CStone Pharmaceuticals (SEHK:2616) Valuation Spotlight After Key Pipeline Advances and IND Milestone

Reviewed by Simply Wall St

CStone Pharmaceuticals (SEHK:2616) is in focus after two important pipeline updates landed this week. The company will showcase preclinical data for its CS2015 antibody at ACAAI 2025. In addition, CS2009 has cleared an IND milestone in China.

See our latest analysis for CStone Pharmaceuticals.

CStone’s share price has surged 148% year-to-date and delivered an exceptional 227% total shareholder return over the past year. This performance has been fueled in recent days by promising advances in both its oncology and autoimmune pipelines. Momentum has swung sharply back into the positive following the announcement of a major clinical milestone and a forthcoming international conference presentation.

Looking for more opportunities in healthcare? Now is an ideal time to explore innovation leaders through our discovery of See the full list for free.

With CStone’s rapid gains driven by anticipation of its clinical milestones, the question for investors now is whether the current price still undervalues future potential, or if recent success is already factored in by the market.

Price-to-Sales of 40.4x: Is it justified?

CStone Pharmaceuticals currently trades at a steep price-to-sales ratio of 40.4x, noticeably higher than both its peers and the sector norm, despite its recent gains to HK$6.08 per share.

The price-to-sales ratio gives investors an idea of how much they are paying for each dollar of revenue. For biotechs like CStone, which are often in high-growth phases but not yet consistently profitable, this multiple is a widely watched benchmark because earnings-based ratios may not be meaningful.

However, at 40.4x, CStone’s price-to-sales is significantly higher than the Hong Kong Biotechs industry average of 14x as well as the peer group average of 17.6x. Furthermore, the fair value price-to-sales ratio, based on a regression analysis considering fundamentals, is just 3.5x. This suggests that the market is pricing in very bullish expectations that may need to be reassessed if growth targets are not met.

Explore the SWS fair ratio for CStone Pharmaceuticals

Result: Price-to-Sales of 40.4x (OVERVALUED)

However, setbacks in clinical trial progress or slower than expected revenue growth may quickly dampen investor enthusiasm and challenge current valuations.

Find out about the key risks to this CStone Pharmaceuticals narrative.

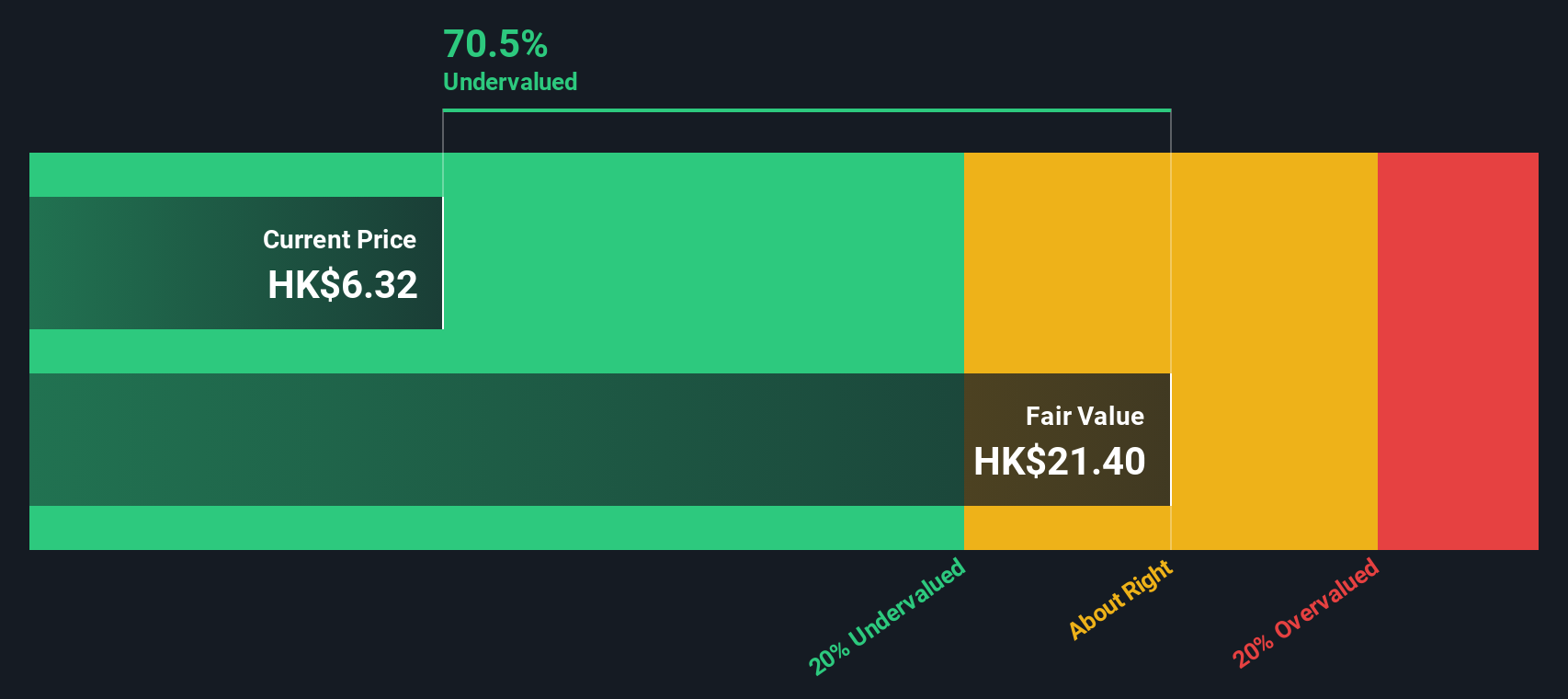

Another View: SWS DCF Model Signals Deep Value

While the current price-to-sales ratio looks high, our DCF model paints a strikingly different picture. According to this method, CStone Pharmaceuticals is trading 71.9% below its estimated fair value of HK$21.61. This suggests it could be significantly undervalued. When fundamentally-derived estimates differ so much from multiples, which outlook will markets believe?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CStone Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 897 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CStone Pharmaceuticals Narrative

If you want to dig deeper, challenge these results, or simply follow your own process, you can piece together your personal story in a few minutes, Do it your way.

A great starting point for your CStone Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Want Even More Investment Ideas?

Don't let your next big winner slip away. Take your portfolio further by finding unique growth opportunities, hidden undervalued gems, and innovative themes with our powerful screener tools.

- Boost your search for overlooked value by spotting gems among these 897 undervalued stocks based on cash flows whose cash flows hint at untapped potential.

- Capitalize on the AI revolution by targeting emerging market leaders with these 25 AI penny stocks before everyone else gets on board.

- Lock in regular income and stability through high-yield choices with these 16 dividend stocks with yields > 3% for your long-term strategy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2616

CStone Pharmaceuticals

A biopharmaceutical company, researches and develops anti-cancer therapies to address the unmet medical needs of cancer patients in Mainland China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives