EMA Backing for Sugemalimab Might Change the Case for Investing in CStone Pharmaceuticals (SEHK:2616)

Reviewed by Sasha Jovanovic

- Earlier this month, CStone Pharmaceuticals received a positive opinion from the European Medicines Agency's CHMP recommending approval of sugemalimab as a monotherapy for adults with unresectable stage III non-small cell lung cancer, following compelling Phase III data from the GEMSTONE-301 trial.

- This regulatory milestone further strengthens CStone’s clinical track record in oncology and highlights the company’s ability to advance immunotherapies addressing significant unmet needs in Europe.

- We’ll explore how this regulatory progress for sugemalimab shapes CStone’s investment narrative and global ambitions within the immuno-oncology space.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

What Is CStone Pharmaceuticals' Investment Narrative?

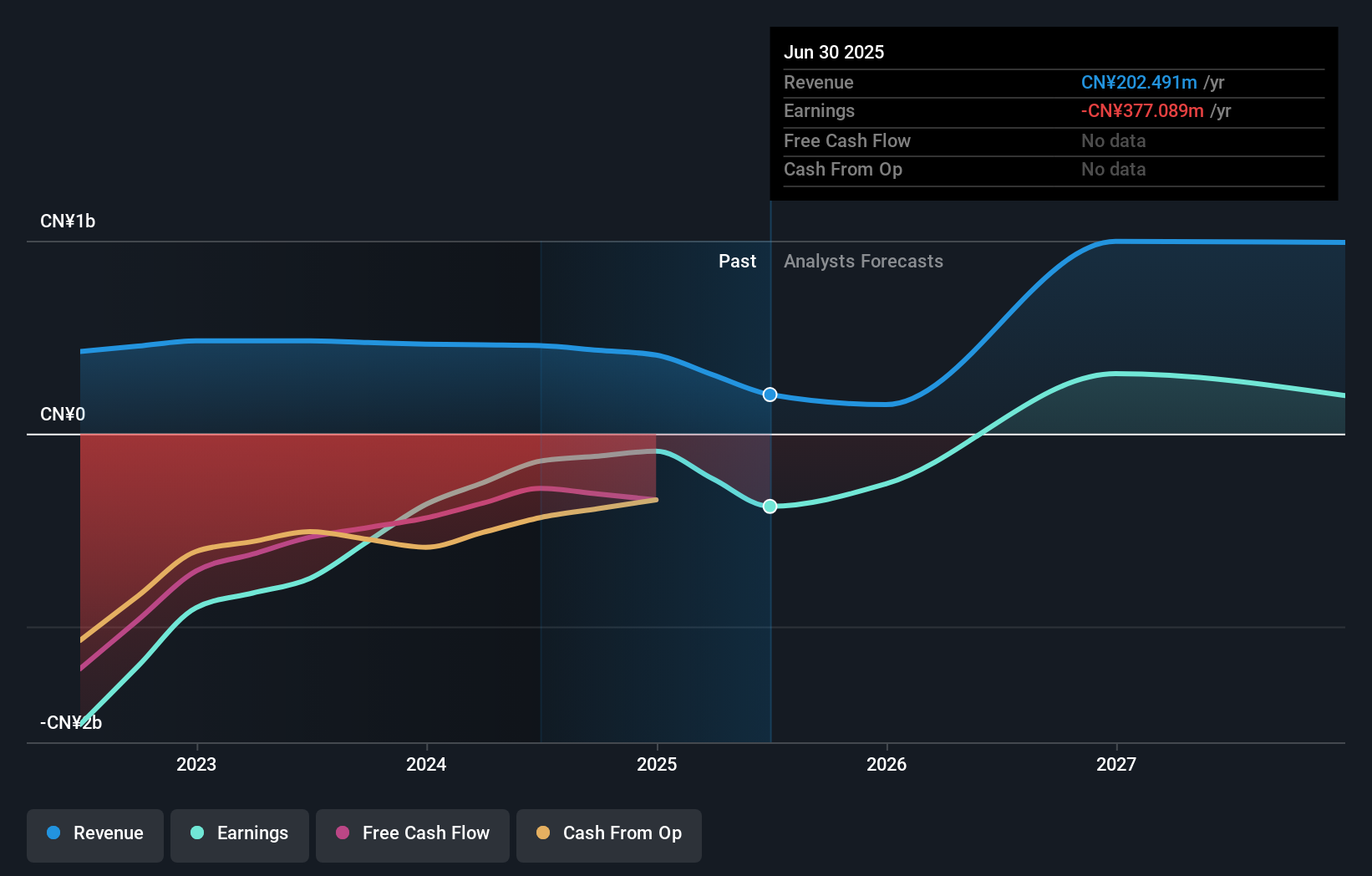

For anyone considering CStone Pharmaceuticals, the investment case hinges on the company’s ability to translate its innovation pipeline and recent clinical/regulatory milestones into sustainable commercial success. The positive opinion from the European Medicines Agency’s CHMP for sugemalimab in unresectable stage III NSCLC is both a validation of CStone’s science and a potential catalyst for strengthening its European footprint. This development may help balance ongoing revenue challenges and high net losses, as sugemalimab is increasingly positioned at the core of the company’s global oncology ambitions. At the same time, preliminary Phase I data for CS2009 shows early pipeline momentum but remains at an initial stage, meaning any revenue impact is still speculative. Despite these breakthroughs, short-term risks remain concentrated around financial sustainability, commercial execution in new markets, and the company’s high valuation relative to sales and profit expectations.

But rising approval prospects are set against persistent financial losses, an important point investors should be aware of.

Exploring Other Perspectives

Explore another fair value estimate on CStone Pharmaceuticals - why the stock might be worth as much as 6% more than the current price!

Build Your Own CStone Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CStone Pharmaceuticals research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free CStone Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CStone Pharmaceuticals' overall financial health at a glance.

No Opportunity In CStone Pharmaceuticals?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2616

CStone Pharmaceuticals

A biopharmaceutical company, researches and develops anti-cancer therapies to address the unmet medical needs of cancer patients in Mainland China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives