Read This Before Selling Beijing Tong Ren Tang Chinese Medicine Company Limited (HKG:3613) Shares

We often see insiders buying up shares in companies that perform well over the long term. Unfortunately, there are also plenty of examples of share prices declining precipitously after insiders have sold shares. So we'll take a look at whether insiders have been buying or selling shares in Beijing Tong Ren Tang Chinese Medicine Company Limited (HKG:3613).

Do Insider Transactions Matter?

Most investors know that it is quite permissible for company leaders, such as directors of the board, to buy and sell stock in the company. However, rules govern insider transactions, and certain disclosures are required.

Insider transactions are not the most important thing when it comes to long-term investing. But logic dictates you should pay some attention to whether insiders are buying or selling shares. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

See our latest analysis for Beijing Tong Ren Tang Chinese Medicine

Beijing Tong Ren Tang Chinese Medicine Insider Transactions Over The Last Year

In the last twelve months, the biggest single purchase by an insider was when CEO & Executive Director Huan Ping Zhang bought HK$626k worth of shares at a price of HK$8.35 per share. So it's clear an insider wanted to buy, even at a higher price than the current share price (being HK$8.33). While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. To us, it's very important to consider the price insiders pay for shares. It is generally more encouraging if they paid above the current price, as it suggests they saw value, even at higher levels.

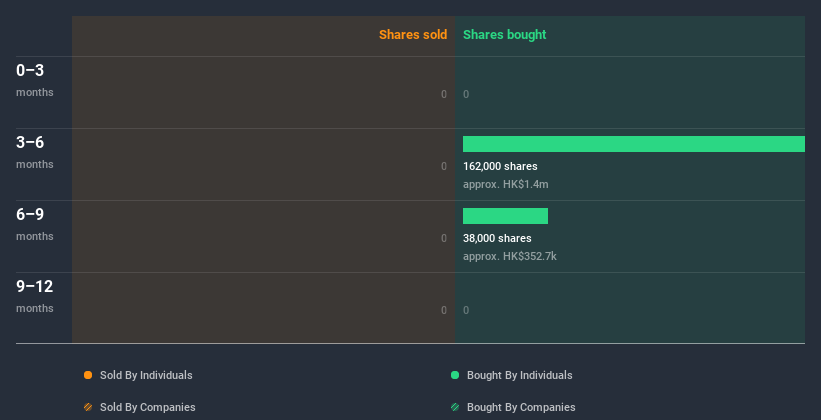

In the last twelve months Beijing Tong Ren Tang Chinese Medicine insiders were buying shares, but not selling. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Does Beijing Tong Ren Tang Chinese Medicine Boast High Insider Ownership?

Another way to test the alignment between the leaders of a company and other shareholders is to look at how many shares they own. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Our data isn't picking up on much insider ownership at Beijing Tong Ren Tang Chinese Medicine, though insiders do hold about HK$6.6m worth of shares. But they may have an indirect interest through a corporate structure that we haven't picked up on. It's always possible we are missing something but from our data, it looks like insider ownership is minimal.

So What Do The Beijing Tong Ren Tang Chinese Medicine Insider Transactions Indicate?

It doesn't really mean much that no insider has traded Beijing Tong Ren Tang Chinese Medicine shares in the last quarter. However, our analysis of transactions over the last year is heartening. While we have no worries about the insider transactions, we'd be more comfortable if they owned more Beijing Tong Ren Tang Chinese Medicine stock. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. While conducting our analysis, we found that Beijing Tong Ren Tang Chinese Medicine has 1 warning sign and it would be unwise to ignore it.

Of course Beijing Tong Ren Tang Chinese Medicine may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

When trading Beijing Tong Ren Tang Chinese Medicine or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Beijing Tong Ren Tang Chinese Medicine, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing Tong Ren Tang Chinese Medicine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:3613

Beijing Tong Ren Tang Chinese Medicine

Engages in the manufacture, retail, and wholesale of healthcare products and Chinese medicine to wholesalers and individuals.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives