Amid recent market fluctuations, driven by tariff uncertainties and mixed economic data, investors are seeking opportunities in various corners of the market. Penny stocks, a term that may seem outdated but remains relevant, represent smaller or less-established companies that can offer significant value. By focusing on those with robust financials and potential for growth, investors can uncover promising opportunities within this niche segment.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.87 | HK$44.43B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.545 | MYR2.71B | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.705 | MYR417.12M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.405 | MYR1.13B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.53M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| Warpaint London (AIM:W7L) | £4.00 | £309.02M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.14 | HK$723.66M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.26 | £161.95M | ★★★★★☆ |

Click here to see the full list of 5,699 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Brii Biosciences (SEHK:2137)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Brii Biosciences Limited focuses on developing therapies for infectious and central nervous system diseases in China and the United States, with a market cap of HK$872.45 million.

Operations: The company generated CN¥38.38 million in revenue from its biotechnology startups segment.

Market Cap: HK$872.45M

Brii Biosciences Limited, with a market cap of HK$872.45 million, is currently unprofitable and pre-revenue, generating CN¥38.38 million from its biotechnology startups segment. The company is debt-free and has sufficient cash runway for over three years based on current free cash flow levels. Notable recent developments include the commencement of a share buyback program authorized to repurchase up to 10% of its issued share capital, potentially enhancing net asset value and earnings per share. Additionally, promising preliminary results from its Phase 2 ENSURE study were presented at a major liver disease conference in San Diego.

- Unlock comprehensive insights into our analysis of Brii Biosciences stock in this financial health report.

- Evaluate Brii Biosciences' prospects by accessing our earnings growth report.

Gohigh NetworksLtd (SZSE:000851)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gohigh Networks Co., Ltd. operates in China, focusing on digital intelligence applications, information services, and IT sales, with a market capitalization of CN¥3.39 billion.

Operations: The company generates revenue of CN¥3.38 billion from its operations within China.

Market Cap: CN¥3.39B

Gohigh Networks Co., Ltd. operates with a market cap of CN¥3.39 billion, generating revenue of CN¥3.38 billion from its digital intelligence and IT services in China. Despite its unprofitability and negative return on equity (-52.05%), the company maintains a satisfactory net debt to equity ratio of 33.4%. Short-term assets (CN¥3.8B) exceed both short-term (CN¥2.7B) and long-term liabilities (CN¥304.9M), indicating solid liquidity management, yet it faces less than one year of cash runway based on current free cash flow levels, which could pose challenges if profitability remains elusive without strategic adjustments or improved cash flow management.

- Click here to discover the nuances of Gohigh NetworksLtd with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Gohigh NetworksLtd's track record.

Tiansheng Pharmaceutical Group (SZSE:002872)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tiansheng Pharmaceutical Group Co., Ltd. is involved in pharmaceutical manufacturing and distribution, with a market cap of CN¥1.23 billion.

Operations: The company's revenue segment includes CN¥575.30 million from its operations in China.

Market Cap: CN¥1.23B

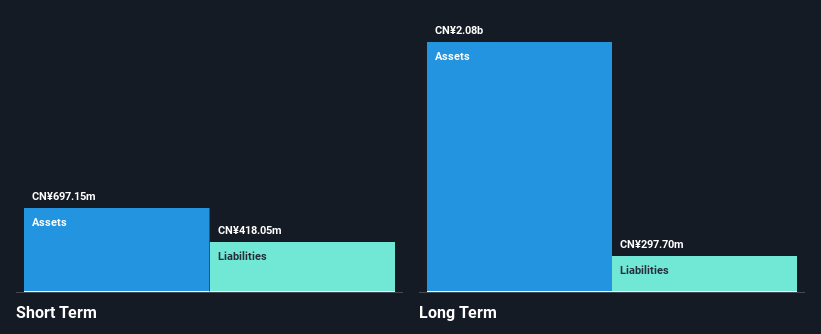

Tiansheng Pharmaceutical Group, with a market cap of CN¥1.23 billion, shows financial resilience despite being unprofitable. The company has reduced its debt to equity ratio over five years from 21.3% to 19.1%, maintaining a satisfactory net debt to equity ratio of 7.3%. Its short-term assets (CN¥697.2M) surpass both short-term (CN¥418M) and long-term liabilities (CN¥297.7M), ensuring liquidity coverage. Although earnings growth comparisons are challenging due to its unprofitability, Tiansheng has consistently reduced losses by 31.5% annually over the past five years and possesses a cash runway exceeding three years based on current free cash flow trends.

- Jump into the full analysis health report here for a deeper understanding of Tiansheng Pharmaceutical Group.

- Explore historical data to track Tiansheng Pharmaceutical Group's performance over time in our past results report.

Key Takeaways

- Embark on your investment journey to our 5,699 Penny Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tiansheng Pharmaceutical Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002872

Tiansheng Pharmaceutical Group

Engages in the pharmaceutical manufacturing and circulation activities.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives