- Hong Kong

- /

- Life Sciences

- /

- SEHK:2268

WuXi XDC Cayman Inc. (HKG:2268) Looks Just Right With A 27% Price Jump

WuXi XDC Cayman Inc. (HKG:2268) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

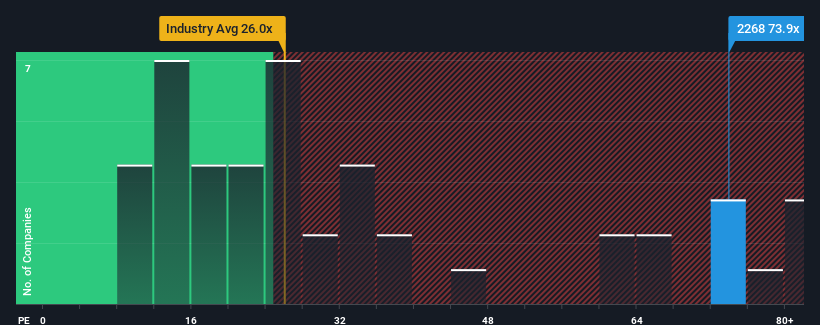

Since its price has surged higher, WuXi XDC Cayman may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 73.9x, since almost half of all companies in Hong Kong have P/E ratios under 8x and even P/E's lower than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times have been advantageous for WuXi XDC Cayman as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for WuXi XDC Cayman

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, WuXi XDC Cayman would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 57% last year. The strong recent performance means it was also able to grow EPS by 440% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 59% per year over the next three years. That's shaping up to be materially higher than the 15% each year growth forecast for the broader market.

With this information, we can see why WuXi XDC Cayman is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On WuXi XDC Cayman's P/E

WuXi XDC Cayman's P/E is flying high just like its stock has during the last month. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of WuXi XDC Cayman's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 1 warning sign for WuXi XDC Cayman that we have uncovered.

Of course, you might also be able to find a better stock than WuXi XDC Cayman. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if WuXi XDC Cayman might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2268

WuXi XDC Cayman

An investment holding company, operates as a contract research, development, and manufacturing organization in China, North America, Europe, and internationally.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives