Is NMPA’s Wave Of Drug Approvals Altering The Investment Case For SSY Group (SEHK:2005)?

Reviewed by Sasha Jovanovic

- In late November 2025, SSY Group reported a series of approvals from China’s National Medical Products Administration for new and existing drugs, including treatments for overactive bladder, respiratory diseases, liver-related cholestasis and vitamin A supplementation.

- These clustered approvals, many classified as passing China’s consistency evaluation, underline SSY Group’s push to broaden its portfolio of higher-quality, regulated pharmaceutical products in its home market.

- We’ll examine how this wave of NMPA-approved therapies, particularly in respiratory and urological care, may influence SSY Group’s broader investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is SSY Group's Investment Narrative?

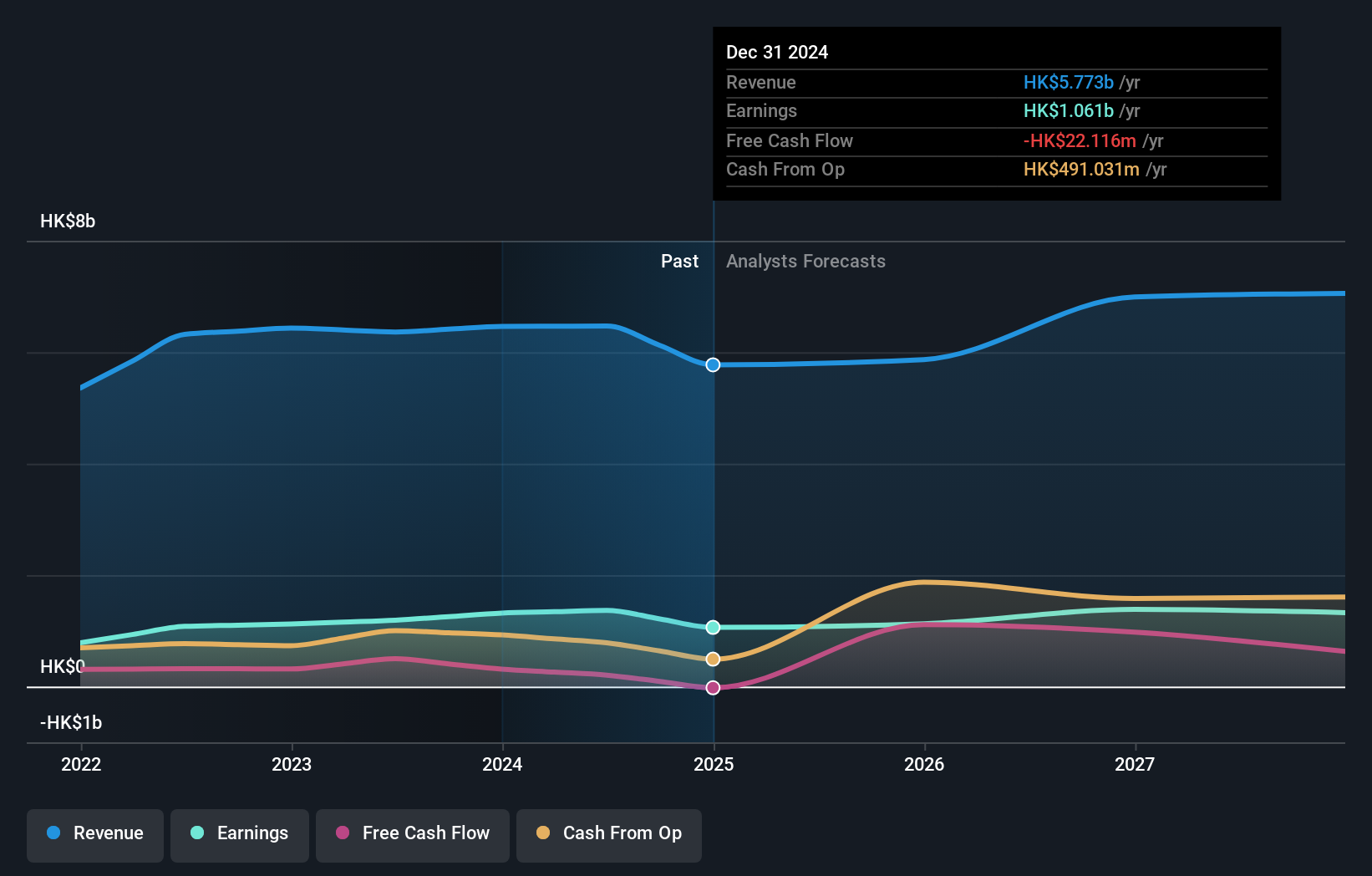

For SSY Group, you really have to believe in a recovery story built on execution rather than hype. The share price has lagged the Hong Kong pharma sector and margins have compressed, while dividends have just been trimmed and CEO pay has risen even as earnings fell, so near term sentiment is fragile. Against that backdrop, the November NMPA approvals for respiratory, cardiovascular, liver and urological drugs show the existing R&D and regulatory pipeline is still converting into marketable products, which could reinforce the current earnings growth forecasts if commercialization goes smoothly. In the short term, though, these wins probably do little to offset the more pressing catalysts and risks: weaker recent results, dividend cover concerns and questions around capital allocation and governance.

However, investors should also factor in the governance and dividend coverage concerns that now stand out. SSY Group's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on SSY Group - why the stock might be worth over 2x more than the current price!

Build Your Own SSY Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SSY Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free SSY Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SSY Group's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2005

SSY Group

An investment holding company, researches, develops, manufactures, trades in, and sells various pharmaceutical products to hospitals and distributors in the People’s Republic of China and internationally.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026