As global markets continue to navigate economic uncertainties, the U.S. stock indexes have been climbing toward record highs, with growth stocks outperforming value shares and small-cap stocks lagging behind their larger counterparts. In this dynamic environment, identifying high-growth tech stocks that can thrive despite inflationary pressures and potential interest rate adjustments involves assessing factors such as innovation, market demand, and financial health.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 25.35% | 25.09% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Xspray Pharma | 127.78% | 104.91% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1204 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

ALTEOGEN (KOSDAQ:A196170)

Simply Wall St Growth Rating: ★★★★★★

Overview: ALTEOGEN Inc., a biotechnology company, specializes in creating long-acting biobetters, proprietary antibody-drug conjugates, and antibody biosimilars, with a market cap of ₩20.15 trillion.

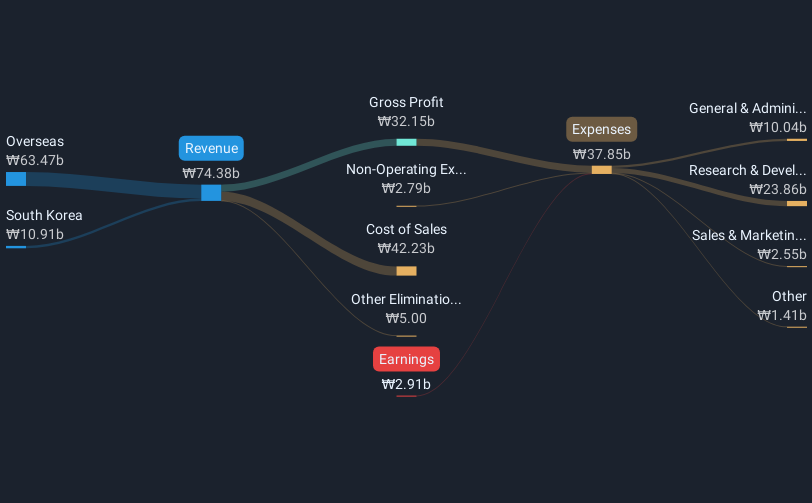

Operations: The company focuses on biotechnology, generating revenue primarily from its biotechnology segment, which amounts to ₩74.38 billion.

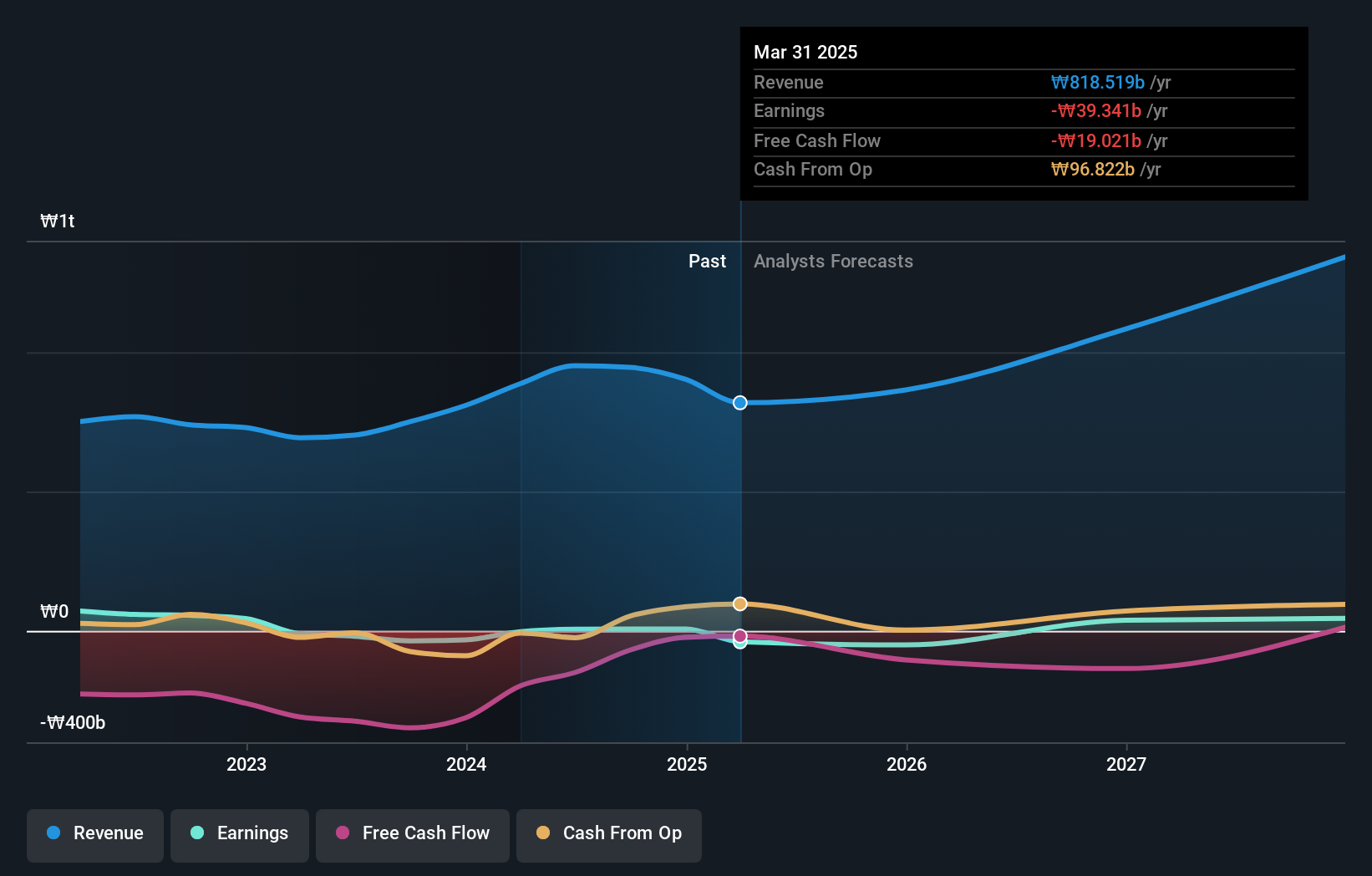

ALTEOGEN has recently secured a significant private placement, indicating robust investor confidence and bolstering its financial position for aggressive expansion in biotech. This move aligns with its impressive forecasted annual revenue growth of 84.2%, substantially outpacing the broader KR market's 9% increase. Despite current unprofitability, the company's strategic focus on R&D is poised to drive future profitability, with earnings expected to surge by 140.6% annually. Moreover, ALTEOGEN's projected Return on Equity of 67.6% in three years underscores its potential for high efficiency in capital utilization, further solidifying its stance in a competitive industry landscape.

- Take a closer look at ALTEOGEN's potential here in our health report.

Evaluate ALTEOGEN's historical performance by accessing our past performance report.

Lotte Energy Materials (KOSE:A020150)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lotte Energy Materials Corporation is engaged in the production and sale of elecfoils both domestically and internationally, with a market capitalization of approximately ₩1.39 trillion.

Operations: The company generates revenue primarily from its Manufacturing Sector, contributing ₩752.97 billion, and a smaller portion from the Service Sector at ₩224.83 billion.

Lotte Energy Materials has recently demonstrated a strategic commitment to growth through its private placement of KRW 150 billion, signaling strong investor confidence. This move is poised to bolster its financial flexibility, aligning with an impressive earnings forecast that anticipates a 71.9% annual increase, significantly outpacing the broader KR market's growth. Despite challenges in maintaining consistent profitability, evidenced by a significant one-off loss of ₩9.2B last year, the company's focus on innovative energy solutions and recent profitability turn suggests potential for sustained improvement. However, its projected low Return on Equity of 2.2% over the next three years may raise concerns about long-term shareholder value creation.

- Click here and access our complete health analysis report to understand the dynamics of Lotte Energy Materials.

Understand Lotte Energy Materials' track record by examining our Past report.

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. is a biopharmaceutical company focused on the research, development, manufacturing, and commercialization of novel drugs to address unmet medical needs in China and internationally, with a market cap of HK$42.91 billion.

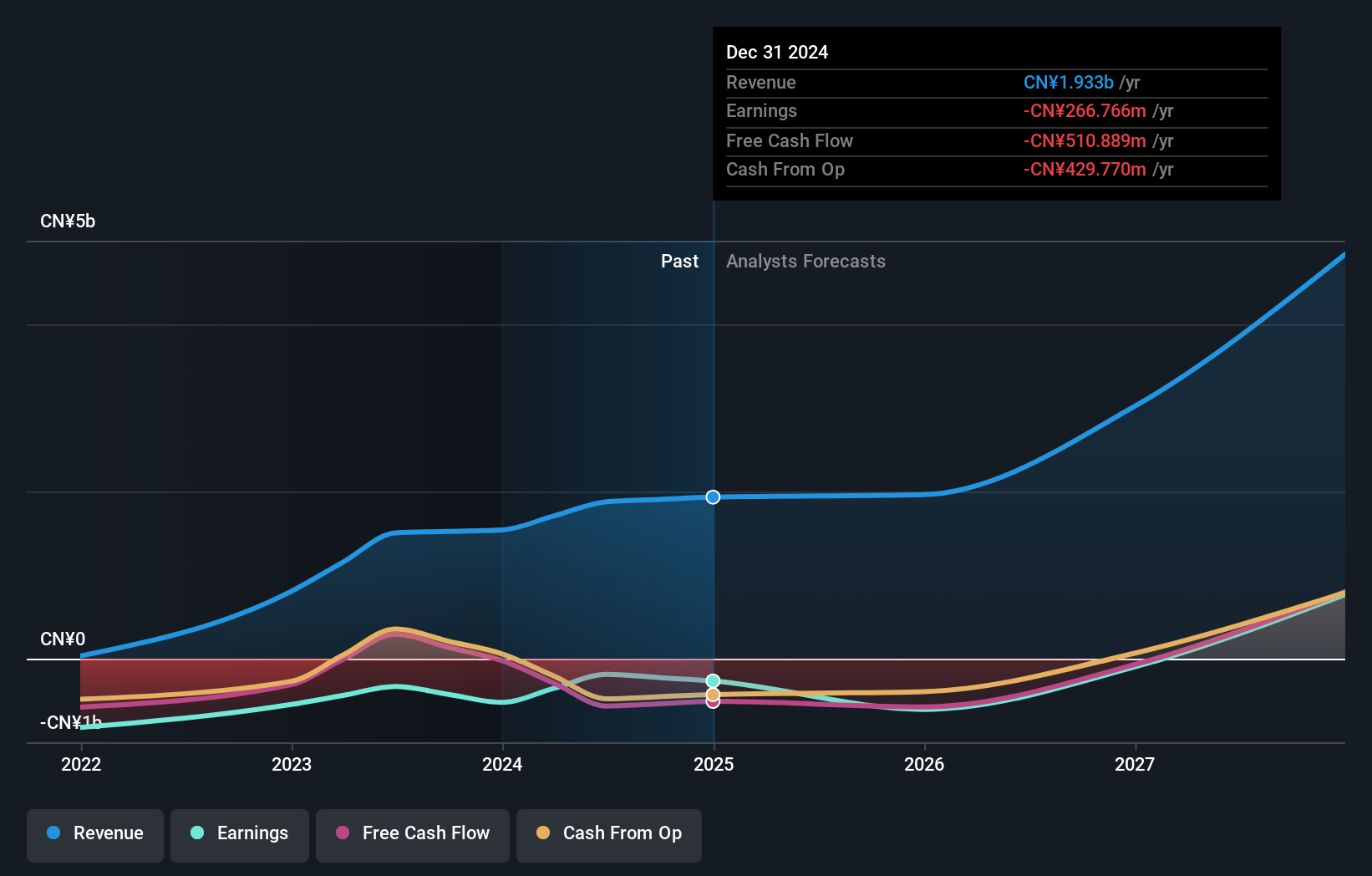

Operations: The company generates revenue primarily from its pharmaceuticals segment, totaling CN¥1.88 billion.

Sichuan Kelun-Biotech Biopharmaceutical Co., Ltd. has been actively expanding its portfolio with recent approvals and clinical advancements, signaling robust growth prospects in biotechnology. The company's revenue is forecasted to grow by an impressive 24.4% annually, outpacing the Hong Kong market's average of 7.9%. Despite being currently unprofitable, Sichuan Kelun-Biotech is expected to turn profitable within three years, a testament to its strategic focus on developing innovative cancer therapies like the TROP2 antibody drug conjugate sacituzumab tirumotecan for advanced urothelial carcinoma. This focus on high-stakes, high-reward oncology treatments could position them well in a competitive industry landscape where innovation directly correlates with market success.

Next Steps

- Investigate our full lineup of 1204 High Growth Tech and AI Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6990

Sichuan Kelun-Biotech Biopharmaceutical

A biopharmaceutical company, engages in the research and development, manufacturing, and commercialization of novel drugs in oncology, immunology, and other therapeutic areas in the People’s Republic of China and internationally.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives