Evaluating Simcere Pharmaceutical Group (SEHK:2096) Valuation After First U.S. Patient Dosed in Oncology Trial

Reviewed by Kshitija Bhandaru

Simcere Pharmaceutical Group (SEHK:2096) has advanced its oncology program with the first U.S. patient dosed in the Phase 1 trial of SIM0505 for advanced solid tumors. This development expands the clinical reach beyond China and draws investor attention to ongoing trial progress.

See our latest analysis for Simcere Pharmaceutical Group.

Simcere’s recent momentum is hard to miss, with the stock’s 91.5% year-to-date share price return fueled by progress in its expanding oncology pipeline. Investors responded positively to the first U.S. Phase 1 dosing, and the 1-year total shareholder return now stands at 103%. This puts Simcere ahead of many sector peers and suggests that long-term optimism is building.

If you’re watching for other innovative healthcare names making significant strides, you can uncover new opportunities with our See the full list for free.

With Simcere’s strong run and clinical milestones driving enthusiasm, investors may be wondering whether its current valuation still leaves room for upside or if the market has already factored in the company’s future growth trajectory.

Price-to-Earnings of 35.4x: Is it justified?

Simcere Pharmaceutical Group is trading on a price-to-earnings (P/E) ratio of 35.4x, making its shares considerably more expensive than the Hong Kong pharmaceuticals industry average and peer group. The stock's recent boom has pushed this metric well above typical sector levels.

The price-to-earnings ratio reflects how much investors are willing to pay for each unit of profit that the company generates. In fast-growing sectors like pharmaceuticals, higher P/E ratios can indicate strong expectations for future earnings growth, but they may also signal that shares are priced for perfection. In Simcere's case, the elevated P/E shows that the market is optimistic about its growth prospects after achieving profitability. However, it also places the company under pressure to deliver on those high hopes.

Compared to the industry average P/E of 13x and peer average of 12.2x, Simcere's P/E stands out as especially high. The fair price-to-earnings ratio, estimated at 27.9x, suggests the current premium could stretch beyond what is justified by fundamentals. If the market adjusts its expectations, there may be movement towards this fair level.

Explore the SWS fair ratio for Simcere Pharmaceutical Group

Result: Price-to-Earnings of 35.4x (OVERVALUED)

However, slowing revenue growth or any setback in clinical trials could quickly dampen investor enthusiasm and change the current growth narrative.

Find out about the key risks to this Simcere Pharmaceutical Group narrative.

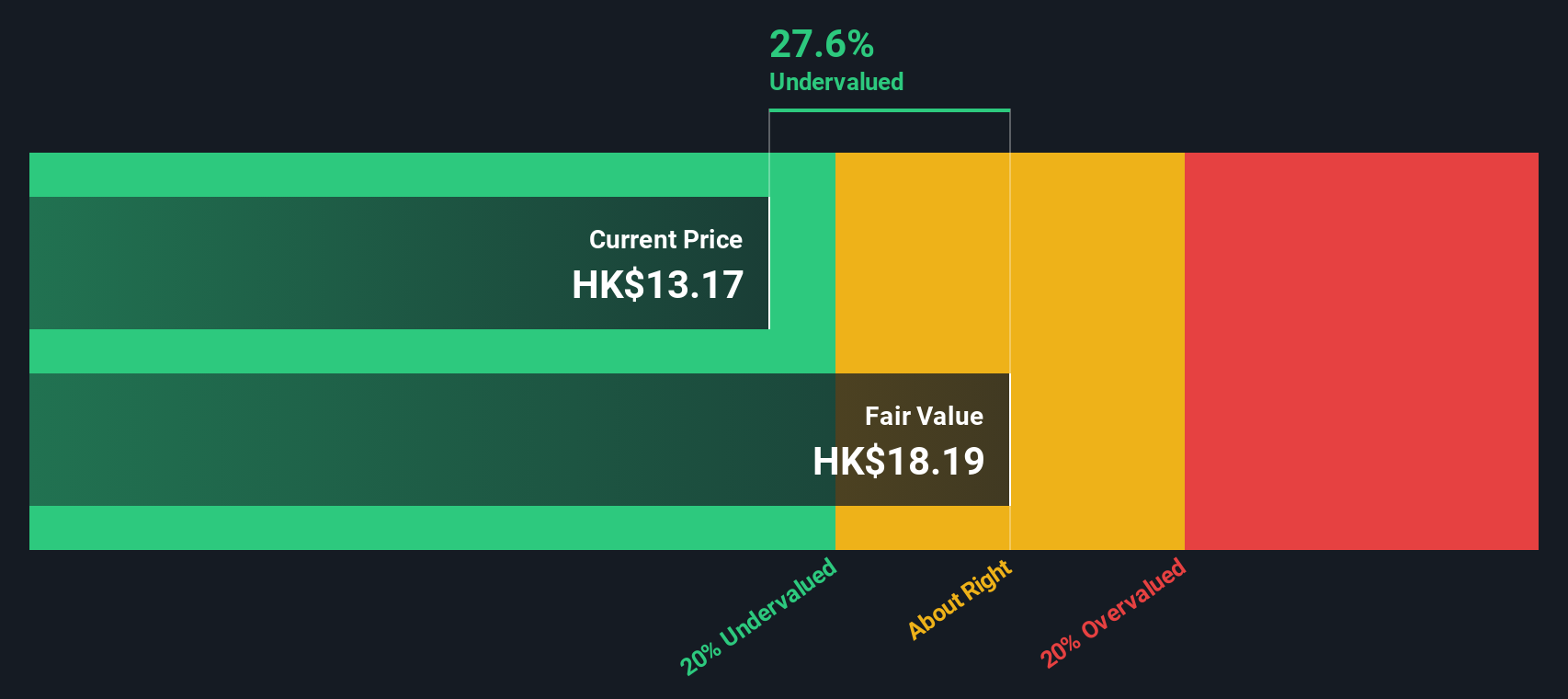

Another View: Discounted Cash Flow Implies Undervaluation

Beyond earnings multiples, the SWS DCF model suggests a different conclusion. It places Simcere’s fair value much higher, at HK$18.18 per share, compared to the current price of HK$13.1. This points to the shares trading at a 27.9% discount, hinting at possible upside. However, can this model’s long-term assumptions stand up against the heightened expectations reflected in today’s market price?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Simcere Pharmaceutical Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Simcere Pharmaceutical Group Narrative

If you have your own perspective or want to see the data from a different angle, why not shape your own investment story in just a few minutes? Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Simcere Pharmaceutical Group.

Looking for more investment ideas?

Don’t let opportunities slip past you. Seize your edge by searching for unique stocks that fit your strategy with the Simply Wall Street Screener.

- Pounce on high-yield potential by examining these 18 dividend stocks with yields > 3% offering yields above 3% for income-focused portfolios.

- Tap into the growth of artificial intelligence by checking out these 24 AI penny stocks poised to benefit from cutting-edge innovation and rapid sector expansion.

- Catch the crypto wave early by scanning these 79 cryptocurrency and blockchain stocks that stand to profit from the blockchain and digital finance revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2096

Simcere Pharmaceutical Group

An investment holding company, engages in the research, development, manufacture, and sale of pharmaceutical products to distributors, pharmacy chains, and other pharmaceutical manufacturers in China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives