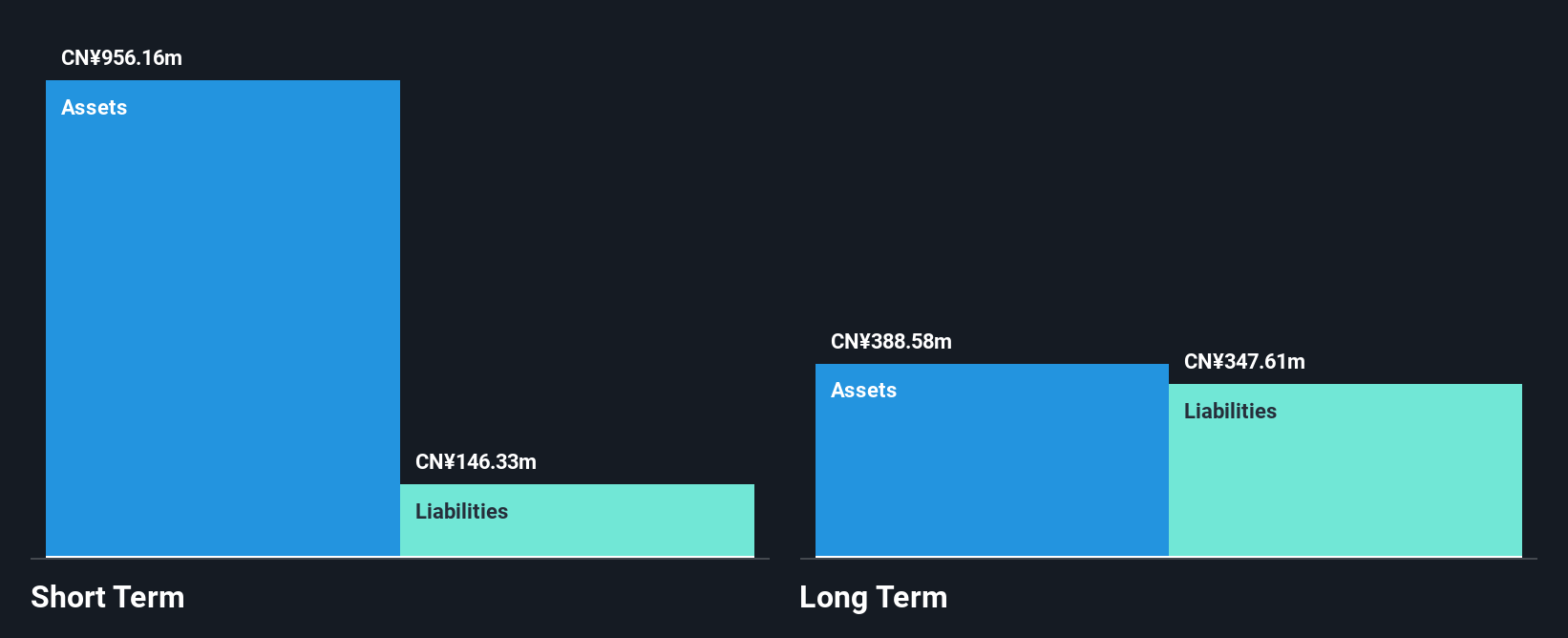

Antengene Corporation Limited, with a market cap of HK$3.35 billion, focuses on developing oncology therapies and has shown promising progress in its clinical pipeline despite being unprofitable. Recent data from the Phase I/II CLINCH study for ATG-022 demonstrate significant antitumor activity and a favorable safety profile across various expression levels of CLDN18.2 in gastric cancer patients, supporting further clinical development. The company's financial position is bolstered by more cash than debt and sufficient short-term assets to cover liabilities, though its share price remains highly volatile. Antengene's strategic advancements are underscored by recent index inclusion and regulatory designations enhancing its growth potential in Asia's biopharmaceutical sector.

- Navigate through the intricacies of Antengene with our comprehensive balance sheet health report here.

- Gain insights into Antengene's outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Click here to access our complete index of 959 Asian Penny Stocks.

- Contemplating Other Strategies? Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3833

Xinjiang Xinxin Mining Industry

Engages in mining, ore processing, smelting, refining, and selling of nickel, copper, and other nonferrous metals.

Excellent balance sheet with low risk.

Market Insights

Community Narratives