Roche Partnership Could Be a Game Changer for Hansoh Pharmaceutical Group (SEHK:3692)

Reviewed by Sasha Jovanovic

- Chinese biotech company Hansoh Pharmaceutical Group has entered a licensing agreement worth up to US$1.45 billion with Roche, granting Roche exclusive global rights to develop, manufacture, and commercialise an investigational treatment for colorectal cancer and other solid tumours.

- This collaboration gives Hansoh access to a major global pharmaceutical partner and spotlights the company's advancing drug pipeline in oncology.

- We’ll examine what this expansive partnership with Roche could mean for Hansoh Pharmaceutical’s long-term growth outlook and industry positioning.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Hansoh Pharmaceutical Group's Investment Narrative?

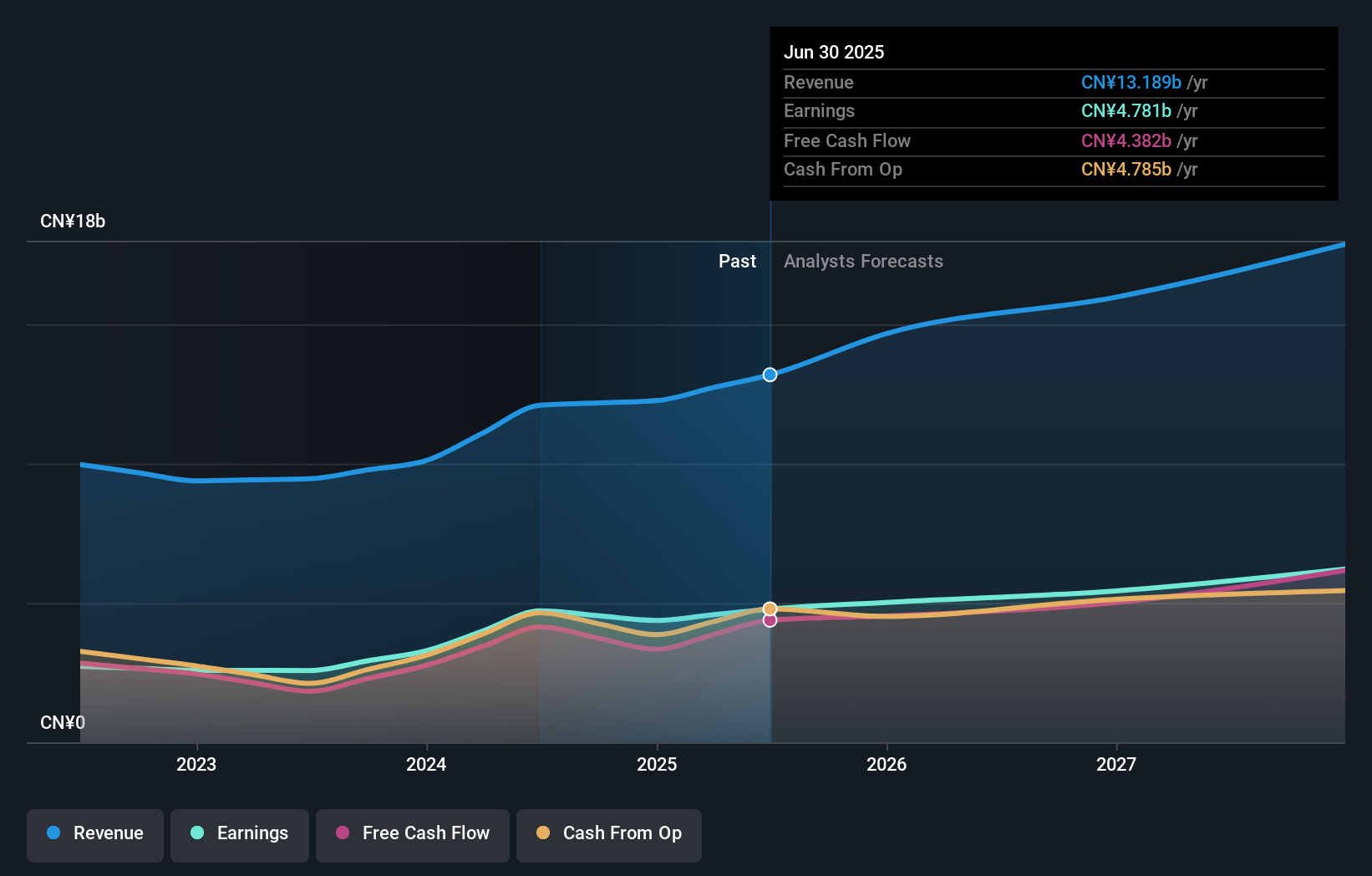

For Hansoh Pharmaceutical Group, the real big-picture belief centers on the company’s ability to convert a promising and expanding pipeline into sustainable success, especially in competitive global markets. The recent licensing deal with Roche, worth up to US$1.45 billion, is a tangible validation of Hansoh’s innovative momentum and ramps up near-term expectations. While the share price jump signals that investors see this partnership as a meaningful catalyst, it also shifts the focus from regulatory approvals and local market share gains toward execution risk and the ability to deliver results globally with Roche. Short-term, this deal could amplify revenue potential and introduce development milestones, but integration and outcome delivery now become crucial risks, especially given Hansoh’s already above-average valuation multiples. If the Roche agreement leads to earlier global commercialization, the profile and risk dynamics of Hansoh could shift materially from the analysis prior to the announcement.

But while the Roche deal excites, execution risks after such global agreements remain a key consideration for investors. Despite retreating, Hansoh Pharmaceutical Group's shares might still be trading 22% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 2 other fair value estimates on Hansoh Pharmaceutical Group - why the stock might be worth just HK$44.24!

Build Your Own Hansoh Pharmaceutical Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hansoh Pharmaceutical Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Hansoh Pharmaceutical Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hansoh Pharmaceutical Group's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hansoh Pharmaceutical Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3692

Hansoh Pharmaceutical Group

An investment holding company, engages in the research, development, production, and sale of pharmaceutical products in the People’s Republic of China.

Excellent balance sheet and fair value.

Market Insights

Community Narratives