A Look at Kelun-Biotech (SEHK:6990) Valuation Following Breakthrough ADC Trial Results and New China Approvals

Reviewed by Simply Wall St

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990) is catching plenty of attention after unveiling positive late-stage trial results for its lead ADC therapies at the 2025 ESMO Congress. With both trastuzumab botidotin and sacituzumab tirumotecan outperforming standard treatments in breast and lung cancer, as well as new regulatory approvals in China, investors are taking a fresh look at the company’s commercial prospects.

See our latest analysis for Sichuan Kelun-Biotech Biopharmaceutical.

The excitement around Kelun-Biotech is showing up in the numbers, too. After surging on breakthrough trial updates and several new China approvals, the company boasts a 181.19% year-to-date share price return, and a 149.07% total return over the past twelve months. This is a clear sign that momentum is building as investors reprice the company's growth outlook.

If these pharma breakthroughs have sparked your interest, you’ll find plenty more opportunities among innovators in the sector. See the full list for free with our healthcare stocks screener: See the full list for free.

With shares soaring on a wave of good news, the question now is whether Kelun-Biotech’s stock is trading at a bargain given its pipeline wins, or if the market is already reflecting those future gains in the price.

Price-to-Book Ratio of 20.1x: Is it justified?

Sichuan Kelun-Biotech Biopharmaceutical trades at a Price-to-Book ratio of 20.1x, which is significantly higher than both its industry average and peer group. At its last close of HK$471, the stock commands a premium valuation based on this multiple, suggesting the market is paying up for anticipated future growth.

The Price-to-Book ratio measures how much investors are willing to pay for each dollar of a company's net assets. In biotech, high ratios can sometimes be justified if a company is expected to deliver transformational innovation or rapid earnings growth.

For Kelun-Biotech, the market clearly places a high value on its pipeline and growth story. However, with a Price-to-Book ratio almost four times the Hong Kong Biotechs industry average of 5.4x, investors are assuming a rapid transformation from unprofitability to strong returns. Its multiple is below the peer group average of 34.2x but remains lofty compared to the sector overall.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book Ratio of 20.1x (OVERVALUED)

However, setbacks in regulatory approvals or slower than expected revenue growth could quickly challenge the optimism reflected in Kelun-Biotech’s current valuation.

Find out about the key risks to this Sichuan Kelun-Biotech Biopharmaceutical narrative.

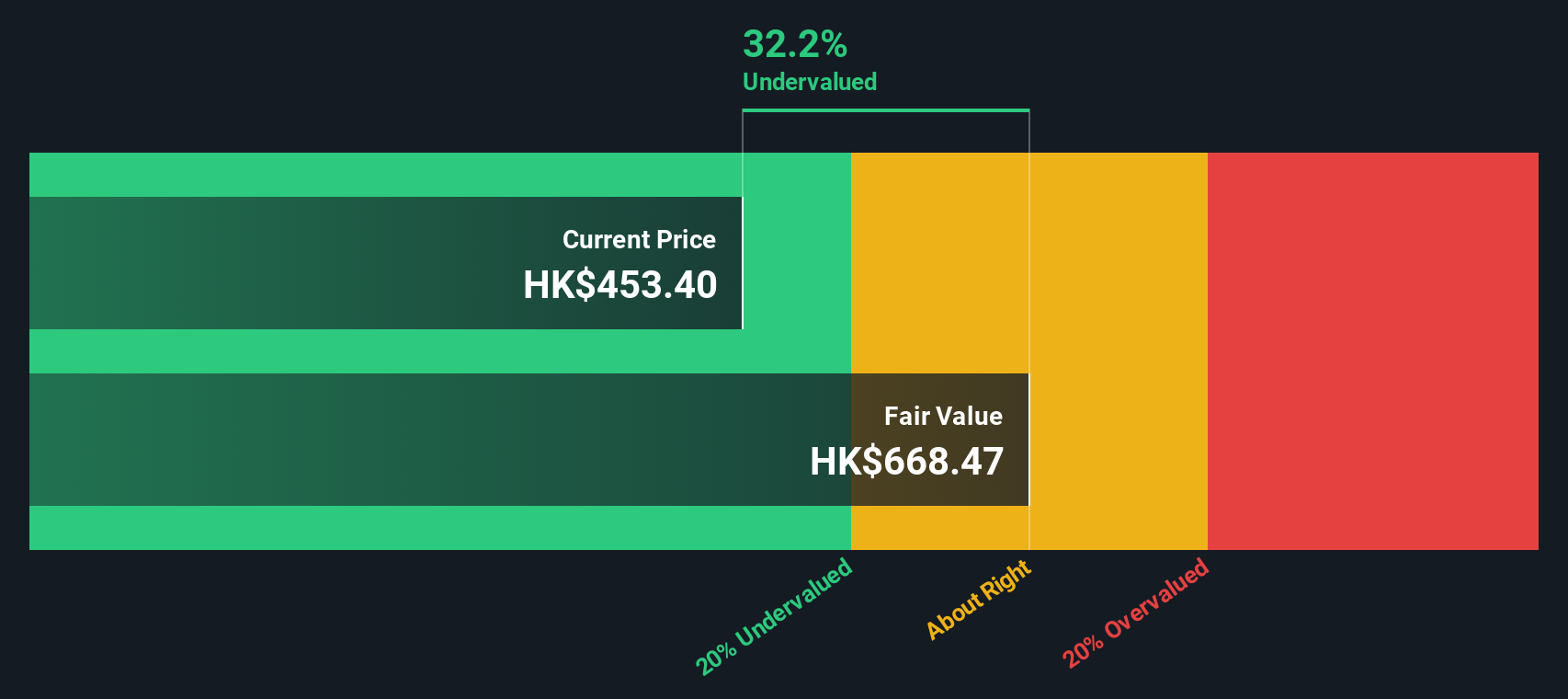

Another View: Our DCF Model Shows Undervaluation

While the Price-to-Book ratio presents Kelun-Biotech as expensive, our SWS DCF model tells a different story. It values the stock at HK$659.98, approximately 28.6% above the current price, suggesting shares may be undervalued if growth expectations are met. Is the market discounting Kelun-Biotech's future potential too heavily?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sichuan Kelun-Biotech Biopharmaceutical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sichuan Kelun-Biotech Biopharmaceutical Narrative

If you have your own perspective on Kelun-Biotech or want to dig deeper into the company’s data, you can easily craft your own view in just a few minutes using Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Sichuan Kelun-Biotech Biopharmaceutical.

Looking for more investment ideas?

Smart investors always stay one step ahead. Broaden your portfolio with proven strategies and fresh opportunities hand-picked by our screeners below before the best ideas get snapped up.

- Tap into the income potential of steady payers by reviewing these 17 dividend stocks with yields > 3%, which bring strong yields and sustainable growth.

- Ride the momentum of cutting-edge machine learning with these 24 AI penny stocks, which are poised to accelerate the future of automation and data analytics.

- Capitalize on overlooked value plays by checking out these 875 undervalued stocks based on cash flows, which the market hasn’t fully priced in yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6990

Sichuan Kelun-Biotech Biopharmaceutical

A biopharmaceutical company, engages in the research and development, manufacturing, and commercialization of novel drugs in oncology, immunology, and other therapeutic areas in the People’s Republic of China and internationally.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives