Is Now The Time To Put Beijing Tong Ren Tang Chinese Medicine (HKG:3613) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Beijing Tong Ren Tang Chinese Medicine (HKG:3613), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Beijing Tong Ren Tang Chinese Medicine

How Fast Is Beijing Tong Ren Tang Chinese Medicine Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Over the last three years, Beijing Tong Ren Tang Chinese Medicine has grown EPS by 5.1% per year. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

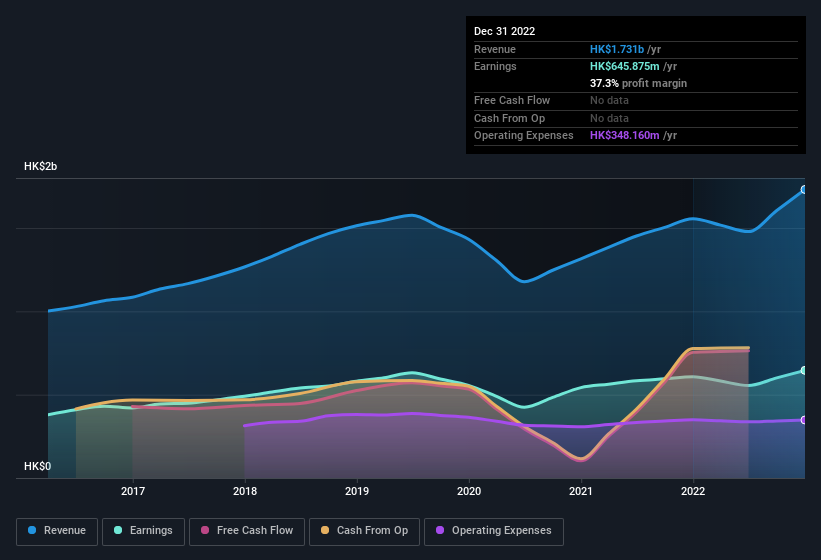

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. On the revenue front, Beijing Tong Ren Tang Chinese Medicine has done well over the past year, growing revenue by 11% to HK$1.7b but EBIT margin figures were less stellar, seeing a decline over the last 12 months. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Beijing Tong Ren Tang Chinese Medicine's future EPS 100% free.

Are Beijing Tong Ren Tang Chinese Medicine Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Not only did Beijing Tong Ren Tang Chinese Medicine insiders refrain from selling stock during the year, but they also spent HK$558k buying it. That's nice to see, because it suggests insiders are optimistic.

It's commendable to see that insiders have been buying shares in Beijing Tong Ren Tang Chinese Medicine, but there is more evidence of shareholder friendly management. Namely, Beijing Tong Ren Tang Chinese Medicine has a very reasonable level of CEO pay. The median total compensation for CEOs of companies similar in size to Beijing Tong Ren Tang Chinese Medicine, with market caps between HK$7.8b and HK$25b, is around HK$5.0m.

The Beijing Tong Ren Tang Chinese Medicine CEO received total compensation of just HK$1.1m in the year to December 2021. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Beijing Tong Ren Tang Chinese Medicine To Your Watchlist?

One important encouraging feature of Beijing Tong Ren Tang Chinese Medicine is that it is growing profits. And there's more to love too, with modest CEO remuneration and insider buying interest continuing the positives for the company. The sum of all that, points to a quality business, and a genuine prospect for further research. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Beijing Tong Ren Tang Chinese Medicine is trading on a high P/E or a low P/E, relative to its industry.

The good news is that Beijing Tong Ren Tang Chinese Medicine is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Tong Ren Tang Chinese Medicine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3613

Beijing Tong Ren Tang Chinese Medicine

Engages in the manufacture, retail, and wholesale of healthcare products and Chinese medicine to wholesalers and individuals.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives