There's Reason For Concern Over Keymed Biosciences Inc.'s (HKG:2162) Massive 28% Price Jump

Despite an already strong run, Keymed Biosciences Inc. (HKG:2162) shares have been powering on, with a gain of 28% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 32% in the last twelve months.

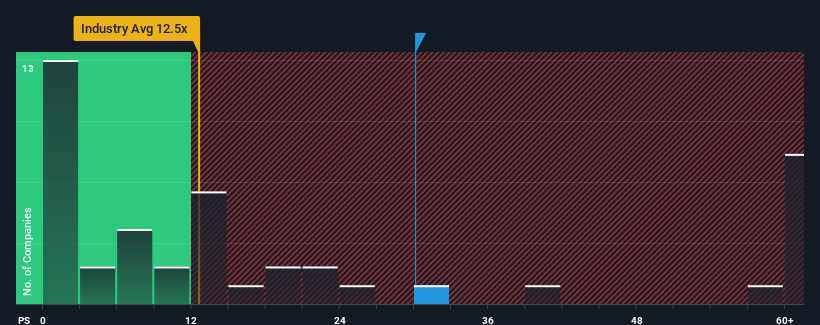

Following the firm bounce in price, Keymed Biosciences may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 30.1x, since almost half of all companies in the Biotechs industry in Hong Kong have P/S ratios under 12.5x and even P/S lower than 2x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Keymed Biosciences

What Does Keymed Biosciences' Recent Performance Look Like?

Recent times have been advantageous for Keymed Biosciences as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Keymed Biosciences' future stacks up against the industry? In that case, our free report is a great place to start.How Is Keymed Biosciences' Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Keymed Biosciences' to be considered reasonable.

Retrospectively, the last year delivered an explosive gain to the company's top line. In spite of this unbelievable short-term growth, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 51% per annum as estimated by the ten analysts watching the company. With the industry predicted to deliver 56% growth each year, the company is positioned for a comparable revenue result.

With this information, we find it interesting that Keymed Biosciences is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Bottom Line On Keymed Biosciences' P/S

Shares in Keymed Biosciences have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given Keymed Biosciences' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 2 warning signs for Keymed Biosciences (1 is significant!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Keymed Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2162

Keymed Biosciences

A biotechnology company, engages in the research and development of biological therapies for the treatment of autoimmunity and oncology diseases.

Excellent balance sheet and fair value.

Market Insights

Community Narratives