CanSino Biologics (SEHK:6185) Losses Worsen, Undervalued Against DCF Despite 120% Earnings Growth Forecast

Reviewed by Simply Wall St

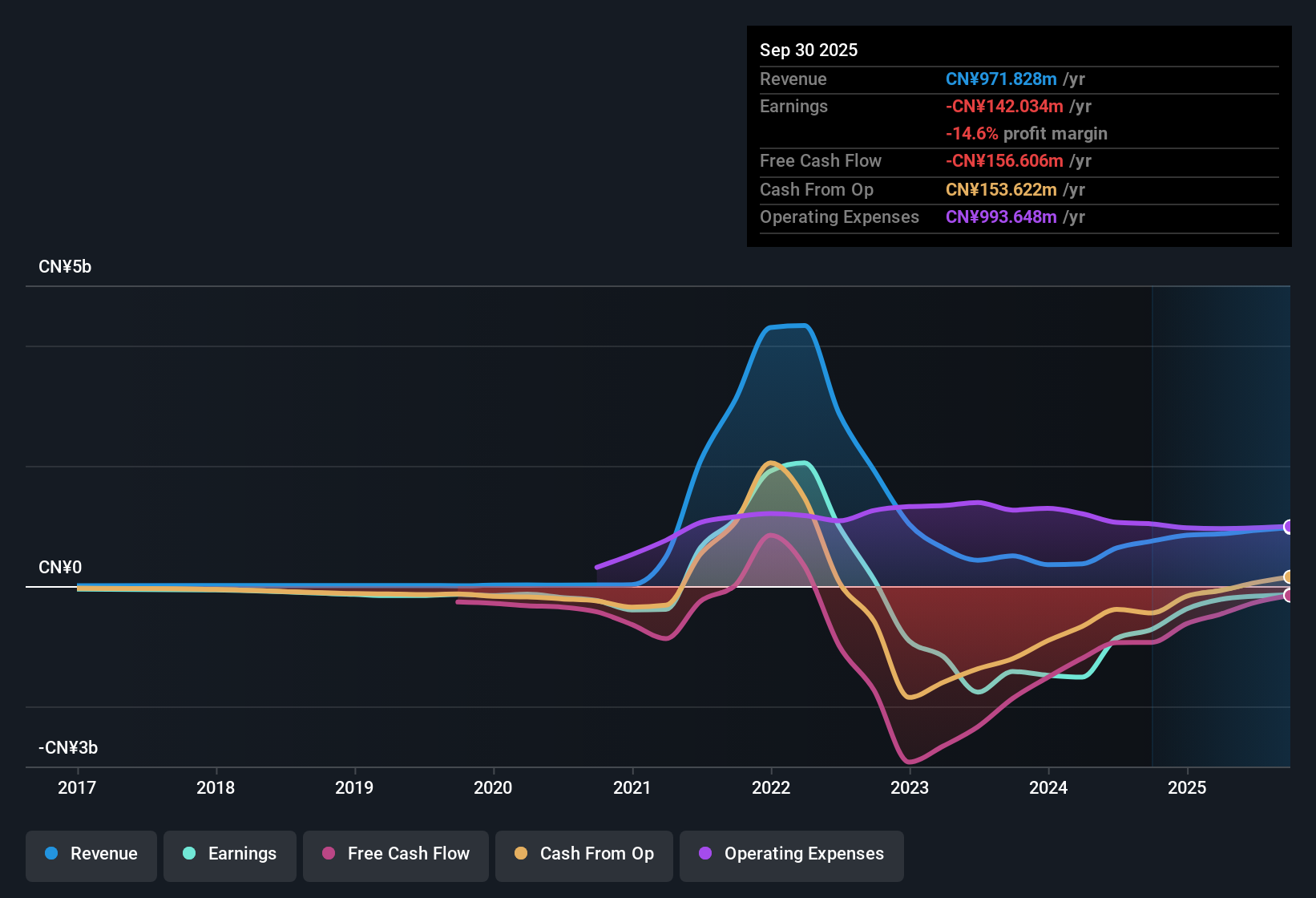

CanSino Biologics (SEHK:6185) remains in the red, with losses deepening at an average rate of 31.2% per year over the past five years. Despite net profit margins failing to show improvement, forecasts indicate the company could swing to profitability within three years. Earnings are projected to grow 120% per year and revenue is expected to expand at 30.1% per year, well ahead of the wider Hong Kong market’s 8.6% annual pace. Investors will be watching the tension between CanSino’s history of widening losses and its standout growth outlook, especially as no major or minor risks have been reported, while strong growth and value remain clear rewards.

See our full analysis for CanSino Biologics.The next section puts these latest financial results head-to-head with widely held narratives about CanSino Biologics, to see where the numbers confirm market sentiment and where they might prompt a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Deepen Despite Positive Growth Forecasts

- Losses at CanSino Biologics have been mounting, with the company’s net income declining at an average rate of 31.2% per year over the past five years, showing no improvement in net profit margins during the last year.

- The prevailing market view has focused on how rising losses conflict with ambitious forecasts for a turnaround. This highlights tension between strong revenue growth expectations, with 120% projected annual earnings growth and 30.1% revenue growth, and the ongoing lack of profitability.

- Even as profit margins stay weak, analysts emphasize that turning profitable within three years would mark a dramatic reversal.

- Investors are keeping a close watch, as sustained net losses could test faith in the company’s upbeat growth narrative.

Price-to-Sales Ratio Undercuts Industry Peers

- Trading at a Price-to-Sales Ratio of 10.4x, which is far below the Hong Kong Biotechs industry average of 15.5x and peers at 34.7x, CanSino’s valuation signals cautious optimism despite its strong revenue outlook.

- The prevailing market view leans into the idea that CanSino’s discounted sales ratio may offer attractive entry for long-term investors, while underscoring that the lower valuation is largely a function of continued losses.

- Some argue that the gap to industry multiples creates room for upside if the turnaround materializes in the projected timeframe.

- Others see the market’s skepticism as justified given persistently negative margins and uncertainty around the three-year path to profitability.

Share Price Trails DCF Fair Value Estimate

- With the current share price at HK$44.92, CanSino trades at a notable discount to its DCF fair value of HK$55.28.

- This prevailing market perspective highlights a clear valuation tension. While the share price lags the DCF fair value by a significant margin, justified caution remains given the backward-looking trend of deepening losses.

- Optimists may view the DCF gap as evidence the stock is undervalued, especially if earnings growth targets are on track.

- Skeptics question whether a DCF-based target is realistic until the company proves it can stem losses and improve margins.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on CanSino Biologics's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

CanSino Biologics continues to struggle with persistent losses and unproven profitability, raising doubts about the reliability of its future growth projections.

If you want more certainty, use stable growth stocks screener (2119 results) to uncover companies already delivering consistent, proven results through changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6185

CanSino Biologics

Develops, manufactures, and commercializes vaccines in the People’s Republic of China.

High growth potential and good value.

Market Insights

Community Narratives