CStone Pharmaceuticals (SEHK:2616): Valuation in Focus After Landmark CHMP Nod and Pipeline Breakthroughs

Reviewed by Simply Wall St

CStone Pharmaceuticals (SEHK:2616) is gaining attention after two key developments: a positive opinion from Europe’s drug regulator for sugemalimab in lung cancer, and fresh data on its early-stage immunotherapy candidates. Investors are watching closely.

See our latest analysis for CStone Pharmaceuticals.

The recent surge in CStone Pharmaceuticals’ share price, up nearly 158% year-to-date, reflects growing investor confidence on the back of regulatory wins and progress with its immunotherapy pipeline. Although shares have been volatile in the past month, with a 19% dip, long-term total shareholder returns have soared 202% over the past year, fueled by hopes for future growth from key drug candidates and approvals.

If these biotech breakthroughs have piqued your interest, it might be the perfect moment to explore other healthcare stocks showing breakthrough potential with the See the full list for free.

But with the share price rallying and major news in the rear-view mirror, is CStone Pharmaceuticals still undervalued, or is investor optimism already reflected in today’s price, leaving little room for upside?

Price-to-Sales Ratio of 42.1x: Is it justified?

CStone Pharmaceuticals is commanding a sky-high price-to-sales multiple of 42.1x at a last close of HK$6.32, making it much more expensive than local biotech peers.

The price-to-sales ratio compares a company’s market capitalization to its total sales. This provides investors with a quick way to assess how much they are paying for each dollar of revenue. For early-stage or unprofitable biotech firms like CStone Pharmaceuticals, this metric is widely used since earnings numbers are often negative or volatile.

At 42.1x, the stock’s valuation is not only well above the Hong Kong Biotechs industry average of 15.1x but also far exceeds the estimated fair price-to-sales ratio of 4x. This suggests that the market has incorporated very high expectations for future sales growth or landmark drug approvals. If the market begins to see slower progress, the valuation multiple could contract closer to the fair level.

Explore the SWS fair ratio for CStone Pharmaceuticals

Result: Price-to-Sales of 42.1x (OVERVALUED)

However, rapid share price gains could reverse if clinical trial setbacks occur or if sales growth is slower than expected, which could shift investor sentiment quickly.

Find out about the key risks to this CStone Pharmaceuticals narrative.

Another View: Does the SWS DCF Model Agree?

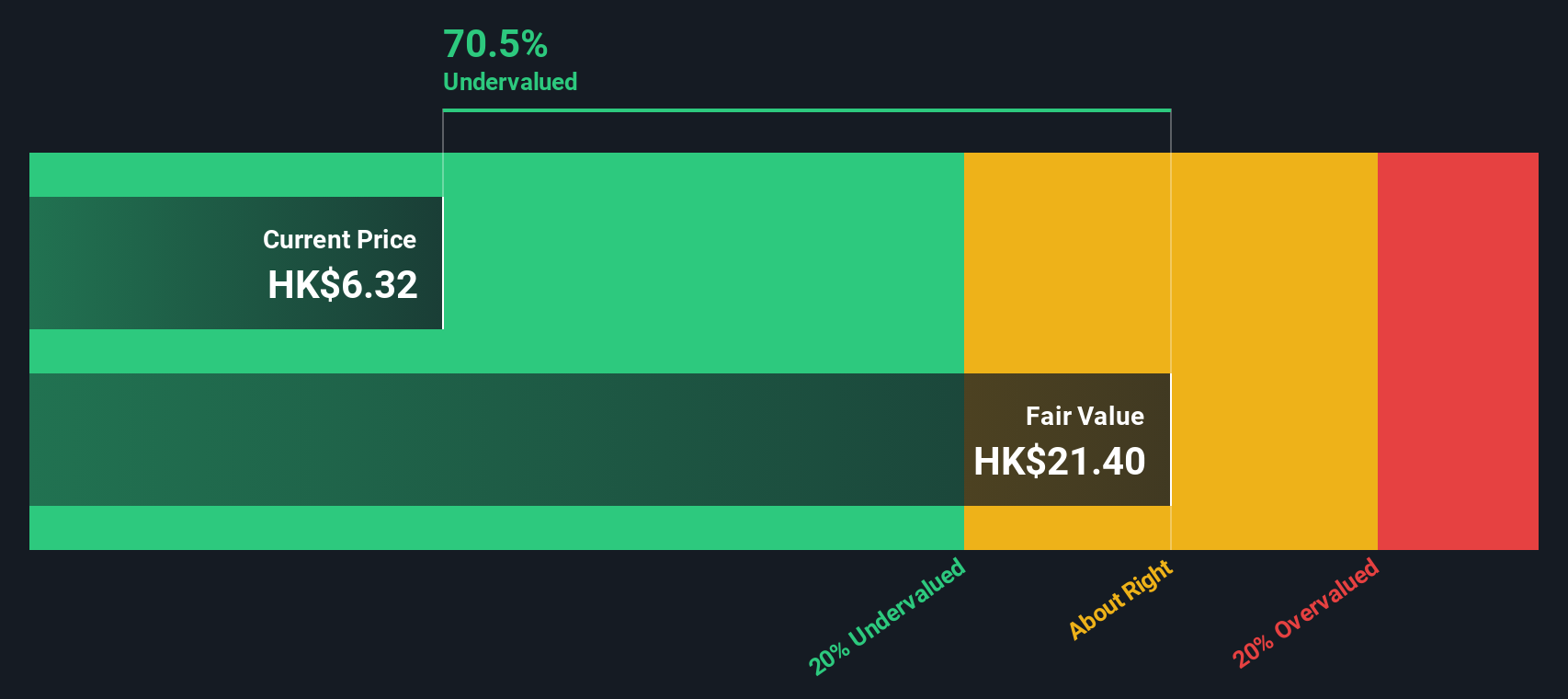

While the price-to-sales ratio suggests CStone Pharmaceuticals is expensive, our DCF model paints a very different picture. According to this method, shares are trading around 70% below fair value, hinting that the market may be overly cautious or perhaps missing something entirely.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CStone Pharmaceuticals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CStone Pharmaceuticals Narrative

If you want to dig deeper or have your own perspective on CStone Pharmaceuticals, try building your own view in just a few minutes. Do it your way

A great starting point for your CStone Pharmaceuticals research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make sure you never miss a hidden opportunity. The best time to broaden your investing toolkit is now, before the next winning trend passes you by.

- Tap into explosive growth by checking out these 27 AI penny stocks, which are poised to transform the future with real-world applications and smart innovation.

- Get ahead of inflation and secure passive income with these 17 dividend stocks with yields > 3%, which consistently delivers attractive yields above 3%.

- Catch rising stars early by reviewing these 3559 penny stocks with strong financials, which boast strong financials and high potential for rapid gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2616

CStone Pharmaceuticals

A biopharmaceutical company, researches and develops anti-cancer therapies to address the unmet medical needs of cancer patients in Mainland China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives