Grand Pharmaceutical Group (SEHK:512): Valuation Insights Following Key Liver Cancer Drug Clinical Milestone

Reviewed by Simply Wall St

Grand Pharmaceutical Group (SEHK:512) has completed patient enrollment for its China registration clinical study of GPN00289, a next-generation embolic agent targeting primary liver cancer. This product represents an important step in expanding the company's oncology pipeline.

See our latest analysis for Grand Pharmaceutical Group.

It has been a transformative year for Grand Pharmaceutical Group, with its latest clinical milestone reflecting sustained momentum. The stock’s 84.33% total return over the past 12 months and 165.16% over three years highlight strong long-term performance and renewed investor confidence, even as short-term pricing fluctuates. With the share price now at HK$8.3, recent pipeline progress and market approvals continue to support optimism around the company’s growth outlook.

If Grand Pharmaceutical’s pipeline progress has you watching the healthcare sector, now could be the perfect moment to discover See the full list for free.

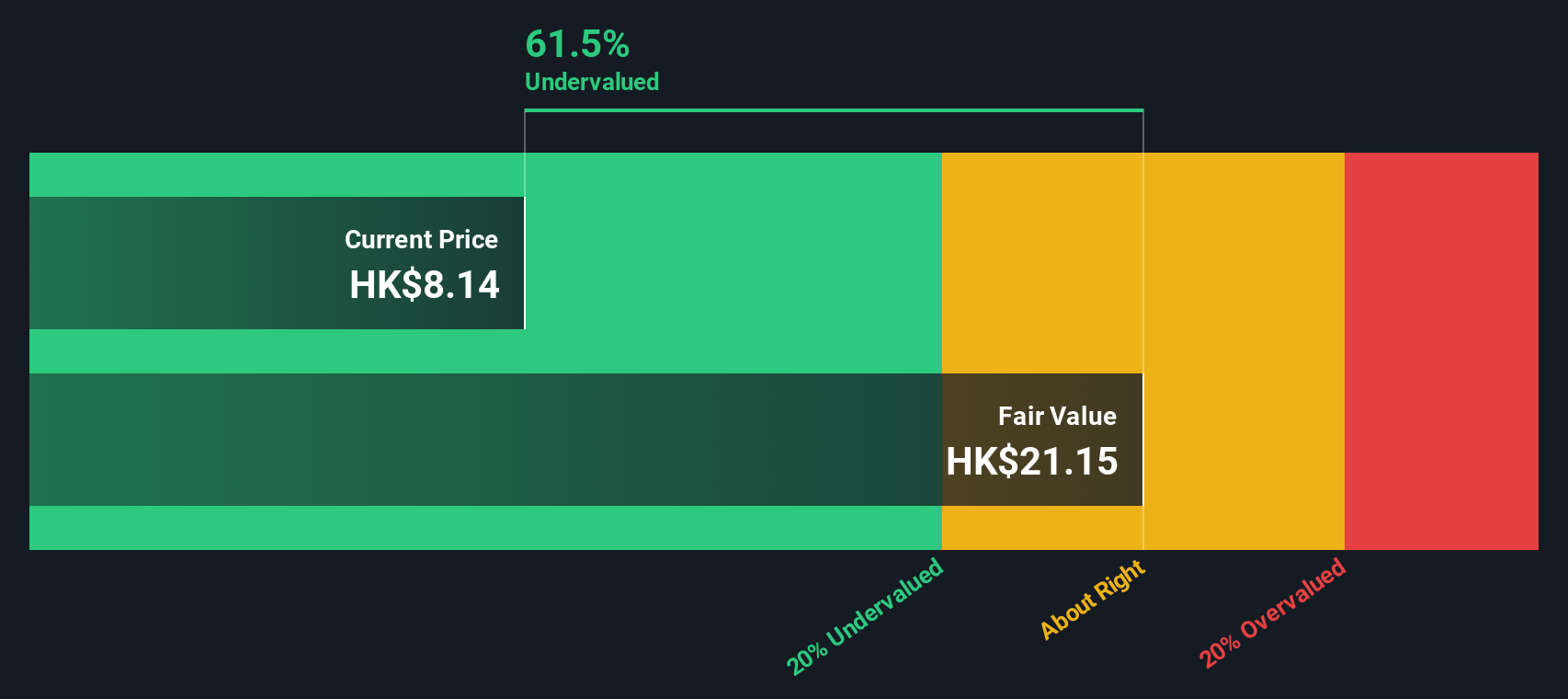

With shares still trading at a substantial discount to analyst targets despite this progress, investors may wonder if Grand Pharmaceutical Group remains undervalued or if the market has already priced in the company’s next wave of growth.

Price-to-Earnings of 14x: Is it justified?

Grand Pharmaceutical Group trades at a price-to-earnings (PE) ratio of 14x based on the last close price of HK$8.3, which stands out compared to both its sector and the company’s own growth profile.

The price-to-earnings multiple reflects how much investors are willing to pay today for each dollar of current earnings. In healthcare, this metric is often used as a gauge of how the market values projected future growth, strategic positioning, and underlying profitability.

Grand Pharmaceutical Group’s PE ratio of 14x represents a discount compared to its peer group average of 17.6x and is also well below the estimated fair price-to-earnings ratio for the stock, which sits at 22x. This gap signals that the market could be underestimating its potential. There may be room for sentiment to shift as the company works to deliver on its pipeline and profit growth ambitions.

Looking at industry benchmarks, Grand Pharmaceutical is slightly more expensive than the Hong Kong Pharmaceuticals industry average of 13.5x. However, the substantial margin below both peers and its own fair ratio presents a strong value opportunity should the company meet or exceed growth expectations.

Explore the SWS fair ratio for Grand Pharmaceutical Group

Result: Price-to-Earnings of 14x (UNDERVALUED)

However, slowing revenue growth or unexpected regulatory hurdles could affect the outlook and reduce the current optimism around Grand Pharmaceutical Group’s valuation.

Find out about the key risks to this Grand Pharmaceutical Group narrative.

Another View: What Does the DCF Model Say?

While the price-to-earnings ratio points to Grand Pharmaceutical Group being undervalued, our DCF model tells an even more dramatic story. According to DCF, the share price appears significantly below its intrinsic value, suggesting there could be a much larger potential upside. Does this raise investor expectations too high?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Grand Pharmaceutical Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Grand Pharmaceutical Group Narrative

If you see things differently or want to dive deeper into the numbers, you can craft your own analysis in just minutes. Do it your way

A great starting point for your Grand Pharmaceutical Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Your Next Investment Move?

Don’t wait for the crowd to act. Your next winning idea could be one click away with these hand-picked stock screens on Simply Wall St.

- Uncover growth stories early by searching through these 3588 penny stocks with strong financials, with the financial strength to capture tomorrow’s opportunities.

- Catch sector leaders paying out solid returns by reviewing these 17 dividend stocks with yields > 3%, and see which businesses are rewarding shareholders with high, reliable yields.

- Get ahead of the market by targeting value through these 873 undervalued stocks based on cash flows, priced attractively against future cash flows and fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:512

Grand Pharmaceutical Group

An investment holding company, engages in the research and development, manufacture, and sale of pharmaceutical preparations and medical devices, biotechnology and healthcare products, and pharmaceutical raw materials.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives