Stock Analysis

Investors five-year losses continue as Luye Pharma Group (HKG:2186) dips a further 4.5% this week, earnings continue to decline

We think intelligent long term investing is the way to go. But along the way some stocks are going to perform badly. Zooming in on an example, the Luye Pharma Group Ltd. (HKG:2186) share price dropped 55% in the last half decade. We certainly feel for shareholders who bought near the top. And we doubt long term believers are the only worried holders, since the stock price has declined 24% over the last twelve months.

If the past week is anything to go by, investor sentiment for Luye Pharma Group isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Luye Pharma Group

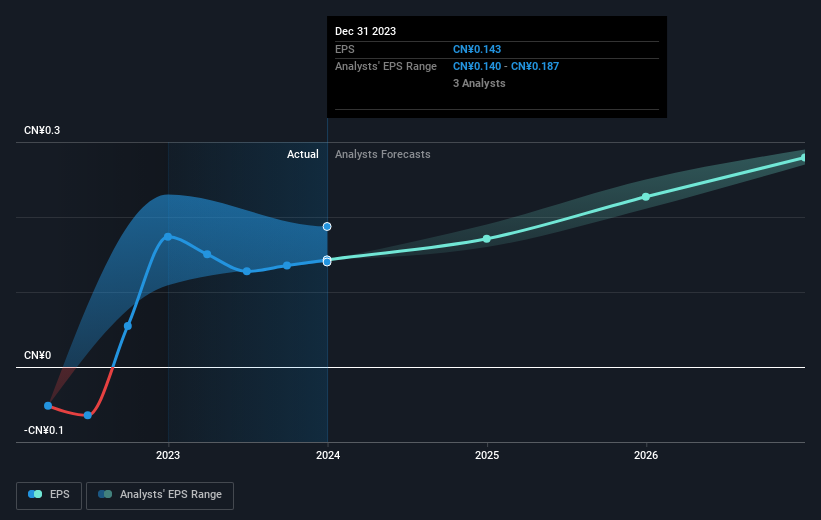

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Looking back five years, both Luye Pharma Group's share price and EPS declined; the latter at a rate of 19% per year. The share price decline of 15% per year isn't as bad as the EPS decline. So the market may previously have expected a drop, or else it expects the situation will improve.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Luye Pharma Group's key metrics by checking this interactive graph of Luye Pharma Group's earnings, revenue and cash flow.

A Different Perspective

Investors in Luye Pharma Group had a tough year, with a total loss of 24%, against a market gain of about 1.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before forming an opinion on Luye Pharma Group you might want to consider these 3 valuation metrics.

We will like Luye Pharma Group better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2186

Luye Pharma Group

An investment holding company, develops, produces, markets, and sells pharmaceutical products worldwide.

Reasonable growth potential with adequate balance sheet.