Everest Medicines (SEHK:1952) Valuation Spotlight as Leadership Transition Signals Strategic Shift

Reviewed by Simply Wall St

Everest Medicines (SEHK:1952) is set for a transition at the top, as Wei Fu steps down as chairman to focus on other commitments. Yifang Wu, a seasoned veteran from Fosun Pharma, will take the helm starting October 10, 2025.

See our latest analysis for Everest Medicines.

Investors seem to be weighing Everest Medicines’ leadership shake-up against its strong recent momentum, with the share price up 4% in the past day and 7% year-to-date. Despite short-term volatility, the company's one-year total shareholder return of over 75% stands out and suggests that market confidence in its long-term prospects remains robust.

If this leadership transition has piqued your interest, it could be a smart time to see what other healthcare innovators are making moves. See the full list for free.

With shares still trading at almost a 22% discount to analyst targets and a substantial 49% below estimated intrinsic value, the question remains: Is Everest Medicines truly undervalued, or is the market already factoring in future growth potential?

Most Popular Narrative: 17.8% Undervalued

Compared to its last close, the current most popular narrative sees Everest Medicines as trading well below fair value, even as consensus still weighs future growth ambitions against present-day risks. For investors following analyst perspectives, the stock’s discount to this estimate creates an attention-grabbing stage.

Diversified late-stage pipeline and strategic partnerships position the company for sustained innovation, financial flexibility, and long-term earnings growth. Heavy reliance on a single product, regulatory and pricing risks, ambitious but costly pipeline, and uncertain global expansion all threaten profitability, cash flow, and revenue diversification.

Curious what kind of revenue surge could lead to such a lofty valuation? The real driver here is a bold leap in profit margins and earnings power. Get the details behind these bullish assumptions, and see what numbers might surprise you, in the full breakdown.

Result: Fair Value of $64.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained losses and heavy dependence on NEFECON mean that earnings could disappoint if regulatory hurdles or pricing pressures intensify in key markets.

Find out about the key risks to this Everest Medicines narrative.

Another View: Multiples Paint a Different Picture

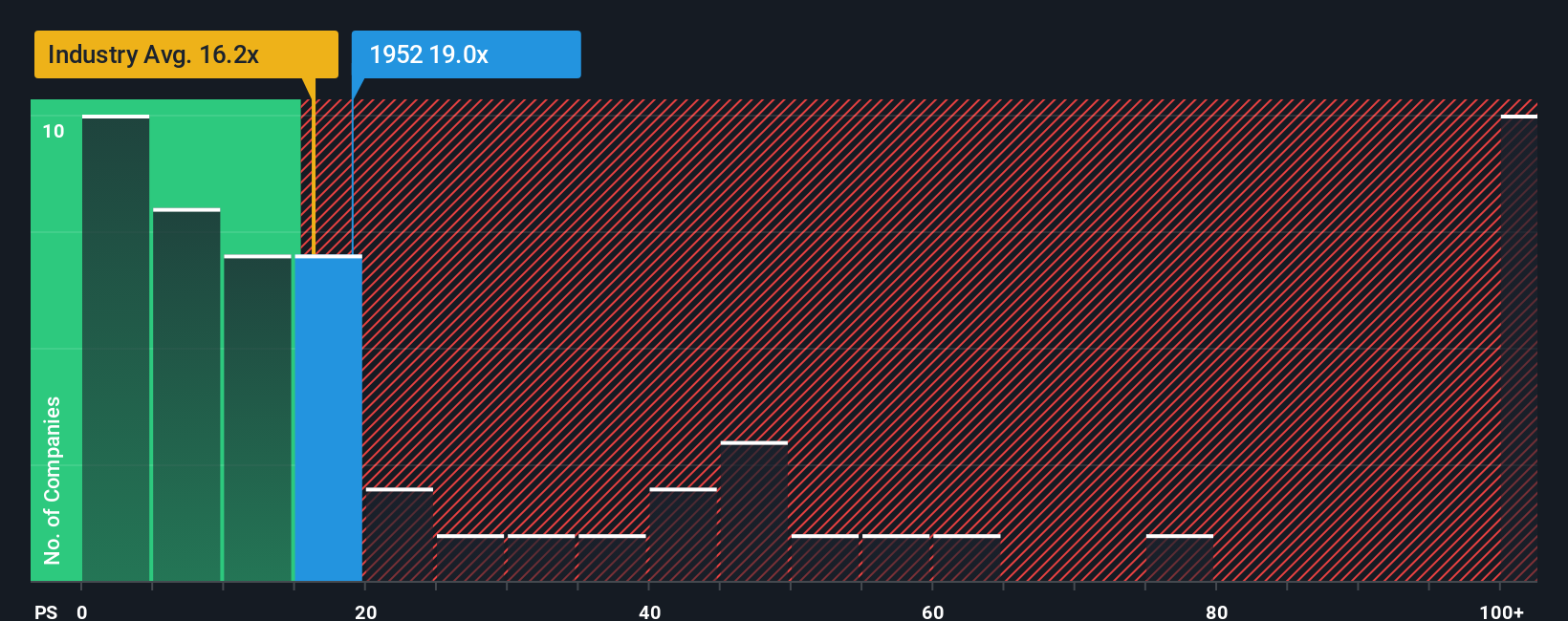

While the popular narrative spotlights Everest Medicines as undervalued, a look at its price-to-sales ratio tells another story. The company trades at 20.2 times sales, which is more expensive than both the Hong Kong Biotechs industry average of 16.6 times and the peer average. Notably, it also sits well above the fair ratio of 12.4 times sales, which signals that premium expectations are already priced in. Does this mean the risk of overpaying is higher than it first seems?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Everest Medicines Narrative

If you see the story differently or want a fresh take rooted in your own analysis, you can craft a personalized narrative for Everest Medicines in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Everest Medicines.

Looking for More Investment Ideas?

Sharpen your investing toolkit and stay ahead of the market. Some of the most promising stocks are still flying under the radar. Don’t let these opportunities get away.

- Unlock steady income by reviewing these 17 dividend stocks with yields > 3%, offering yields above 3% to fortify your portfolio against market swings.

- Spot the innovators redefining industries as you scan these 24 AI penny stocks. These companies are reshaping healthcare, finance, and automation with transformative technology.

- Capitalize on overlooked value and check out these 874 undervalued stocks based on cash flows, featuring strong cash flows that might have significant upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Everest Medicines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1952

Everest Medicines

A biopharmaceutical company, engages in the discovery, license-in, development, and commercialization of therapies and vaccines to address critical unmet medical needs in Greater China and other Asia Pacific markets.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives